GENIUS Act could legitimize stablecoins for institutional adoption and set a global precedent, says DWF Labs managing partner.

The United States Senate is preparing to debate a critical piece of legislation intended to regulate the sector, which could significantly increase stablecoin adoption among institutions.

The Guiding and Establishing National Innovation for US Stablecoins GENIUS Act was passed by the US Senate in a procedural vote of 66–32 on May 20, following its failure to secure the support of major Democrats on May 8.

The bill is now en route to a debate on the Senate floor.

The measure aims to establish explicit regulations for stablecoin collateralization and to require adherence to Anti-Money Laundering laws.

“This act not only regulates stablecoins, but also legitimizes them,” stated Andrei Grachev, managing partner at Falcon Finance and DWF Labs.

“It establishes unambiguous regulations, and with clarity, there is assurance.”

During the Chain Reaction daily X spaces program on May 20, Grachev informed Cointelegraph that this is the outcome that institutions have anticipated.

He stated, “That is what institutions have been waiting for.”

“Stablecoins aren’t a crypto experiment anymore. They’re a better form of money. Faster, simpler, and more transparent than fiat. It’s only a matter of time before they become the default.”

Senate Bill Is Perceived As Means To Achieve Unified Digital System

According to Grachev, the GENIUS Act may be the initial step in establishing a “unified digital financial system that is borderless, programmable, and efficient.”

“When the US moves on stablecoin policy, the world watches.”

In addition, Republican Senator Cynthia Lummis, a co-sponsor of the bill, identified Memorial Day as a “reasonable focus” for its prospective passage.

According to Grachev, regulatory clarity alone will not stimulate institutional adoption.

Additionally, products that provide consistent and predictable yields will be required.

He stated that Falcon Finance is presently in the process of creating a synthetic yield-bearing dollar product that is specifically tailored for this market.

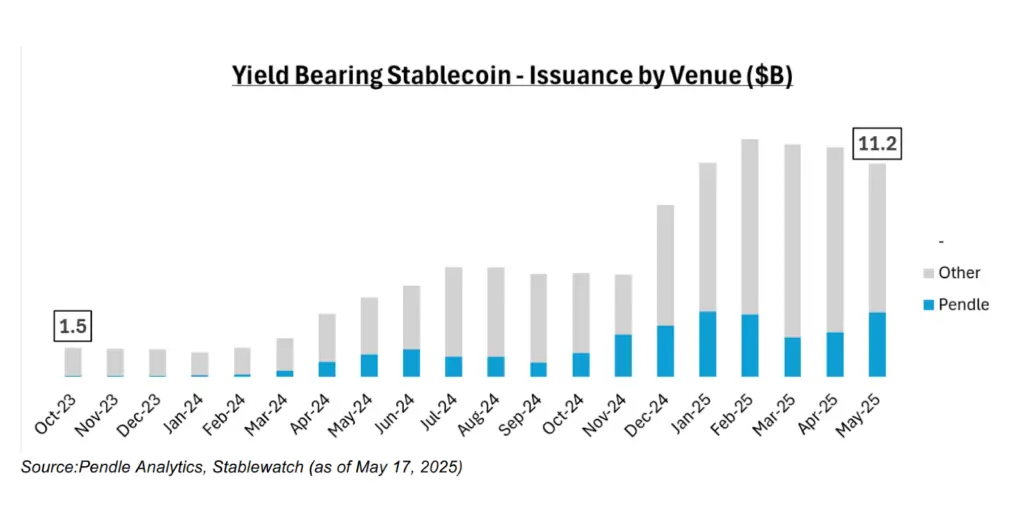

Cointelegraph reported on May 21 that yield-bearing stablecoins now account for 4.5% of the total stablecoin market, reaching a total circulation of $11 billion.

Regulatory Voids In GENIUS Act Do Not Address Offshore Stablecoin Issuers

Some critics contend that despite its widespread support, the GENIUS Act does not go far enough.

Vugar Usi Zade, the chief operating officer of Bitget exchange, stated to Cointelegraph that “the bill fails to adequately address offshore stablecoin issuers such as Tether, which continue to exert an excessive influence on global liquidity.”.

He also stated that issuers based in the United States will now be subject to “steeper costs,” expected to accelerate market consolidation and favor well-resourced companies that can meet the new thresholds.

However, Zade acknowledged that the legislation could provide more “stability” to regulated offerings, contingent upon its final wording and enforcement.