The FTX bankruptcy estate has auctioned the final SOL tokens at a discount to Pantera Capital and Figure Markets.

To compensate former clients and creditors, the FTX estate has sold the final $168 tokens of its profoundly discounted Solana SOL tickers to Pantera Capital and Figure Markets.

FTX sold the $2.6 billion worth of Solana tokens for $102 per token, which is an absolute bargain compared to SOL’s current market price of $168.

Through the auction, 800,000 SOL tokens were acquired by Figure Markets; Pantera Capital acquired the remaining portion of the lot sold by the insolvent exchange.

As stipulated in FTX’s agreement with purchasers of the discounted assets, a vesting schedule of four years will be applied to the tokens and coins.

Even with the recovery of $7.3 billion in assets by the FTX bankruptcy estate, the estate’s endeavors failed to persuade all.

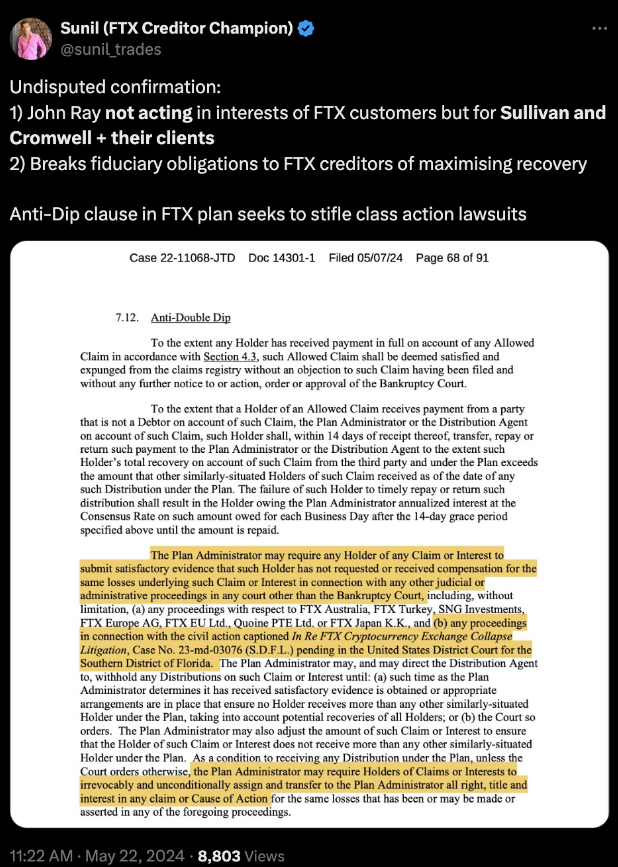

A creditor who led the FTX creditor community, Sunil Kavuri, objected to the bankruptcy estate’s sale of assets at steep discounts. Kavuri declared:

“Sullivan & Cromwell has trampled over our property rights. They have liquidated billions of dollars of crypto assets. There’s a token S&C sold at 11 cents; it’s now trading at two dollars. FTX had $10 billion in Solana tokens — they sold it at 70% discount.”

Kavuri continued by stating that the digital assets were the property of the former platform’s creditors and clients. He then criticized FTX’s bankruptcy attorneys, Sullivan & Cromwell, for selling them at a substantial discount, arguing that they should have been returned to the injured parties.

Those injured in the FTX collapse and who have long been critical of Sullivan & Cromwell’s involvement in the bankruptcy proceedings share sentiments similar to those expressed by the FTX creditors.

The court ultimately ordered an independent investigation into Sullivan & Cromwell, which concluded that the firm was not in collusion with FTX in response to these criticisms.

Following the disclosure of the bankruptcy auctions, the price of SOL decreased by 4%; however, the alternative layer-1 network maintains a robust price performance.

The altcoin is experiencing a consistent uptrend that peaked in November 2023 and peaked at $210.