Among the most transformative shifts in the crypto sector are the rise of AI agents, the expansion of ReFi, the mainstream adoption of tokenized real-world assets (RWAs), and the evolution of DeFi 2.0 into institutional-grade infrastructure.

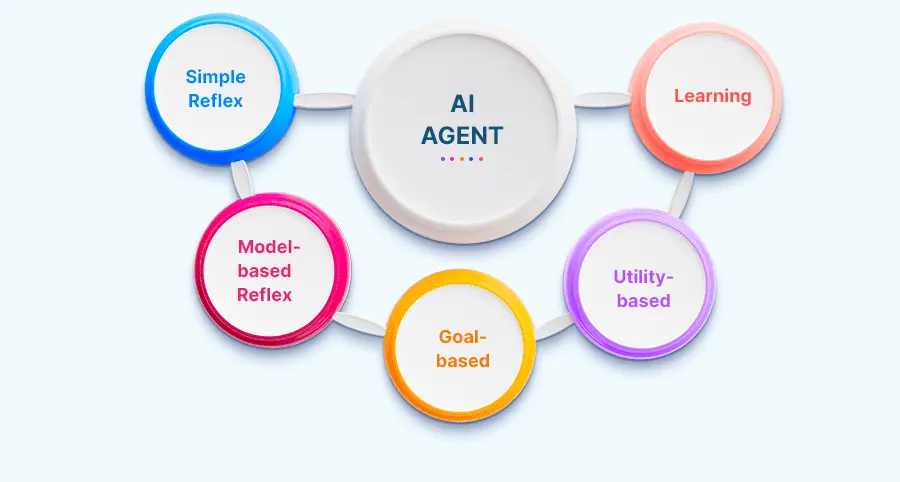

The Rise of AI Agents on Crypto

Definition

AI agents in crypto are autonomous, goal-oriented software entities that connect AI and blockchain execution.

These agents analyze huge volumes of on-chain and off-chain data, make real-time decisions, and interact directly with smart contracts, allowing for autonomous and transparent trading, staking, and governance.

Use Cases in DeFi

Automated market-making and liquidity management: AI agents constantly rebalance liquidity pools and pursue optimal yields across major protocols such as Aave, Curve, and Lido.

Risk management and arbitrage: They conduct rapid cross-chain arbitrage, execute flash loans, and monitor financial strategies using advanced risk controls.

Portfolio optimization: agents rebalance holdings, diversify positions, and execute trades based on market sentiment and risk models.

GameFi and Metaverse Roles

AI agents are transforming gaming and metaverse landscapes by:

- Acting as blockchain-aware NPCs, equipped with wallets and economic agency.

- Serving as passive earners, allowing for automated farming, trading, and staking.

- Evolving into human-trained, assetized AI players, such as iAgent, which learns from gameplay footage and becomes tradeable across multiple games.

Benefits

- Efficiency and 24/7 Availability: AI agents work tirelessly to execute tasks and seize opportunities that human users would miss.

- Reduced Human Error: Their data-driven protocols and automation significantly reduce errors that occur when trading or adjusting strategies manually.

Challenges

- Ownership of AI-Generated Value: Because agents operate autonomously, determining earnings and decision ownership raises complex legal and ethical concerns.

- Security Risks: AI agents are vulnerable to adversarial attacks. Studies on platforms such as ElizaOS indicate how context manipulation can redirect agent actions, resulting in asset loss or protocol violations.

- Regulatory Clarity Needed: As agents engage in financial operations autonomously, evolving regulatory frameworks are required to monitor algorithmic behavior, transparency, and accountability.

Crypto AI agents are emerging as the next evolutionary step, handling DeFi automation, metaverse utility, and trading with precision and autonomy.

However, as they become more sophisticated, they raise questions about legal ownership, technical vulnerabilities, and regulatory oversight. Balancing innovation and responsibility is critical as these agents become foundational in the late 2025 crypto landscape.

Regenerative Finance (ReFi): The Next Big Narrative

What is ReFi?

