As U.S. Treasury yields rose this month, gold prices extended their downward trend this week, falling below the $2,300 threshold at the opening bell on Thursday

Gold prices are still on a precarious trajectory due to the increased return on Treasury securities. The XAU/USD index, which monitors the performance of the precious metal, indicates that it has declined to $2,297.

During today’s opening bell, gold prices decreased by nearly 0.32 points and lost 0.01% of their value.

What is the future of gold prices following today’s decline?

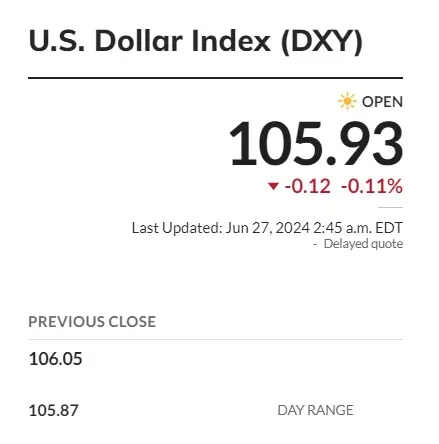

Gold investors are concerned about the potential for further price declines following today’s decline below the $2,300 threshold. Today, the U.S. dollar has reached the 105.91 level and is experiencing a surge in the global market.

The forex markets are being dominated by the world’s most dominant currency, which has caused local currencies to experience new lows.

Today, gold is experiencing a decline due to the strengthening of the U.S. currency. If the U.S. dollar continues to increase in the DXY charts, gold prices will decline to $2,277. The prices must encounter resistance at these levels, and failure to do so could result in a decline to the $2,250 range.

Consequently, the performance of gold is significantly influenced by the upcoming weeks, as there is a greater likelihood of a decline. Gold prices are currently experiencing a correction despite having increased by nearly 18% year-to-date.

Retail and institutional investors are primarily engaged in profit reservations, which also contributes to the current decline in gold prices.

Due to volatility, gold prices may encounter difficulties during the third quarter of 2024. Timing the market at this juncture could be hazardous, as the subsequent trajectory is contingent upon other macroeconomic factors.

Observing and anticipating developments before establishing an entry position in gold is advisable.