Fed Chair Powell signals potential rate cut in 2025, with most FOMC members expecting lower rates to support growth amid cooling inflation.

Jerome Powell has once again addressed the potential for a Federal Reserve rate cut this year, with most FOMC members anticipating it will occur later. The Federal Reserve Chair also addressed the potential for a rate reduction at the July FOMC meeting.

Powell Considers the Possibility of a Federal Reserve rate reduction later this year

Powell declared at the ECB forum on Central Banking that most FOMC members believe reducing rates once more later this year is appropriate. This occurred as the Federal Reserve Chair expressed his opinion on the timing of an interest rate reduction and whether it was premature to do so.

Powell continued to affirm that the United States economy was in a favorable position, and that they should wait and observe the effects of the Trump tariffs. He acknowledged that inflation has thus far aligned with expectations, which typically indicates that a Federal Reserve rate cut is imminent. Nevertheless, he indicated that they anticipate increasing inflation readings during the summer.

In the interim, the Federal Reserve Chair also stated that he cannot determine whether July is an appropriate time to contemplate a rate cut, and that the decision would be contingent upon the incoming data. This will encompass the June CPI and PPI inflation data, released on July 15 and 16, respectively.

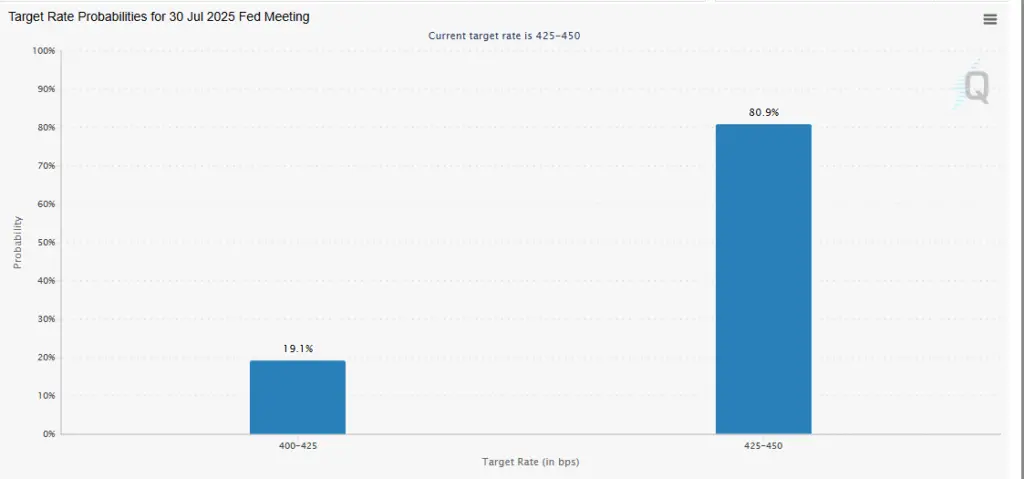

Governor Christopher Waller of the Federal Reserve had indicated that a rate reduction could occur as early as July. Nevertheless, traders anticipate that the July FOMC meeting will not result in a rate reduction. According to data from CME FedWatch, there is an 80.9% likelihood that the Federal Reserve will maintain rates at their current levels following the July 30 meeting.

Nevertheless, speculators, like the FOMC participants, anticipate an interest rate reduction in the latter half of the year, commencing in September. According to CoinGape, the probability of a rate reduction in September has increased to 94%.

Powell’s Response to Trump’s Insults

When asked about Donald Trump’s assaults, Jerome Powell responded that he is solely concerned with fulfilling his responsibilities, which are a component of the president’s efforts to secure a reduction in the Federal Reserve’s interest rate. Additionally, the Federal Reserve Chair stated that his primary objective is to guarantee that the labor market is as robust as possible and to stabilize the United States economy.

As previously reported, Donald Trump submitted a handwritten letter to Powell requesting that the Federal Reserve reduce rates to approximately 1%. Also, the president has declared that he is conducting interviews with potential candidates to succeed the Fed Chair.

Powell declined to disclose whether he intends to continue as Fed Governor upon concluding his term as Chair in May of the following year. He stated that his primary objective is to ensure his successor inherits a robust economy.