Regenerative Finance (ReFi) refers to blockchain-powered initiatives that generate environmental and social impact via transparent, programmable, and financially viable mechanisms.

Unlike conventional finance, which focuses solely on profit, ReFi prioritizes ecological restoration, carbon neutrality, and equitable value creation, often achieved through tokenized assets, DAOs, and incentive-aligned smart contracts.

Tokenized carbon credits, biodiversity incentives, sustainable agriculture, and community-led climate funding are among the key applications.

Why ReFi Matters in Late 2025

ReFi has matured into a critical narrative in crypto, bolstered by global sustainability trends and demand for green finance:

Blockchain-enabled tokenized carbon markets have seen over $4 billion in trading volume, with many Fortune 100 firms participating year on year.

ReFi directly appeals to institutional ESG mandates by transforming tokenized carbon credits and green assets into verifiable financial tools rather than mere offsets.

Smart contracts within ReFi enable automated green DeFi lending, real-time environmental impact verification, and scalable financing for ecological projects.

Case Studies: Top ReFi Projects

| Project | Role & Highlights |

| Toucan Protocol | Bridges verified carbon credits onto the blockchain, issuing tokens like Base Carbon Tonne (BCT) to boost liquidity and transparency. |

| KlimaDAO | A DAO built on Toucan infrastructure, which buys and retires carbon-backed tokens to drive up credit prices and incentivize climate action. |

| Regen Network | Enables tokenized ecosystem services—including biodiversity and land regeneration—by compensating land stewards via smart contracts. |

| Celo & Climate Collective | Mobile-first blockchain platforms promoting sustainable finance, universal basic income pilots, and coordinated ReFi DAO efforts. |

These projects highlight how ReFi turns ecological impact into digital-native, market-ready assets, aligning environmental regeneration with crypto incentives.

Integration with AI Agents

The synergy between ReFi and AI agents paves the way for automated environmental stewardship:

- Smart allocation of green capital: AI agents could analyze ESG data and deploy funds dynamically to high-impact projects, like reforestation or carbon mitigation.

- Automated ESG compliance: These agents can independently verify environmental outcomes, retire carbon credits when metrics are met, and adjust governance proposals based on decentralized environmental impact data.

- Scalable coordination: Combining networked green DAOs with AI-enhanced decision-making promotes local-global coordination, trustless validation, and reliable ecological funding.

ReFi positions itself as crypto’s environmental backbone, transforming climate accountability into transparent, programmable finance.

Tokenized carbon credits, land restoration assets, and green governance enabled by DAOs are no longer niches; they’re becoming foundational in late 2025. As AI agents join the fold, ReFi’s impact grows through automation, compliance, and smart capital allocation.

Tokenized Real-World Assets (RWAs) Go Mainstream

2025 Landscape: RWAs Dominate Stable Yields as DeFi Matures

Tokenized real-world assets (RWAs) have evolved from experimental pilots to a major component of crypto’s infrastructure.

The market has risen from around $15.2 billion in December 2024 to more than $24 billion by June 2025, making it crypto’s second-fastest-growing sector after stablecoins.

Institutions like BlackRock, JPMorgan, Franklin Templeton, and Apollo are moving into RWA tokenization, indicating widespread mainstream adoption.

Key Sectors Driving RWA Tokenization

- Government Bonds and Money Market Funds: Major asset managers, such as Franklin Templeton, have launched tokenized, UCITS-compliant U.S. Government money-market funds on blockchain (e.g., on Stellar), providing institutional-grade accessibility and transparency.

- Institutional Funds & Securities: BlackRock’s “BUIDL” tokenized money market fund and other high-value offerings are issued through platforms such as Securitize.

- Other Asset Classes: RWAs extend to tokenized real estate, commodities, equities, and private credit, enabled via fractional ownership models and smart contracts.

Institutional Adoption: Leading the Charge

Goldman Sachs and BNY Mellon are collaborating to tokenize money-market funds, leveraging new regulatory clarity under frameworks such as the GENIUS Act to improve efficiency and enable fractional trading.

