A recent development involving the US and German governments has placed Bitcoin (BTC) and the broader crypto market at risk of a further downtrend

According to on-chain data, both governments are attempting to liquidate a significant portion of their BTC holdings.

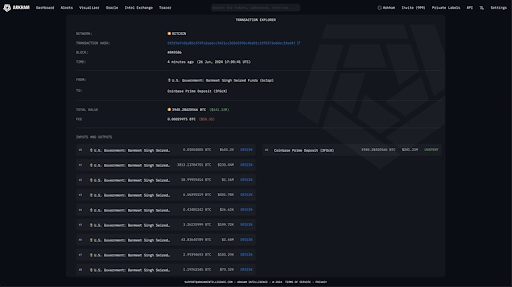

The United States government transferred $240 million in Bitcoin to Coinbase Prime

In an X (formerly Twitter) post, Arkham Intelligence, an on-chain analytics platform, disclosed that the United States government had transferred 3,940 BTC ($240 million) to Coinbase Prime. This has sparked concerns that the government may be considering the disposal of these crypto tokens, which would increase the selling pressure on the flagship cryptocurrency.

Arkham also disclosed that this BTC was confiscated from narcotics trafficker Banmeet Singh after his trial earlier this year. Singh is reputed to have sold drugs through the Silk Road marketplace, a dark web platform from which the United States government has seized a significant quantity of Bitcoin. This is an intriguing fact.

In the past, the US government offloaded a portion of the Silk Road BTC, which resulted in substantial selling pressure for the flagship cryptocurrency. Their most recent confirmed sale occurred in March when they sold 9,861 BTC ($216 million). The transaction of the 3,940 BTC transferred to Coinbase has not yet been verified, indicating that it has not yet been sold.

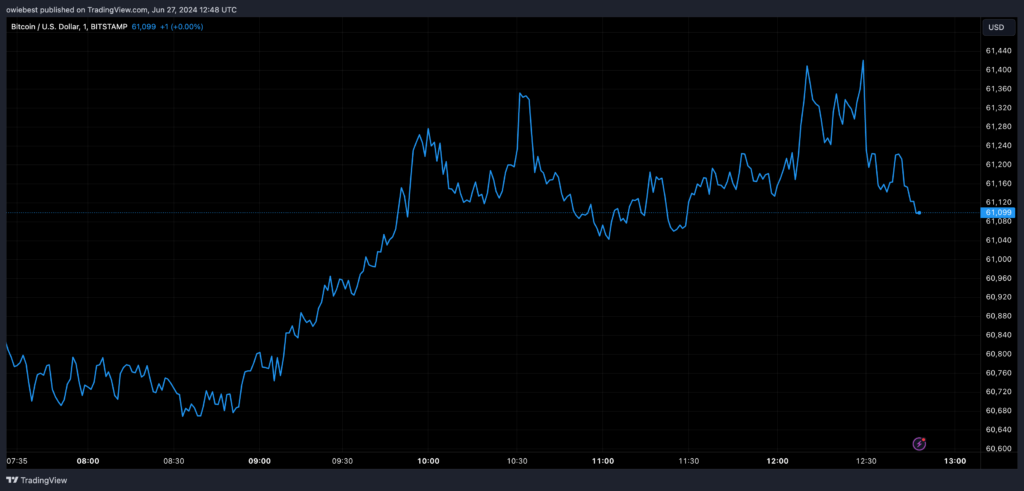

Nevertheless, the US government is not the sole entity interested in liquidating its positions in the market. According to data from Arkham Intelligence, the German government recently transferred 125 BTC ($7.71 million) each to Kraken and Bitstamp.

This is in addition to the 400 BTC ($24 million) they recently transferred to Kraken and Coinbase. In the interim, the German government transferred 1,000 BTC to an unknown address (139Po), which may be another cryptocurrency exchange.

The prospective sale of Bitcoin by the US and German governments is even more concerning, as Bitcoin is already under significant selling pressure. It was recently reported by Bitcoinist that BTC producers have sold 30,000 BTC ($2 billion) this month alone, which has significantly contributed to the crypto’s significant decline since the beginning of the month.

An additional government elects to maintain

While the United States and other governments continue to liquidate their Bitcoin holdings, El Salvador, on the other hand, has elected to continue accumulating the flagship cryptocurrency. Since September 2021, El Salvador has recognized Bitcoin as a legal tender. In November 2022, they implemented a “1 Bitcoin a day program,” which entails the acquisition of 1 BTC daily.

According to data from Arkham Intelligence, they have adhered to this policy and possess 5,794 BTC ($351.82 million). El Salvador has also accumulated wealth through mining operations and foreign investments.