To reclaim more than $50 million in locked assets, Alameda Research, a division of the defunct cryptocurrency exchange FTX, has filed a lawsuit against KuCoin.

Due to changes in the market, the assets’ original $28 million worth has now surpassed $50 million. Since FTX’s demise in November 2022, KuCoin has frozen its assets.

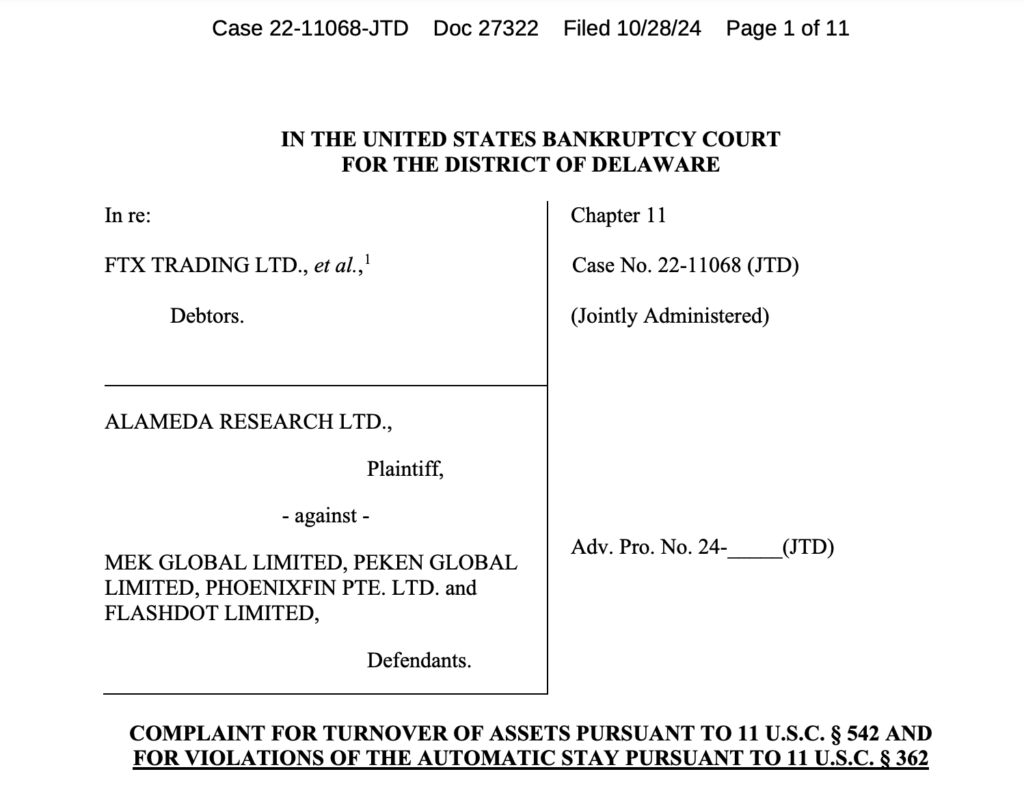

Since FTX’s demise in November 2022, the money has been frozen by cryptocurrency exchange KuCoin, according to a filing dated October 28. The United States Bankruptcy Court for the District of Delaware, which is in charge of FTX’s Chapter 11 case, received the complaint.

Despite multiple discussions, KuCoin has allegedly refused to disclose the funds, according to the petition. Due to changes in the market, the assets, which were initially valued at $28 million, are now worth over $50 million. As stated in the document:

“KuCoin has without justification refused to turn over the assets in the Account to the Debtors, despite numerous requests.”

Alameda contends that KuCoin violated the Bankruptcy Code by refusing to disclose the assets, and the company is requesting the money back and possible damages for the delays. According to the complaint, the money should be returned to creditors for repayment because it is part of the FTX estate.

The FTX bankruptcy estate recently settled a similar action against the Bybit exchange. The arrangement calls for transferring over $53 million worth of BIT tokens to Mirana Corp, the Bybit exchange’s investment branch, and the withdrawal of $175 million in digital assets held on Bybit, according to a filing made on October 24. The deal will increase FTX’s repayment efforts by $228 million.

In November 2023, the bankrupted exchange first brought a $1 billion lawsuit against Bybit and Mirana, claiming that the companies had taken out over $327 million in cash and digital assets before the exchange’s demise by using “VIP” access and a tight relationship with FTX management.

A US bankruptcy judge accepted FTX’s liquidation plan on October 7, enabling the business to shut down and start paying back customers.

For 98% of debtors, the plan guarantees up to 119% of the claimed value. However, the payback is not based on current market pricing but on the assets’ worth during FTX’s collapse in November 2022.

One of the top cryptocurrency exchanges was FTX. After the fraud was exposed, it declared bankruptcy in November 2022. Many of the allegations against FTX have focused on its trading division, Alameda Research, which is accused of misusing billions of dollars in client cash.