Gate.io delists 33 tokens and USDT pairs, citing quality issues, causing sharp price drops for low-value tokens like ULD, SECOND, and LNR.

Additionally, Coinbase delisted four tokens, asserting that each pertinent organization was rebranding the assets in question. This resulted in various outcomes, such as the slight increase in RENDER from the same company, which resulted from the delisting of RNDR.

Gate.io Delists Thirty-three tokens

Since its 12th anniversary last month, Gate.io, a widely used centralized exchange, has implemented several innovative strategies.

The exchange has maintained prominence amid significant interface overhauls and the issuance of new business licenses. Today, the market was thrown into pandemonium when Gate.io announced that it would delist 33 tokens simultaneously.

“Gate has conducted a thorough reuation of 33 coins and determined that they no longer meet our platform’s trading criteria. As a result, we will delist these coins from our platform. After delisting. we will continue to provide a 1-month withdrawal service for users,” the firm claimed.

The list of casualties from Gate.io’s mass delisting is extensive, with the majority being small initiatives. The organization boasts extensive crypto assets, such as AI tokens, restacking projects, and GameFi initiatives.

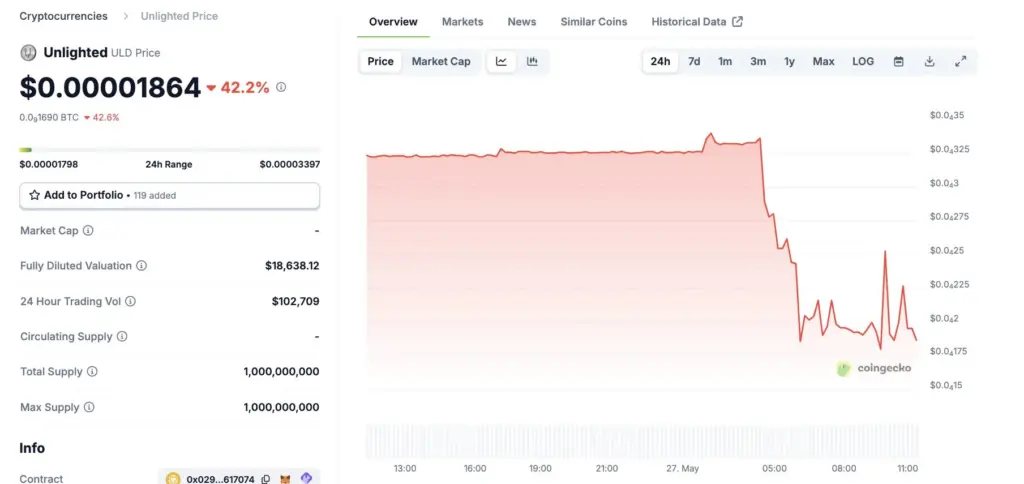

Subsequently, most of these assets experienced a complete collapse, with Unlighted (ULD) experiencing a decline of over 40%.

Although ULD was a significant casualty, there are a few other notable examples. Following their delisting by Gate.io, RATIO experienced a 27% decline, OpenDAO (SOS) by 33%, Kine Protocol (KINE) by 21%, and so forth. Although not all assets experience crashes of this nature, even the most unusual ones provide insightful narratives.

For instance, Finblox (FBX) experienced a mere 2% decline; however, it had already experienced a substantial decline earlier this month, with a loss of nearly 40% over the past two weeks.

Especially for these smaller tokens, mass delistings such as Gate.io’s can result in a generalized rout.

Binance also precipitated a free fall by simultaneously delisting 14 assets, most of which realized double-digit losses, last month.

Users were either mocking the projects or commending the company’s actions, as the community appeared unconcerned by this event today.

The consensus is that Gate.io had legitimate reasons to delist these assets, as they were deemed low quality or otherwise irrelevant to the broader ecosystem. It proposed purchasing them from users at consistently negligible prices.

Additionally, Coinbase announced a collective delisting shortly after Gate.io. Nevertheless, Coinbase did not do this to reject these assets based on their quality.

It identified four organizations, each replacing its current token with a new asset. These replacements and rebrands have been performing well; RENDER experienced growth subsequent to RNDR’s delisting.

Coinbase’s delisting elucidates Gate.io’s motivations. The former exchange sought to eliminate assets from a disorganized list of alternatives; however, it appears it intends to replace them all.

Conversely, Gate.io distinguishes between wheat and chaff. For these unfortunate tokens, this delisting could cause permanent damage.