Securitize has emerged as a powerhouse in the tokenization infrastructure space, serving as a transfer agent, broker-dealer, and ATS.

By mid-2025, it had issued more than $4 billion in on-chain assets, including BlackRock’s BUIDL, Exodus equity token, and Apollo’s Public-Private Collaborations:

R3 and Solana are enabling banks such as HSBC, Bank of America, and Euroclear to explore tokenization through public blockchains.

Benefits: Liquidity, Transparency, and 24/7 Access

- Liquidity: RWAs convert traditionally illiquid assets into tradable fractional tokens, enabling new secondary market activity.

- Transparency and Efficiency: Immutable blockchain ledgers reduce friction, intermediaries, and settlement times while maintaining clear ownership and audit trails.

- 24/7 Global Access: Unlike traditional markets with trading hours, tokenized assets can be traded at any time and across borders.

Risks: Regulation, Counterparty Trust, and Oracle Accuracy

- Regulatory Barriers: True tokenization of securities is still hampered by outdated market infrastructure and unclear legal frameworks. Experts point out that full migrations will take years, and many current offerings are essentially wrapped tokens with no shareholder rights.

- Counterparty and Custodial Risk: Hybrid token structures, in which off-chain assets are represented digitally, require strong legal frameworks to ensure actual ownership; failure to do so can lead to enforceability issues.

- Liquidity Challenges: Despite increased issuance, many RWA tokens have limited trading activity, low volume, and little participation in secondary markets.

- Oracle and Valuation Accuracy: Reliable real-world data feeds (such as asset valuations or dividend schedules) are critical; errors or manipulation in oracles can jeopardize trust and execution.

The tokenization of real-world assets stands out as a foundational force, opening up government securities, real estate, and institutional funds to blockchain-based finance. Benefits include unparalleled liquidity, transparency, and accessibility.

However, regulatory misalignment, custodial complexity, liquidity bottlenecks, and oracle risks remain critical challenges that must be addressed in order to achieve sustainable growth.

DeFi 2.0: Smarter, Institutional-Grade Infrastructure

Evolution from DeFi 1.0: From Overcollateralized Loans to Undercollateralized Credit & Credit Scoring

DeFi 2.0 shifts from DeFi 1.0’s overcollateralized lending and to more nuanced financing models.

Goldfinch, Maple, and Centrifuge protocols are pioneering undercollateralized loans by utilizing mechanisms such as “trust through consensus” to extend credit to underserved borrowers without requiring complete collateral coverage.

Furthermore, emerging innovations, such as the On-Chain Credit Risk Score (OCCR), provide dynamic borrower assessment tools, allowing platforms to tailor loan-to-value (LTV) ratios and liquidation thresholds based on quantified risk.

AI and DeFi: Risk Modeling and Adaptive Collateral Requirements

AI and adaptive algorithms improve DeFi’s risk infrastructure. For example, the AgileRate model on platforms such as Aave uses real-time supply-demand dynamics and recursive learning methods to adjust interest rates and optimize utilization while minimizing liquidation risks.

Similar frameworks, such as “Thinking Fast and Slow,” provide data-driven lending protocols that dynamically adjust terms in response to market changes.

Cross-Chain Liquidity: Protocols Enabling Seamless Capital Flow

DeFi 2.0 promotes fluid liquidity across blockchain networks through robust interoperability solutions:

LayerZero powers trustless omnichain messaging, enabling direct cross-chain interactions, such as executing on-chain trades across multiple blockchains.

Stablecoin Insider reports that platforms such as Stargate Finance and Synapse Protocol use LayerZero to create unified liquidity pools and facilitate asset transfers across chains.

Emerging solutions such as Mitosis, enable modular liquidity movement without the use of traditional bridges, lowering security risk and increasing capital efficiency.

