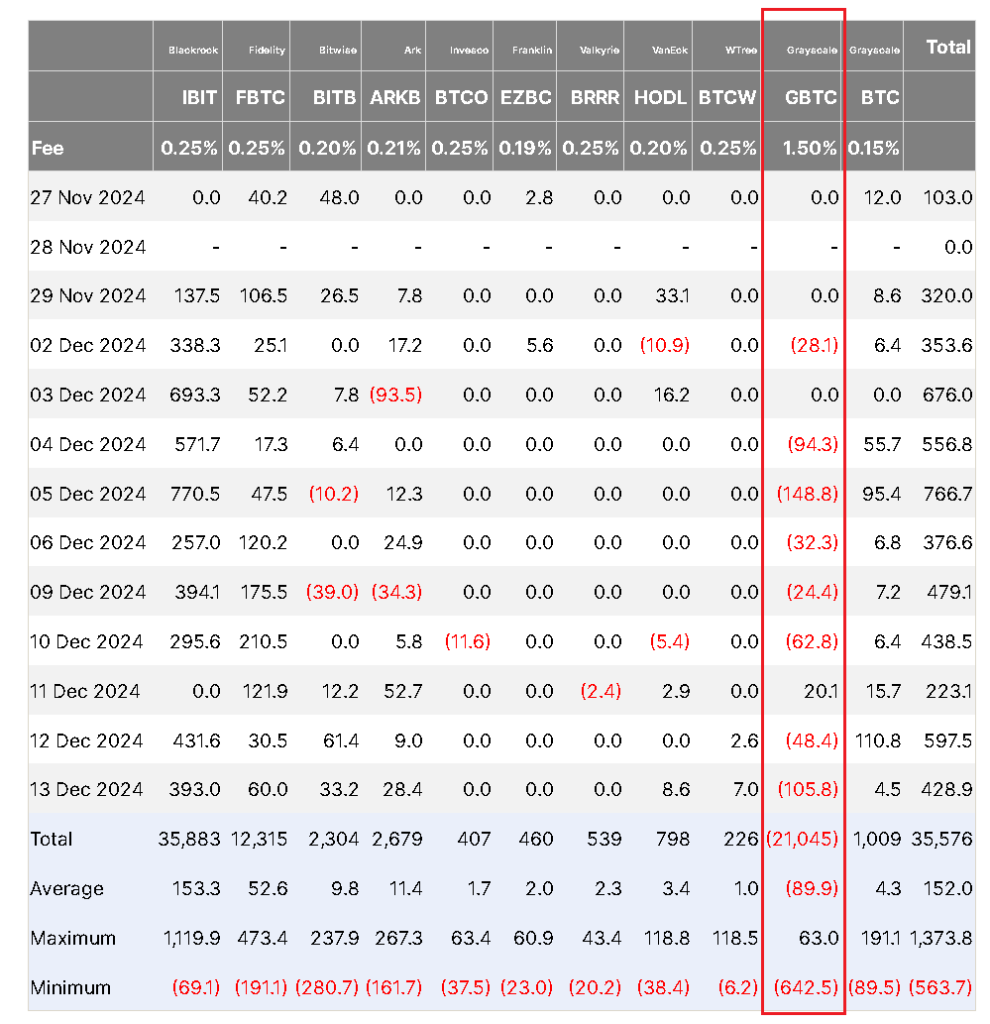

Grayscale Bitcoin Trust (GBTC) has experienced over $21 billion in outflows since its January 11 launch, marking the only U.S. spot Bitcoin ETF with negative net flows.

The Grayscale Bitcoin Trust (GBTC) is the sole spot Bitcoin exchange-traded fund (ETF) in the United States with a negative net investment flow, as over $21 billion has been withdrawn from the fund since its inception on Jan. 11.

Grayscale Bitcoin Trust Outflow

The trust continues to dispose of millions of dollars’ worth of investment on a daily basis, resulting in a cumulative outflow of $21.045 billion as of Dec. 16. For the past 11 months, GBTC has reported a daily average loss of $89.9 million, as per data from Farside Investors.

Despite the fact that the remaining 10 Bitcoin ETFs approved in the United States have maintained positive balance sheets, the investments made by nine of the funds are overshadowed by GBTC’s outflows, as illustrated in the chart above.

Other spot Bitcoin ETFs are overshadowed by Grayscale’s $21 billion outflows.

The new nine ETFs, which include the Fidelity Wise Origin Bitcoin Fund, Bitwise Bitcoin ETF, ARK 21Shares Bitcoin ETF, Invesco Galaxy Bitcoin ETF, Franklin Bitcoin ETF, Valkyrie Bitcoin Fund, VanEck Bitcoin ETF, WisdomTree Bitcoin Fund, and Grayscale Bitcoin Mini Trust ETF, have collectively received $20.737 billion.

In contrast, BlackRock’s iShares Bitcoin Trust (IBIT) plays a major role in ensuring a positive balance sheet. IBIT’s total inflows stand at $35.883 billion, with the fund attracting $153.3 million daily since inception.

Spot Bitcoin ETFs Surge to $35.5 billion despite Grayscale’s investment exodus

Despite the billions of dollars of outflows, the total spot Bitcoin ETF market has surged, reaching over $35.5 billion in investments in under a year.

Grayscale’s Ethereum Trust ETF (ETHE), which was launched along with eight other spot Ether

ETFs in the US, is following a trend similar to its Bitcoin counterpart.

As of Dec. 13, ETHE has lost over $3.5 billion total in under six months since its launch on July 23.

All other funds on the spot ETH ETF ecosystem have a positive inflow, with BlackRock’s iShares Ethereum Trust ETF (ETHA) and Fidelity Ethereum Fund (FETH) leading the drive with investments worth nearly $3.2 billion and $1.4 billion, respectively.