The German government did not optimize for the least amount of maximum revenue; instead, it was trying to sell its Bitcoin stack as quickly as possible.

The wallet aimed to sell Bitcoin quickly and maximize liquidity on each order book using five cryptocurrency exchanges.

According to Miguel Moreno, the creator of Arkham Intelligence, the selling patterns of the German government-labeled wallet’s Bitcoin BTC$64,914—including the vast transactions to many centralized cryptocurrency exchanges (CEXs)—indicate that the goal was to benefit short-term.

In an interview at EthCC, Moreno said that the transfers to other exchanges were made to optimize Bitcoin liquidity:

“The last thing I would have expected is that they would just go to five different exchanges and start market selling… The fact that they’re going to so many different exchanges just reads like they’re just trying to get as much liquidity from each order book as possible, because otherwise, why wouldn’t you just use one?”

Moreno clarified that selling through five separate exchanges is less complicated than setting up accounts and moving funds to only one.

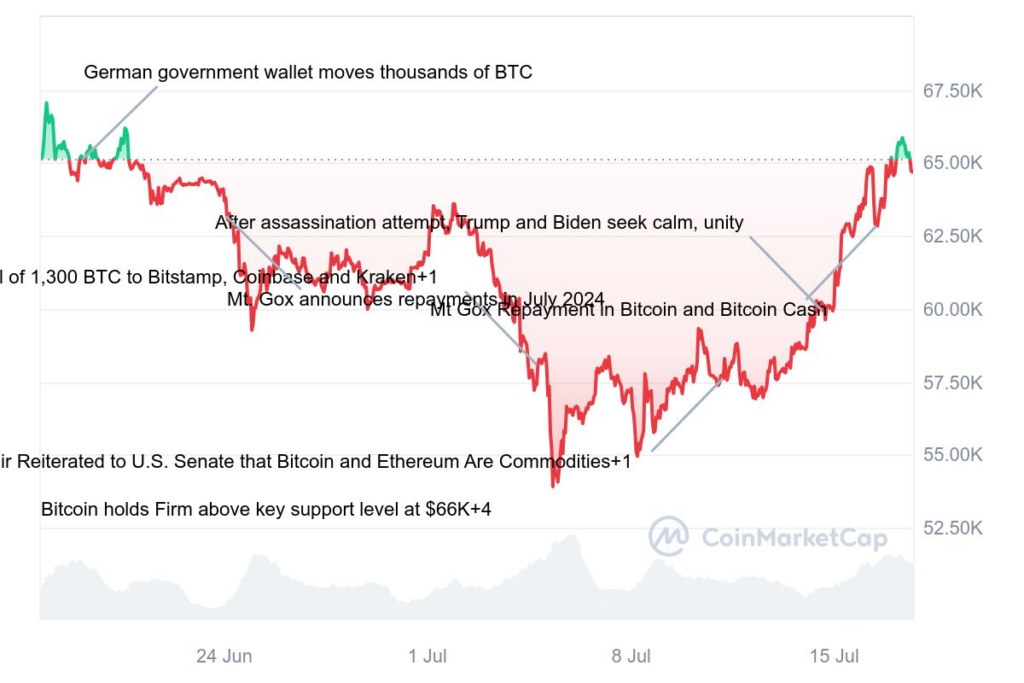

Bitcoin has been under pressure to decline due to outflows and rumors about the German government selling it; the cryptocurrency was only able to recover from its June decline when it ran out of Bitcoin to sell.

As soon as the German government ran out of bitcoin, the price of bitcoin began to rise.

June saw a decline in the price of bitcoin, and it wasn’t until the German government ran out of bitcoin to sell that the price of bitcoin began to rise again.

One day after the German government-labeled wallet ran out of Bitcoin, on July 14, the cryptocurrency’s price rebounded above the psychological $60,000 barrier.

According to CoinMarketCap data, the price of bitcoin dropped more than 7% in June but recovered more than 11% each week, closing at $64,688 as of 1:50 p.m. UTC.

Instead of the amount of BTC sales, the German government’s selling reports caused the bitcoin price to collapse.

The selling by the German government wasn’t the only thing that kept the price of Bitcoin low during the past month. The price decline has also been influenced by elements such as Mt. Gox’s inbound creditor repayments and stagnant Bitcoin exchange-traded fund (ETF) flows.

The market’s response to the announcement, rather than the amount of Bitcoin sold by the German government, determined the price of Bitcoin, according to Arkham’s Moreno.

Moreno clarified:

“It could well be that there’s $20 billion of Bitcoin volume a day, and the German government selling $60 million a day is easily absorbed. It could also be the case that because there’s news of the German government selling… there’s $5 billion going out the door on the retail side because they’re afraid of getting caught.”

But when the market has assimilated the Mt. Gox payouts, the chance to obtain long exposure to Bitcoin will present itself, much like it did after the German government started selling the cryptocurrency, said well-known analyst RunnerXBT.

“Like with Germany transfers, they will eventually have no price impact,” the analyst added. I want to wait for that to happen.