The Bitcoin Trust (GBTC) of Grayscale is undergoing a significant flow shift due to the upward trajectory of the Bitcoin price

This contrasts earlier this year’s situation when GBTC outflows were not halted despite favorable Bitcoin price action. BlackRock’s IBIT has surpassed Grayscale’s GBTC in BTC holdings since the introduction of US Bitcoin ETFs, which brought in a total of $14 billion in inflows.

GBTC has decreased from 619,000 BTC to 285,081 BTC, whereas IBIT has maintained 291,563 BTC, as reported by Heyapollo data.

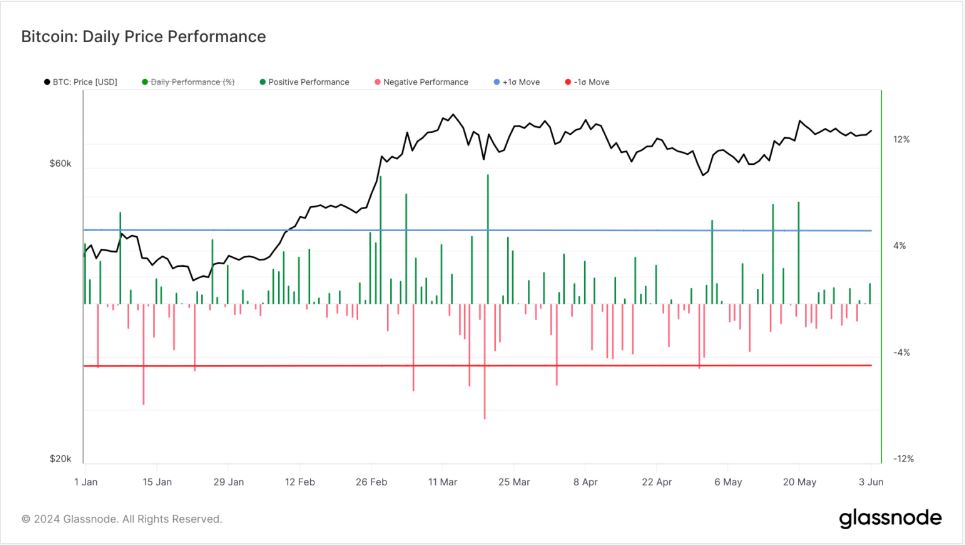

GBTC encountered 109 consecutive trading days of outflows from January 11 to May 2. In May, however, the trend started to reverse. GBTC documented a $63 million inflow on May 3, concurrent with a 6.34% surge in the BTC price.

This was followed on May 15 by a $27 million inflow accompanied by an 8% BTC increase, on May 17 by a $31.6 million inflow accompanied by a 2.70% BTC increase, and on May 20 by a $9.3 million inflow accompanied by a 7.69% BTC increase. These examples underscore how favorable Bitcoin price fluctuations impact GBTC inflows, a notable deviation from prior trends.

Moreover, GBTC inflows and outflows have been negative for the past six days, a period that has largely corresponded with the upward trend in the price of Bitcoin and highlights a stabilizing trend.

The observed dynamic suggests that there is now a more robust correlation between the investment flows of GBTC and the market performance of Bitcoin. This may indicate a change in investor sentiment and approach.