Security Focus: Formal Verification and Modular Risk Insurance Markets

DeFi 2.0 has a strong security architecture that includes formal verification, on-chain insurance, and layered modular designs:

Formal verification, a mathematical proof of smart contract correctness, is increasingly being used to prevent logic vulnerabilities, in addition to traditional audits and runtime safeguards.

On-chain insurance protocols such as Nexus Mutual and Cover are integrated into DeFi 2.0 stacks, providing protection against hacks and contract failures while increasing institutional appeal.

Circuit breakers, bug bounties, and modular contract architecture are examples of risk mitigation measures that increase resilience to systemic shocks.

DeFi 2.0 represents a paradigm shift toward smart, institutional-grade infrastructure.

It introduces undercollateralized lending, which is supported by on-chain credit scoring, AI-driven risk optimization, cross-chain capital fluidity, and strong security protocols such as formal verification and embedded insurance.

Together, these innovations pave the way for a more scalable, secure, and inclusive DeFi ecosystem in late 2025 and beyond.

Intersections: How These Trends Reinforce Each Other

AI Agents + ReFi: Automating Green Capital Allocation and Carbon Footprint Monitoring

Autonomous AI agents can scan on-chain MRV data from registries such as Regen Network and then deploy funds to the most impactful climate projects or retire tokenized credits (e.g., Toucan’s BCT/NCT) as thresholds are met, transforming ESG mandates into programmable actions.

This closes the loop between impact data → automated financing → verifiable retirements.

RWAs + DeFi 2.0: Institutional Bridges Creating Sustainable Yield Opportunities

Tokenized RWAs (approximately $24 billion by June 2025) bring treasury-like yields on-chain, while DeFi 2.0 primitives route liquidity across chains and venues.

BlackRock’s BUIDL (tokenized US Treasury fund) and Franklin Templeton’s tokenized money-market funds are examples of institutional bridges that enable stable, transparent yield within crypto rails.

Metaverse + AI Agents: Human-AI Economies Tied to Real-World Assets

In game worlds, AI companions/NPCs with wallets (NVIDIA ACE showcases the tech stack) can earn, spend, and coordinate with humans.

By linking these agents to RWA yields (for example, tokenized T-bill funds), metaverse treasuries or player guilds can hold real-world, lower-volatility assets while agents manage payouts and in-world utility, combining virtual economies and off-chain value.

Macro View: Convergence Creates a Resilient, Utility-Driven Crypto Economy

AI agents automate decisions, ReFi aligns incentives with measurable impact, RWAs import durable yield and institutional credibility, and DeFi 2.0 provides cross-chain liquidity and risk control.

Tokenization’s benefits, such as 24/7 access, fractional ownership, and transparency, are highlighted by global bodies as supporting a shift from speculation to real utility in late 2025.

The convergence of AI agents, regenerative finance, tokenized real-world assets, and DeFi 2.0 is propelling crypto into a utility-driven future.

AI agents automate green capital flows in ReFi, while RWAs combined with DeFi 2.0 deliver stable, institution-grade yields.

In the metaverse, AI-powered participants connect digital economies to real-world value streams. Together, these intersections create a more resilient, transparent, and sustainable blockchain ecosystem that is poised to redefine global finance in late 2025.

Challenges and Risks Ahead

1. AI-Specific Risks: Over-Automation, Ethical Ownership, Compliance

- Ethical Creep and Autonomy Risks: AI agents might unintentionally manipulate decisions or systems without human intent, from sending inappropriate commands to terminating critical processes, raising ethical concerns.

- Accountability Gaps: As AI agents act autonomously, it becomes unclear who is accountable for outcomes, particularly when those actions affect user funds, governance, or economic dynamics.

- Regulatory Ambiguity: Unregulated oracles feeding AI agents, as well as a lack of compliance oversight, can expose systems to fraud, scams, and evolving legal scrutiny, especially when agents act as financial intermediaries.

2. ReFi Risks: Greenwashing and Lack of Standardized Carbon Accounting

- Greenwashing Dangers: Voluntary carbon markets (VCMs) frequently suffer from inflated baselines, weak governance, and poor monitoring, allowing projects to overstate impact and erode trust.

