Tom Lee of Fundstrat anticipates that the price increase in Bitcoin may persist, citing robust market demand and bullish technical indicators.

Tom Lee, Head of Research at Fundstrat, has underscored the potential for a sustained rally in Bitcoin following its recent surge. In November, Bitcoin’s price experienced a 34% increase, trading at approximately $91,395. Tom Lee identified several indicators that indicate the cryptocurrency’s upward trajectory may endure.

Tom Lee Highlights the Reasons for the Potential Extension of the Bitcoin Price Rally

In an interview with CNBC, Tom Lee, the Head of Research at Fundstrat, observed that Bitcoin’s recent price increases are bolstered by strong market demand and improving technical indicators.

He noted that the Bitcoin price has entered a consolidation phase near $90,000, bolstered by several bullish factors, such as the cryptocurrency’s historical performance during comparable market conditions and increased investor interest.

Tom Lee of Fundstrat believes that the current price increase is consistent with the broader trends in risk assets, as Bitcoin has demonstrated resilience during market corrections. He stated, “Most major indices, such as the NASDAQ and S&P 500, have retreated to critical support levels, frequently serving as a foundation for resurgent growth.” The technical configuration of Bitcoin is comparable, which implies that there is potential for additional gains.

Tom Lee of Fundstrat also linked Bitcoin’s performance to broader market trends, particularly the “Trump trade.” He observed that policies such as ‘D.O.G.E.,’ prioritizing deregulation, reduced taxes, and reduced government spending, could benefit risk assets, such as the Bitcoin price.

He also noted that investors are renewing their interest in sectors such as financials and small-cap stocks as they anticipate policy clarity in the wake of recent political developments. This optimism is reinforced by the anticipation that the Federal Reserve’s monetary tightening cycle is nearing its conclusion, which could stimulate demand for traditional and digital assets.

Bitcoin as a Strategic Asset in the Context of Economic Concerns

Tom Lee of Fundstrat also emphasized the potential of Bitcoin to serve as a strategic asset in addressing economic challenges. Lee did not directly address his previous suggestion that Bitcoin could function as a “treasury reserve asset,” but he underscored its potential as a hedge against macroeconomic uncertainty.

He elaborated that the current discussions regarding U.S. monetary policy, including the Federal Reserve’s potential reduction in interest rate hikes, foster a favorable environment for Bitcoin.

“When uncertainty clears around monetary policy, demand for Bitcoin and other risk assets could increase further,” he noted.

During the interview, Tom Lee addressed the ongoing discussions regarding the U.S. Treasury Secretary position under the Biden administration. Elon Musk has suggested that Cantor Fitzgerald CEO Howard Lutnick is one of the names under consideration. Lutnick has propelled Bitcoin’s classification as a commodity, similar to gold and oil.

The momentum of both institutional and retail investors fuels the growth of Bitcoin

Institutional and retail participation has significantly influenced the recent increase in Bitcoin’s price. A surge in Coinbase’s premium index earlier in the rally, as indicated by data from CryptoQuant, suggests a greater interest from U.S. retail investors. Nevertheless, the index has since experienced a decline, indicating that retail activity has experienced a temporary slowdown.

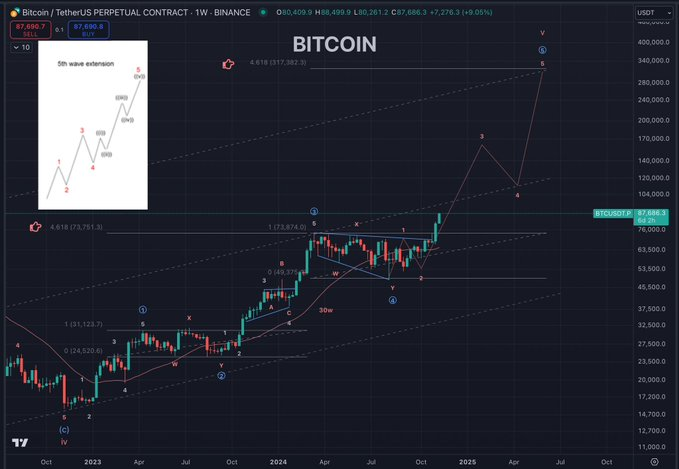

Coosh Alemzadeh, a technical analyst, has identified patterns in Bitcoin’s chart that suggest the potential for additional growth. Alemzadeh asserts that Bitcoin is currently in the fifth wave of an Elliott Wave cycle, which signifies the most significant price increase phase. By the end of 2024, his forecast indicates that Bitcoin’s value could accumulate between $130,000 and $145,000.

Experts warn that Bitcoin’s volatility remains elevated despite the optimistic outlook. The necessity of measured optimism among traders is underscored by the success rate of bullish patterns such as the one currently forming, which is approximately 54%.