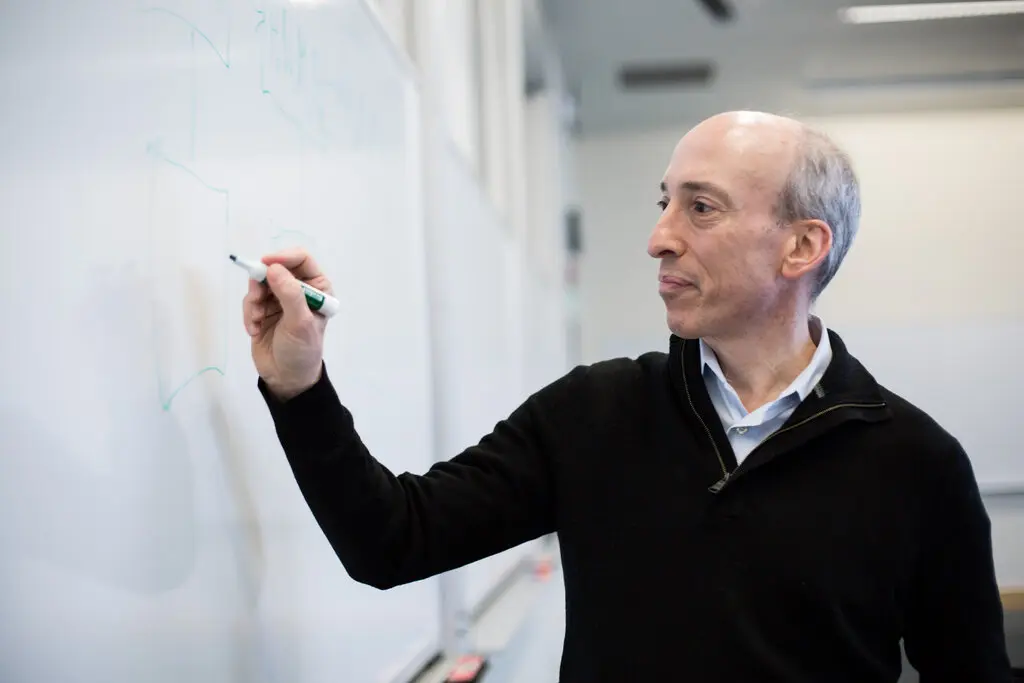

Co-directing FinTechAI@CSAIL and concentrating on AI, finance, and public policy, former US SEC Chair Gary Gensler has returned to MIT Sloan as a Professor.

Former US SEC Chair Gary Gensler has returned to the MIT Sloan School of Management as a Professor of Practice, where he will concentrate on public policy, finance, financial technology, and artificial intelligence. MIT announced his appointment, which marked his return to the position after serving as the Chair of the Securities and Exchange Commission (SEC) during the Biden administration.

Gary Gensler Has Joined MIT Sloan

Former US SEC Chairman Gary Gensler, who resigned earlier this month, will be joining the institution as a Professor of the Practice in the Global Economics and Management Group and the Finance Group, according to a report from MIT. He will be engaged in finance, financial technology, artificial intelligence, policy, research, and education.

In addition to his faculty position, Gensler will serve as the co-director of the FinTechAI@CSAIL program at the Computer Science and Artificial Intelligence Laboratory of the Massachusetts Institute of Technology.

He will work with Professor Andrew W. Lo, who will assist in investigating artificial intelligence in finance. The initiative will allow firms to collaborate with faculty from the Massachusetts Institute of Technology on AI-based financial products.

Career in the Public Sector and Criticism from Lawmakers

Gary Gensler served as the Chair of the Securities and Exchange Commission (SEC) before his return to MIT. He was accountable for regulating the United States capital markets in this capacity. Legislators expressed apprehension regarding the increased enforcement actions against cryptocurrency companies during his tenure.

Senator Cynthia Lummis has since accused the SEC of exceeding its jurisdiction as a federal agency under his leadership. Lummis has characterized these actions as “un-American,” asserting that the regulatory bodies should refrain from taking any action that Congress has not authorized.

Gary Gensler was the Chairman of the Commodity Futures Trading Commission (CFTC) during the Obama administration before becoming the Chairman of the Securities and Exchange Commission (SEC). After the 2008 financial crisis, he was employed by the CFTC to resolve the $400 trillion swaps market. In formulating the Sarbanes-Oxley Act of 2002, he also served as a Senior Advisor to Senator Paul Sarbanes.

Before joining the CFTC, Gensler was a partner at Goldman Sachs for 18 years, responsible for finance, fixed-income trading, and mergers and acquisitions.

Faculty and Industry Responses to Gensler’s Return

Former MIT faculty members who instructed Gary Gensler warmly welcomed him back and acknowledged his extensive experience in finance, technology, and policy. Georgia Perakis, the interim dean of MIT Sloan, stated,

“We are thrilled to have Gary return to MIT Sloan after his time at the SEC.” I am aware that our students will enhance a lot from it to learn from him.”

Simon Johnson, the Head of the Global Economics and Management Group at MIT Sloan, emphasized the former SEC chair’s academic background and prior experience as a professor. I extend this warm welcome on behalf of my colleagues, who are delighted to have him return. “For the first time, he and I will collaborate to teach a new course,” Johnson stated.

Paul Asquith, the Head of the Finance Group at MIT Sloan, observed that Gensler can implement theoretical concepts in the real world.

“It is rather unusual to meet an educator who is as experienced in practical life as he is. In his previous time at MIT, he has been useful to both faculty and students.”

Andrew W. Lo, co-director of the FinTechAI@CSAIL initiative, recognized Gensler’s contribution to the evolving financial landscape. “Gary’s return to MIT, which occurred when technology revolutionized the world, could not have been more opportune.”