Grayscale Investments’ Grayscale XRP Trust exposes accredited investors to XRP, the XRP Ledger coin

According to a Ripple press release, the Trust is accessible to qualified investors for daily subscription and functions in a manner that is consistent with Grayscale’s other single-asset investment trusts.

Grayscale remains optimistic about the long-term value of XRP despite the ongoing legal dispute between the SEC and Ripple XRP, which has resulted in an ambiguous regulatory status.

The XRP ledger is a blockchain intended to enable rapid, cross-border transactions. The Trust aims to offer investors access to a digital asset with real-world payment utility, as Rayhaneh Sharif-Askary, Grayscale’s Head of Product & Research, said.

XRP, a prominent player in the cross-border payments industry, is now accessible to accredited investors, a significant development for the U.S. financial markets.

Grayscale is introducing an investment vehicle for XRP, which has the potential to advance the case for a future XRP-based ETF, as well as to attract broader institutional interest and increase capital inflows.

This launch has the potential to facilitate the integration of other crypto investment products into XRP, such as a spot XRP ETF, by further integrating digital assets into conventional financial markets.

Grayscale’s XRP Trust directly results from the company’s achievement in converting its Bitcoin.

Bitcoin and Ethereum

Following a successful lawsuit against the Securities and Exchange Commission (SEC), Ethereum has transitioned to exchange-traded funds (ETFs). Grayscale’s four-phase productently maintains the potential for future regulatory approval despite the absence of an XRP ETF.

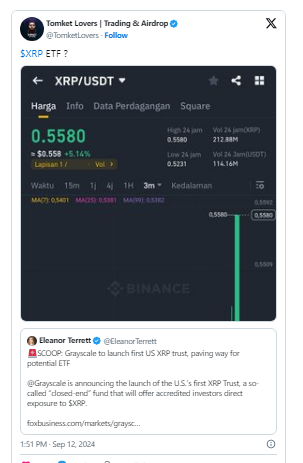

The current price of XRP is $0.57, which is considerably lower than its all-time high of $3.84 in 2018. Nevertheless, the cost of XRP has risen by more than 8% in the past 24 hours since this news was disclosed.

Is the XRP ETF the next step?

Standard Chartered analysts predicted in May that Ripple ETFs could be introduced in 2025 after the approval of Ethereum ETFs.

Brad Garlinghouse, the CEO of Ripple, previously expressed his belief that the emergence of numerous token-based ETFs was inevitable, which fueled speculation regarding the potential future of crypto ETFs.

A spot crypto exchange-traded fund (ETF) invests portfolio funds in a particular cryptocurrency and monitors its price. These funds are typically associated with a specific cryptocurrency and are traded on public exchanges.

Crypto ETFs, like comparable funds, are listed on conventional stock exchanges and may be maintained in an investor’s standard brokerage account.