- Inconsistent Disclosure: In the absence of standardized reporting frameworks, such as PCAF or EU Taxonomy, claims can be misleading or unverifiable, leading to regulatory backlash and investor skepticism.

3. RWA Risk: Jurisdictional Regulatory Fragmentation

- Legal Inconsistencies: Tokenized real-world assets may be treated differently across jurisdictions, resulting in fragmented liquidity, conflicting investor protections, and legal uncertainty for users.

- Structural Vulnerability: Synthetic exposure mechanisms, in which tokens replicate asset value without transferring ownership or rights, can leave users vulnerable in insolvency or freeze events.

4. DeFi 2.0 Risks: Smart Contract Exploits & Systemic Institutional Exposure

- Code Vulnerabilities: DeFi is still vulnerable to reentrancy, Oracle manipulation, flash loan attacks, and other exploits that can result in massive losses.

- Systemic Fragility: As DeFi becomes more integrated with traditional finance and institutions, automatic liquidations, liquidity mismatches, and leverage amplification may pose market-wide contagion risks.

While the convergence of AI agents, ReFi, RWAs, and DeFi 2.0 promises transformative innovation, it also introduces a number of complex challenges.

Addressing these challenges proactively through ethics, compliance, smart contract security, and governance is crucial to incorporating sustainability and resilience into the next chapter of crypto’s evolution.

Future Outlook for Late 2025 and Beyond

AI Guilds to Operate DeFi and GameFi Economies

Expect coordinated “AI guilds” of autonomous agents to manage yield strategies, execute trades, and collaborate in virtual worlds, transitioning from bot-like tools to walleted teammates and coworkers.

NVIDIA’s ACE shows the jump from chatty NPCs to agents that perceive, plan, and behave like players, while industry coverage highlights AI trading agents as a key crypto use case.

ReFi to Tap into Maturing Global Carbon Markets

With new market guidance and rules emerging around Article 6 and voluntary markets, ReFi rails can automate credit issuance, retirement, and claims, thereby improving integrity and corporate usability.

Frameworks developed by ICVCM/VCMI, as well as recent Article 6 linkages, suggest clearer pathways for tokenized credits to serve compliance-related demand.

RWAs Will Drive Stable, Mainstream Crypto Adoption

Tokenized treasuries and money-market funds are becoming on-chain collateral and settlement assets (for example, BlackRock BUIDL via Securitize and Franklin Templeton’s tokenized UCITS fund), helping migrate conservative yield to crypto rails and increasing liquidity across venues.

RWAs are expected to exceed ~$24 billion by mid-2025, as institutions increase participation.

DeFi 2.0 to Blend with TradFi into Hybrid Finance

According to central-bank and policy research, tokenization enables integrated workflows, collateral checks, payments, and settlement in a single mechanical action, laying the foundation for hybrid finance where regulated infrastructure meets programmable markets.

Long-Term Vision: A Multi-Layered Cryptocurrency Economy

As these threads converge, late-2025 crypto will be defined by autonomy (AI agents), sustainability (ReFi), and real-world integration (RWAs + DeFi 2.0), indicating a shift from speculation to long-term utility.

The path forward includes 24/7 tokenized markets, human-AI collaboration in games and finance, and compliance-aware rails that connect to traditional systems. “From AI Agents to ReFi: The Crypto Trends Set to Define Late 2025” is more than just a slogan; it’s the blueprint for the next phase.

Conclusion

From AI Agents to ReFi: The Crypto Trends Set to Define Late 2025 reflects a turning point where blockchain is defined by utility-driven infrastructure and sustainable adoption rather than speculative trading.

AI agents are transforming markets through automation, efficiency, and new economic models, while ReFi projects solidify crypto’s role in climate action and ESG finance. Along with tokenized real-world assets and DeFi 2.0, these forces are combining to reshape global finance.

As we progress through this cycle, those who adapt to these converging forces will not only thrive but also help define the blueprint for a multi-layered, future-ready crypto economy.