Germany’s Bitcoin stack briefly fell below 5,000 following the transfer of substantial funds to Coinbase, Bitstamp, and Kraken; however, it has since rebounded.

The German government’s Bitcoin portfolio has been reduced to 9,094 Bitcoin, which is only 18% of its initial value, following the most recent series of back-and-forth transfers to crypto exchanges on July 11.

The wallet has been storing Bitcoin confiscated from a film pirating website crackdown in January and has transmitted billions since June 19. However, it has intensified its efforts at the beginning of July.

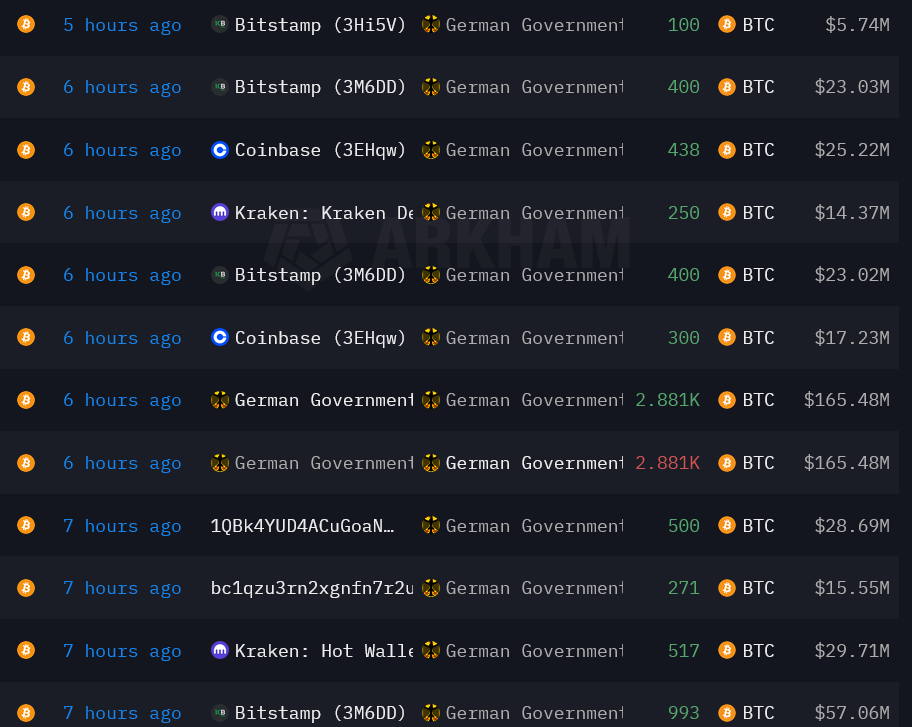

After sending 10,620 BTC worth approximately $615 million to cryptocurrency trading platforms Coinbase, Bitstamp, Kraken, Flow Traders, and two anonymous addresses on July 11, the wallet momentarily fell below 5,000 BTC, according to blockchain intelligence firm Arkham.

Nevertheless, a portion of these assets were subsequently transferred back to the German government wallet, resulting in a return of Germany’s Bitcoin holdings to over 9,000 BTC.

The German government currently controls only 18% of the 49,857 Bitcoin it confiscated from the film piracy website Movie2k in January, according to the current tally.

Arkham thinks the two anonymous addresses ending in “139Po” and “bc1qu” are likely possessed by institutional deposit or over-the-counter trading service providers. Nevertheless, this still needs to be verified.

The widespread sell-off in Germany has yet to be well received by German lawmaker and Bitcoin activist Joana Cotar. Cotar argued in July that Bitcoin could have been adopted as a “strategic reserve currency” to protect against risks in the traditional system.

On an inscription that translates to “Taxes are robbery,” a user of Ordinals appears to have expressed their grievances.

Recently, the BTC price has been significantly impacted by the sell-off and concerns that Mt. Gox has begun distributing over $8 billion of Bitcoin to its creditors.

The Crypto Fear & Greed Index, an indicator that monitors market sentiment, has entered the “Extreme Fear” zone for the first time since January 2023 due to the bearish occurrences.

At the time of writing, Bitcoin is trading at $56,870, a 1.8% decrease from the previous day and a 15.1% decrease from the last month.