After weeks of unloading its reserves onto the market, the German government has officially depleted its BTC reserves, thereby suppressing the price

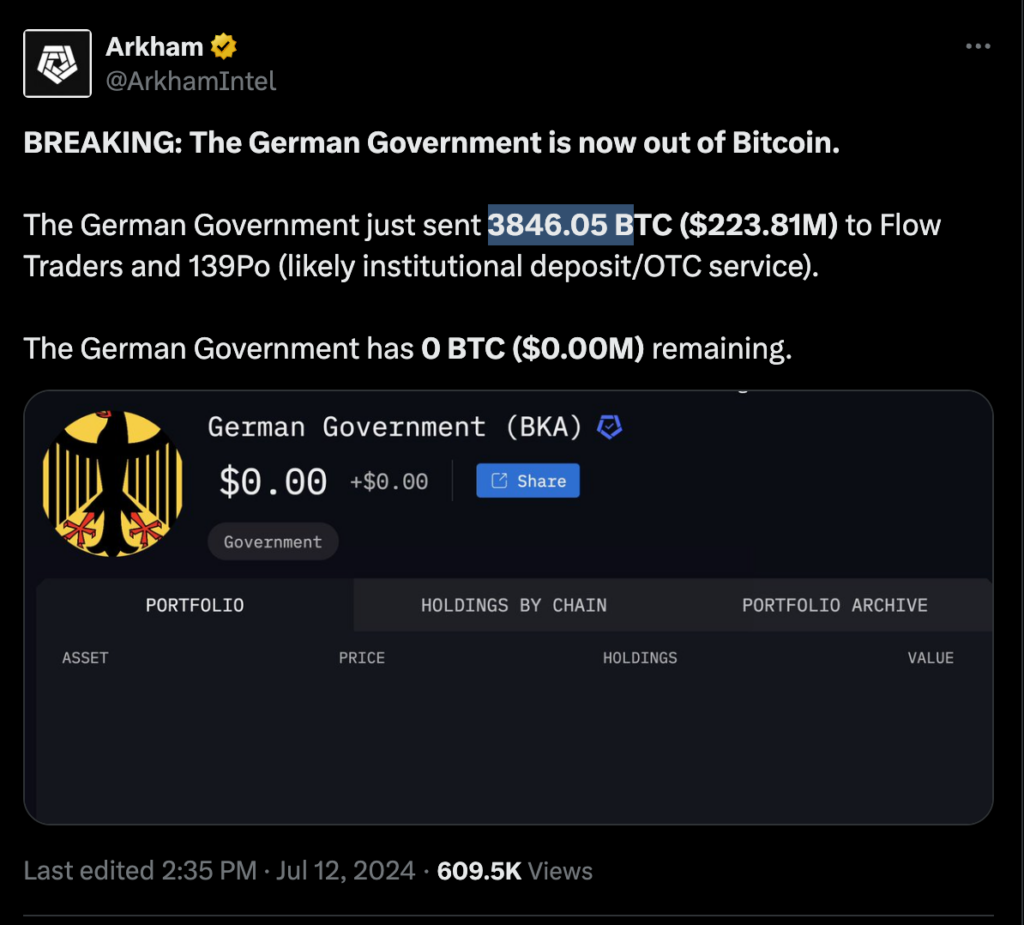

Arkham Intelligence data indicates that Germany’s government liquidated its final Bitcoin holdings on July 12.

Following weeks of heightened selling pressure from the German government, which offloaded tens of thousands of Bitcoin in multiple tranches, the final transaction consisted of 3,093 Bitcoin being sent to a wallet address terminating in “ybVu.”

The majority of the 50,000 Bitcoins that the German government disposed of in the past three weeks resulted from an asset seizure, which was a significant factor in the market’s failure to surpass the $60,000 price threshold and its 200-day exponential moving average.

Institutional investors purchased the decline amid the increased selling pressure. The week of July 8, according to data from CoinShares, United States exchange-traded fund (ETF) investors received $295 million in inflows, which reversed several weeks of suppressed inflows into the investment funds.

Nevertheless, the pricing of Bitcoin may remain suppressed in the upcoming weeks due to the selling pressure resulting from the $9 billion Mt. Gox reimbursement plan, which has contributed to the market’s climate of dread, uncertainty, and doubt in recent months.