FTX users are pushing to unlock $2.2 billion in disputed bankruptcy claims as legal battles continue over fund recovery and creditor repayment priorities.

At least $2.2 billion in contested claims are still pending resolution for FTX creditors, and several customers have complained about problems with the KYC verification procedure.

Users battling for at least $2.2 billion in contested claims still seeking approval are putting the bankrupt cryptocurrency exchange FTX under more scrutiny, as many creditors are still having difficulty getting their reimbursements accepted.

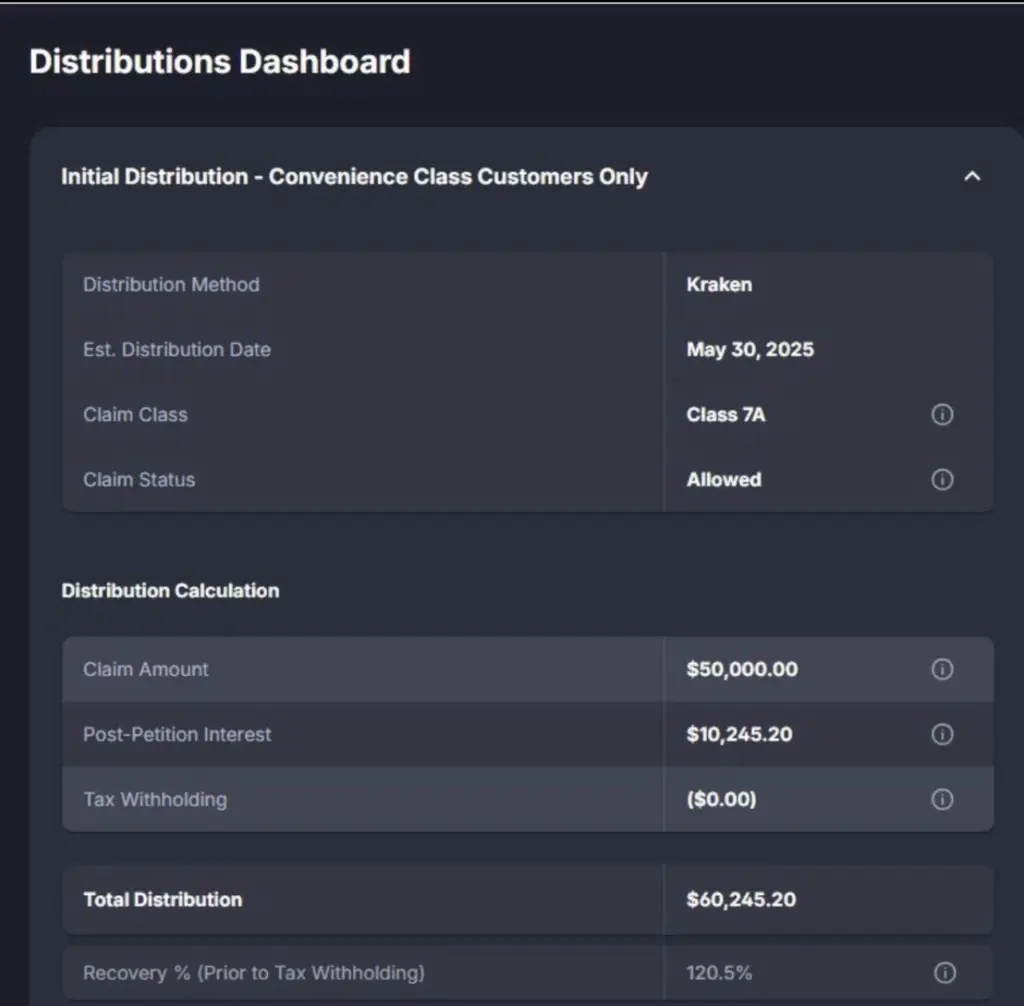

On May 30, the FTX Recovery Trust began its second payment cycle, returning more than $5 billion in digital assets to qualified creditors who had fulfilled pre-distribution conditions.

However, figures provided by Sunil, FTX creditor and member of the Customer Ad-Hoc Committee, indicate that at least $2.25 billion in repayments are still disputed.

“At now, $7.5 billion is permitted claims. An estimated $10.6 billion in total claims is allowed. Legitimate claims will be accepted; 30% of permitted claims are contested, Sunil stated in an X post on June 11.

According to Sunil, the FTX estate has an extra $6.5 billion in reserves for contested claims, which would be paid in the following distribution.

“I foresee most of the disputed [claims] getting allowed for the next distribution.”

Sunil stated that it is hard to forecast when these payments will be delivered until a distribution provider that supports China is revealed. “However, there is a lot of uncertainty regarding the Chinese claims, which made up 8% of claims on the bankruptcy,” Sunil added.

On February 18, $1.2 billion was disbursed to beneficiaries with claims under $50,000 as part of the first round of FTX creditor payments.

The announcement follows FTX’s previous partnership with a third payment distribution service provider. In addition to BitGo and Kraken, FTX announced Payoneer as its third distribution partner on Tuesday. Payoneer is anticipated to help mainly with retail customer payouts and offers cross-border payment services in more than 190 countries.

KYC verification is difficult for FTX users.

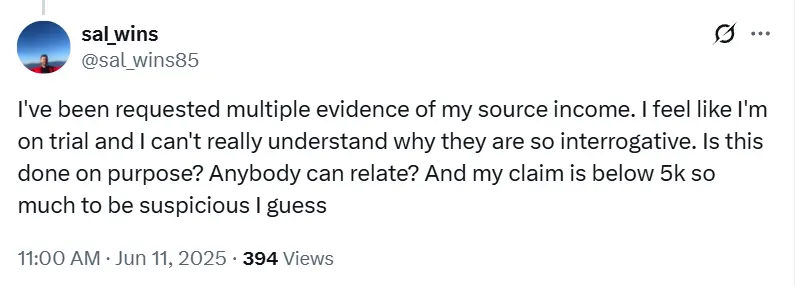

The Know Your Customer (KYC) verification process for the repayments has been problematic for several FTX creditors.

“Any outstanding information on Bahamas KYC?” On June 11, X user Big Penger replied, “No response for five months.”

“I’ve received numerous requests for proof of my income source. An FTX creditor, Sal Wins, stated, “I feel like I’m on trial, and I can’t understand why they are so interrogative,” noting that his claim was for less than $5,000.

According to some cryptocurrency investors, the entire scope of the FTX repayments would significantly improve mood and liquidity, which might lead to further gains for the market.