According to Glassnode data, there has been a “notable decline in trade activity over the last quarter,” though traders hope that Q4 will see a sharp change in the trend

Bitcoin kept going up on September 10, hitting $58,000, 8% above its four-week low of $53,955. A study from Glassnode says that Bitcoin investors “remain unconvinced” in the short term, even though the price has increased.

Another report from Glassnode on September 10 says that investors are using centralized exchanges (CEXs) less and more, with “contracting volumes across the board.”

The study said CEXs are still essential for investors to track their speculation and find new prices in the constantly changing cryptocurrency market.

They looked at onchain amounts added up across CEXs to see how active investors were and how much they were willing to speculate.

The market intelligence company noticed that the monthly average volume has dropped much below the annual average for exchange-related inflows and outflows. They did this by using a similar 30d/365d momentum cross-over.

“This underscores a decline in investor demand and less trading by speculators within the current price range.”Bitcoin exchange volume momentum. Source: Glassnode

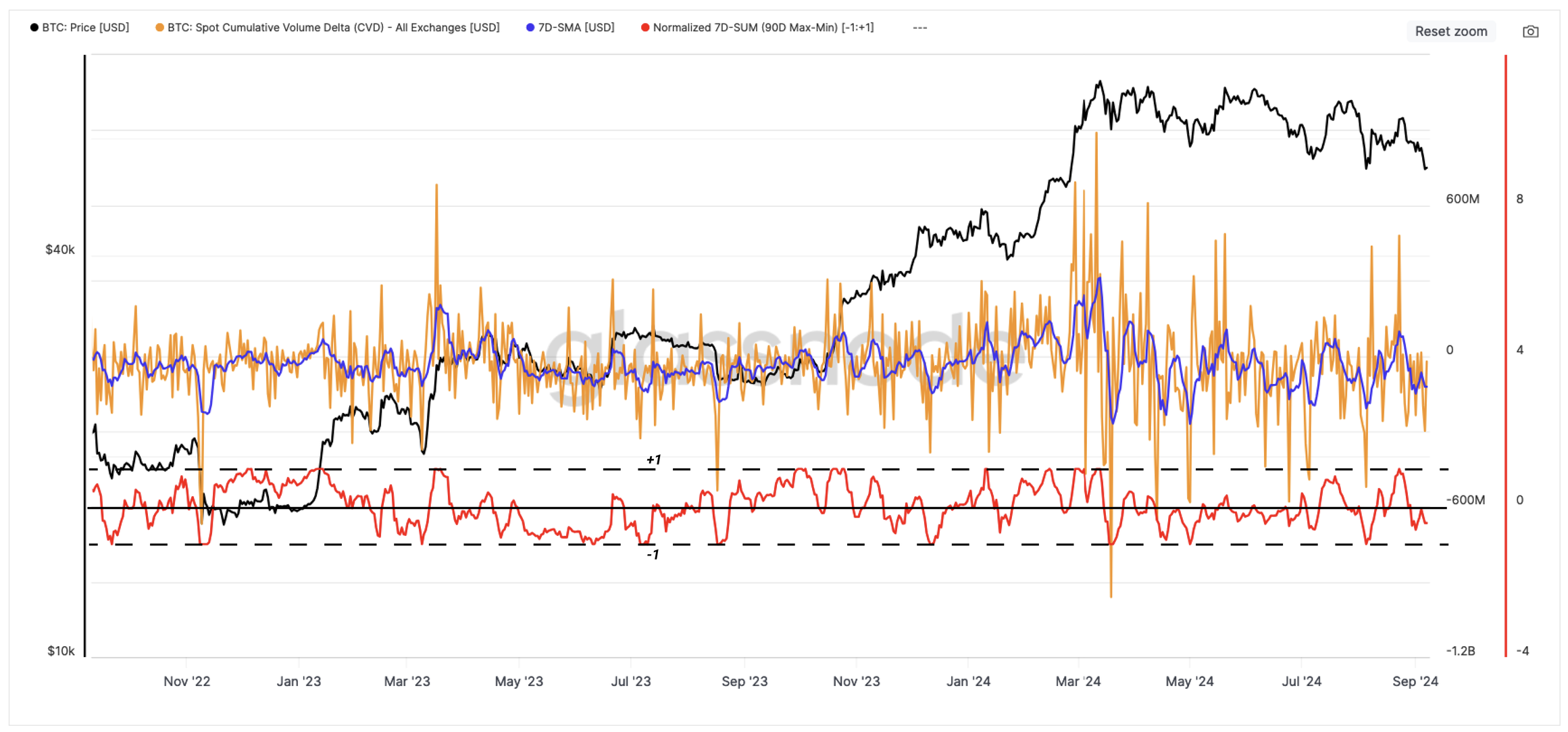

Glassnode thinks that the recent drop in the market slowed down trading. The analysts used the 90d MinMax scalar metric to look at spot trade volumes on exchanges and concluded that the spot volume momentum across CEXs is continuing to weaken.

“This adds more weight to the idea that there has been a notable decline in trade activity over the last quarter.”

Additionally, Glassnode used the CVD measure to find that selling pressure from investors has been rising over the last three months, “contributing toward the downward tilt in price action.” This metric estimates the net balance between market buying and selling pressure in spot markets.

It’s also clear that institutional investors are losing interest, as the study said that spot Bitcoin exchange-traded funds (ETFs) are “exhibiting net outflows.”

“Net capital flows in USD into spot Bitcoin ETFs have softened since Aug 2024 and are now reporting an outflow of $107M/week.”US spot Bitcoin ETF net flows. Source: Glassnode

This is supported by data from Farside Investors, which shows that between August 27 and September 6, US-based spot Bitcoin ETFs saw a net outflow of $1.186 billion. On September 9, there were small inflows of $28 million.

More information from CoinShares shows that $643 million left Bitcoin investment goods during the week ending September 6.

CoinShares said this was because people felt bad. After all, last week’s macroeconomic data was better than predicted, making it more likely that the US Federal Reserve would cut interest rates by 0.25%.

Trading company QCP Capital says that the US Consumer Price Index, due on September 11, along with the first presidential debate between Kamala Harris and Donald Trump, could cause Bitcoin prices to rise and fall again.