According to the company, France has seen a 2% increase in new cryptocurrency users over the last two years, coinciding with Gemini’s market debut.

Gemini, the cryptocurrency exchange Cameron and Tyler Winklevoss created, has formally launched its platform in France almost a year after obtaining a digital asset service provider (DASP) registration.

The company said on Monday, November 19, that the launch enables local customers to deposit, trade, and store at least 70 digital assets on web or mobile devices.

The exchange joins the market months after the platform was granted DASP registration in January by the Autorité des Marchés Financiers (AMF), the French market watchdog.

Gillian Lynch, CEO of Gemini‘s United Kingdom and Europe division, stated, “We’ve taken the time to localize and optimize our product for French customers, ensuring that our platform is translated into French and that we can offer our full suite of services.”

Users can deposit both euros and British pounds.

Thanks to Gemini’s debut in the French market, users can now deposit money in euros and British pounds using local payment methods, including Apple Pay, bank transfers, and debit cards.

The company’s investment platform, which supports over 80 trading pairs and provides various application programming interface (API) interfaces, is accessible to expert traders, according to the statement.

Institutional investors can trade on Gemini’s over-the-counter (OTC) desk, which entails purchasing and selling cryptocurrencies like Bitcoin BTC$92,532 off-exchange, as part of Gemini’s offering in France.

Institutions can also profit from the company’s eOTC trading system, which was built to carry out big orders with a lot of liquidity.

“We’re looking into ways to increase our services and payment rails to give our French customers more options and accessibility,” Lynch said.

According to Gemini, France has greater faith in cryptocurrency than the US or the UK.

France’s good legal framework and increasing bitcoin use make it a vital market for Gemini.

Lynch added, “Gemini’s analysis of the French market demonstrates its increasing interest in digital assets.”

“A robust regulatory framework presents a unique opportunity to introduce our platform to the trading community and extend our presence in the European market over the coming months.”

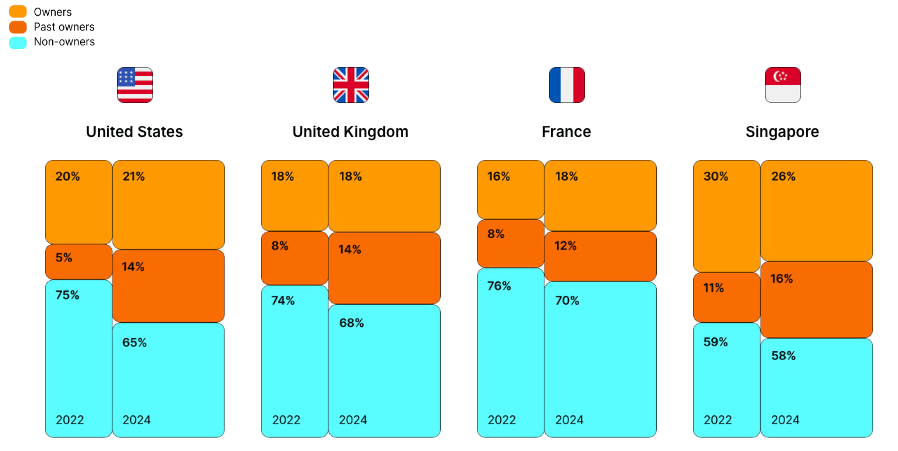

According to the company’s crypto adoption survey, which Lynch cited, France has the fastest-growing crypto economy after the crypto winter, with a 2% increase in the country’s percentage of cryptocurrency owners over the previous two years.

Additionally, Gemini shared data that had yet to be made public, showing that respondents in France have a higher faith in cryptocurrency than those in the US and the UK.

The company believes that this is likely a result of adopting the DASP regime in France and the Markets in Crypto-Assets Regulation (MiCA), a crypto regulatory framework established by the European Union.

“Our State of Crypto report indicates that trust in crypto is higher in France than in the other countries surveyed that are not within the EU, indicating that we have already begun to see the positive impacts of MiCA,” Lynch said.

“France is a key market for Gemini given its pro-crypto stance and forward-thinking approach to regulation given MiCA, which aligns closely with Gemini’s vision.”