A large share of FTX repayments may return to crypto, driven by the market’s strong growth prospects for 2025.

FTX is in the process of distributing over $1.2 billion in repayments to the customers of the bankrupt former cryptocurrency exchange.

FTX, which was previously the second-largest centralized cryptocurrency exchange (CEX) in the world, is planning to commence the process of reimbursing users who have been unable to access their funds for more than two years.

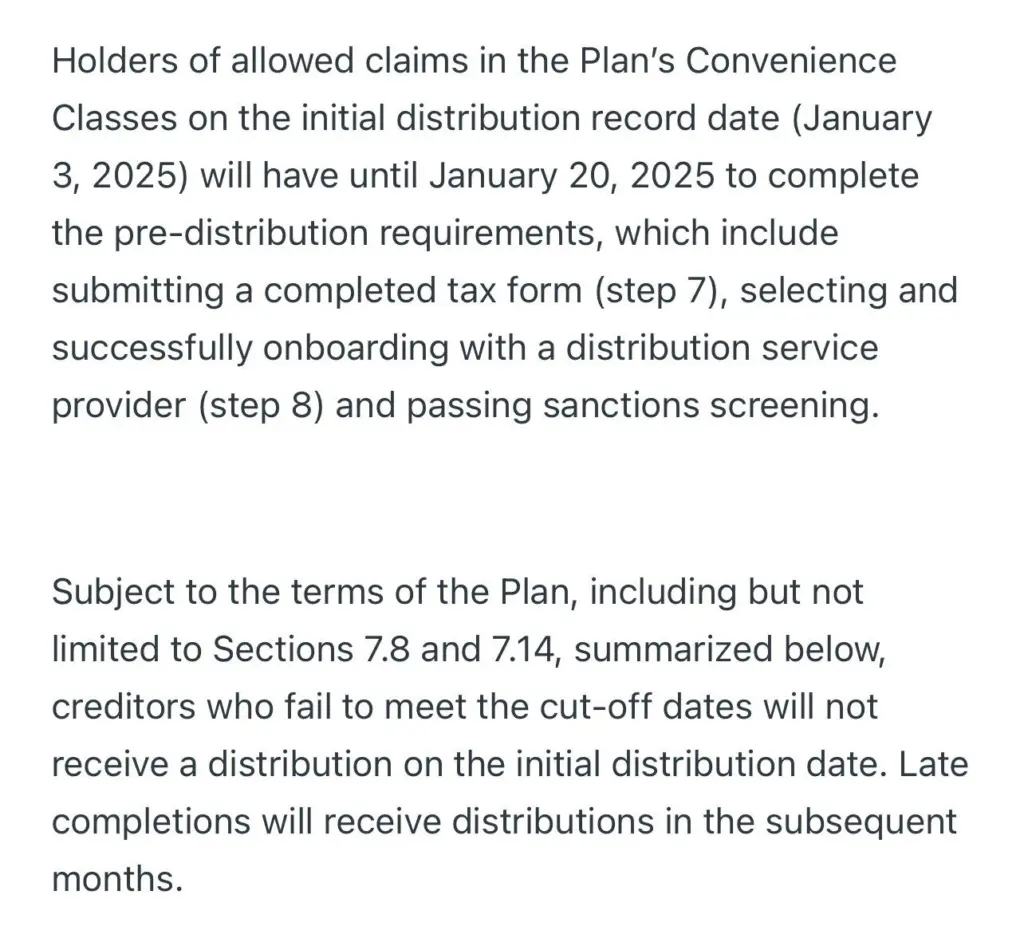

Exchange users who are owed up to $50,000 in digital assets have until January 20 to satisfy their repayment obligations.

According to Sunil, an FTX creditor who is a member of the FTX Customer Ad-Hoc Committee, the largest group of over 1,500 FTX creditors, FTX is expected to commence repaying claims of up to $50,000 after January 20.

“The pre-distribution requirements for the initial distribution have been extended by FTX until January 20th.”

Sunil wrote in a Jan. 11 X post that repayments are unlikely to commence before that date.

The inauguration of US President-elect Donald Trump on January 20 has spurred anticipation of increased regulatory clarity in the crypto sector and the potential acceptance of the Bitcoin Act.

The act suggests the establishment of a Bitcoin reserve in the United States, the world’s largest economy.

According to certain industry observers, Jan. 20 could potentially spark the subsequent phase of the 2025 crypto market cycle, which could result in Bitcoin surpassing $200,000 when combined with the forthcoming FTX repayments.

Will Crypto Market Experience Volatility As Result Of FTX Repayments?

According to FTX’s restructuring plan, which was approved in October 2024, the initial group of investors to receive repayments is users who have claimed up to $50,000.

The plan indicated that 119% of the declared value of the funds of 98% of FTX users could be anticipated to be paid.

Nevertheless, the repayment model, which reimburses claimants based on cryptocurrency prices at the time of bankruptcy, has been criticized by a few creditors.

For instance, Bitcoin prices have surged by over 370% since November 2022.

While some crypto investors anticipate increased market volatility, FTX reimbursements are essential for restoring the industry’s reputation and repairing past damages.

Anndy Lian, an author and intergovernmental blockchain expert, predicts that the repayments will elicit a variety of responses from investors, contingent upon their individual risk tolerance.

Lian informed Cointelegraph that a portion of the reimbursements may have the potential to be reinvested in other cryptocurrencies.

“Smaller investors, who’ve been hit hard by FTX’s collapse, might be more inclined to sell for financial security. Those with a bit more faith in the long-term prospects of crypto might stick it out, betting on future growth. It’s all about individual circumstances and risk appetite.”

“The MT. Gox incident does establish a precedent, as a significant number of individuals opted to retain their coins in anticipation of better times,” Lian emphasized.

Despite the fact that Bitcoin’s value has increased by over 8,500% in the decade since the Japanese exchange collapsed, the majority of Mt. Gox creditors have chosen to retain their BTC.

On July 30, Mt. Gox distributed 41.5% of its Bitcoin to creditors, who received a total of 59,000 Bitcoins.

The creditors of Mt. Gox were not selling, despite obtaining nearly $4 billion in Bitcoin, according to a Glassnode report from July 29. The report stated:

“Creditors opted to receive BTC, rather than fiat, which was new in Japanese bankruptcy law […] As such, it is relatively likely that only a subset of these distributed coins will be truly sold onto the market.”

According to Philipp Zentner, co-founder and CEO of LI.FI protocol, the $1.2 billion that is expected to arrive could be a “significant liquidity event for crypto.” He informed Cointelegraph:

“Overall it’s a macro-positive moment for the industry, particularly given the favorable current market conditions, also prices right now feel like a ‘Black Friday’ sale for crypto.”

Crypto firms BitGo and Kraken announced in December that they would assist in distributing recoveries to FTX users. Assuming all users file complete claims, the exchange could be anticipated to pay out roughly $16 billion.