FTX has court clearance to ask creditors if they want their recovered funds in cash under its liquidation plan or in bitcoin at market value

On June 25, Judge John Dorsey of the United States Bankruptcy Court for the District of Delaware approved FTX’s voting plan.

The company’s most recent liquidation plan, which was proposed in May, was met with dissatisfaction by numerous FTX creditors.

Based on the U.S. dollar value of asset prices at the time of FTX’s bankruptcy filing in November 2022, the plan proposed a 118% return for 98% of the creditors who had claims under $50,000.

Nevertheless, a significant number of FTX creditors are requesting a reimbursement in crypto in-kind, which would account for the 165% increase in the total market cap of the crypto market since the exchange’s collapse.

To contextualize the reluctance of certain creditors to make cash repayments, Bitcoin

When FTX filed for bankruptcy, the stock traded at approximately $16,900. However, it has since increased by 265% to $61,770 as of publication.

In the court hearing, FTX’s counsel, Andy Dietderich, stated that the vote is intended to gather feedback from the extensive group of FTX customers who have yet to participate in the repayment negotiations.

Nevertheless, the attorneys for FTX emphasized that the firm is obligated to assess claims when it files for Chapter 11, a requirement consistent with its proposed strategy.

In addition, attorneys stated that the cash repayment plan that is currently being proposed would be more straightforward to execute, as creditors would not be subject to capital gain tax.

It is important to note that the court is not obligated to approve in-kind crypto repayments, even if creditors vote in favor of them.

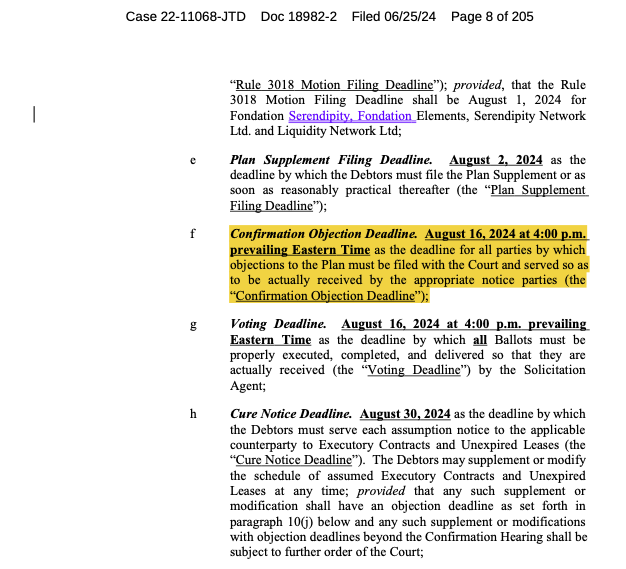

According to court documents, creditors will have until August 16 to vote on the proposal, and Dorsey will determine whether or not to approve it on October 7.

FTX has generated $11.4 billion in cash since declaring bankruptcy; however, Dietderich anticipates this figure will increase to $12.6 billion by October 31, when the company’s Chapter 11 plan could be implemented.

Before its collapse in November 2022, FTX was considered one of the world’s largest cryptocurrency exchanges.

Millions of consumers’ funds were fraudulently obtained, amounting to approximately $8 billion. Alameda Research, the trading firm of FTX, misappropriated a significant portion of these funds, resulting in a liquidity crisis as customers attempted to liquidate their assets.

John Ray, the current CEO of FTX, was granted control of the defunct exchange. Ray is a turnaround specialist still actively engaged in the bankruptcy case.

In November 2023, the firm’s former CEO, Sam Bankman-Fried, was convicted of numerous fraud and money laundering offenses and was subsequently sentenced to 25 years in prison in March.