Google Pay has incorporated 3 new and handy features that will save you time and money that is to soon begin highlighting any rewards you can earn on your card

Three newly added features to Google Pay are designed to increase the transparency and simplicity of online purchasing.

The tech giant’s decision to update Google Pay on June 4, when the app is scheduled to go inactive in the United States, may appear peculiar at first glance.

This cessation may result in ambiguity regarding the applicability of these updates.

The upgrade is being applied to the Google Pay payment system, not the app itself.

As of this writing, the Google Pay application will be discontinued in approximately two weeks. As a result, the subsequent modifications should be visible on desktop and mobile platforms.

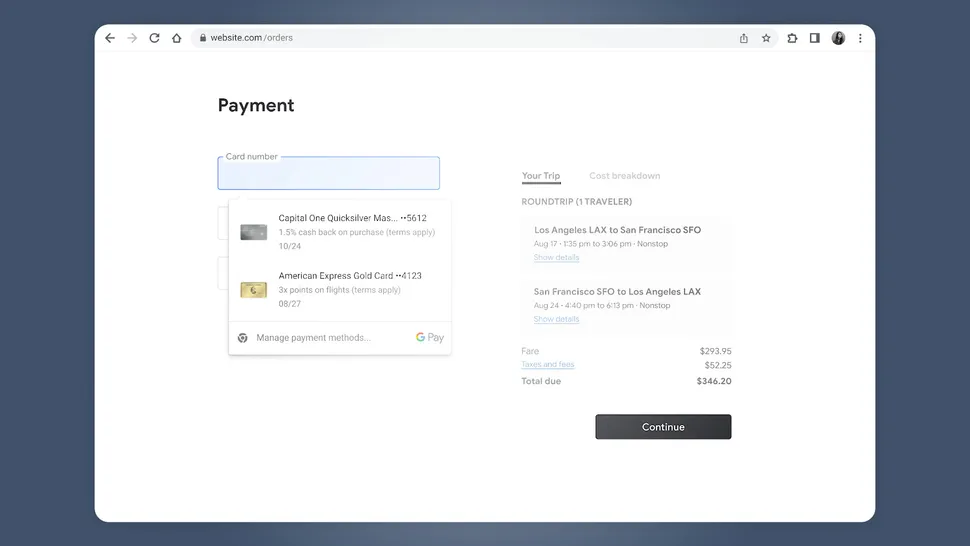

The organization’s announcement post states that “American Express and Capital One cardholders” can now access the advantages they are eligible to receive during the checkout process on Chrome desktop via the “autofill drop-down” menu.

Consider a scenario in which an individual purchases a round-trip flight from Los Angeles to San Francisco, as Google illustrates.

Utilizing an American Express Gold Card may result in a threefold increase in travel points earned.

On the contrary, by selecting a Capital One Quicksilver Card, they will be eligible to receive a cash-back bonus of 1.5 percent on their purchase.

Future integration of additional card options by Google would augment the feature’s functionality, catering to a more extensive user base.

Expanding the purchase now, pay later (BNPL) payment option to additional “merchant sites and Android apps across the United States” constitutes the second new feature.

It would appear that Google is working in tandem with Affirm and Zip, two BNPL services, to facilitate this expansion.

Nevertheless, in their official declaration, Google still needs to elaborate on the precise websites and applications that should be able to support this functionality.

While further details have been requested, it is evident that the objective of this functionality is to offer customers greater flexibility in payment alternatives, which could potentially enhance the convenience and financial accessibility of a diverse array of transactions.

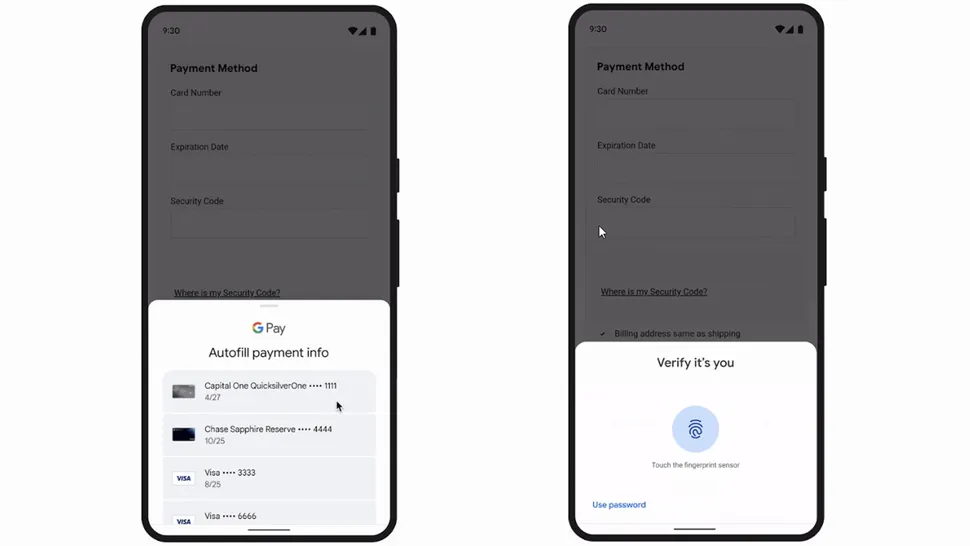

The Autofill update, which constitutes the third feature, is noteworthy for its global reach.

In contrast to the first two features, which are country-specific, the Autofill update will be made available worldwide.

In the future, card information can be verified using biometrics or the screen lock PIN for consumers utilizing Chrome or Android.

This technological progression eliminates users’ need to input their security code manually, optimizing the checkout procedure and fortifying security measures.

(Image credit: Google)

Regarding operation, Autofill typically functions without any interruptions. Google has, nonetheless, implemented safeguards to prevent misuse.

Upon identifying dubious transactions, the payment process will be halted.

Users may also configure a device lockdown function.

This means that Google Pay will request that you unlock your smartphone to access your complete card information, thereby preventing unauthorized parties from using your card details if they gain access to your device.

The integration of these updates signifies a substantial improvement to the Google Pay payment system, with the dual objectives of enhancing user convenience and security.

Constantly releasing these updates concurrently with the discontinuation of the Google Pay application demonstrates Google’s dedication to improving its overall payment infrastructure.

Users must remain vigilant when releasing these upgrades as they become available.

As the Google Pay update is presently being deployed, users can anticipate the appearance of these modifications shortly.

While you anticipate introducing these novel functionalities, it could be advantageous to delve into additional technological progressions.

Look up the list of the top Android smartphones for 2024, for instance, to ensure that your device is outfitted with the most recent technological advancements so that you can maximize the benefits of these updates.

In essence, the forthcoming enhancements to Google Pay serve as a testament to Google’s continuous endeavors to improve and streamline the online purchasing experience.

Google is establishing its dominance in the digital payment industry by implementing functionalities that offer more transparent advantages, adaptable payment alternatives, and bolstered security.

In light of the impending demise of the Google Pay application, the updates above indicate a resilient trajectory for Google’s payment infrastructure, guaranteeing patrons an uninterrupted and fortified purchasing encounter.