Hashdex has filed for dual Spot Bitcoin and Ethereum ETF, and if approved, the crypto ETF would be the first of its kind, but probably not the last.

In a filing with the United States Securities and Exchange Commission (SEC) on June 18, Hashdex suggested the establishment of a combined spot Bitcoin (BTC) and Ether (ETH) exchange-traded fund (ETF) on the Nasdaq exchange.

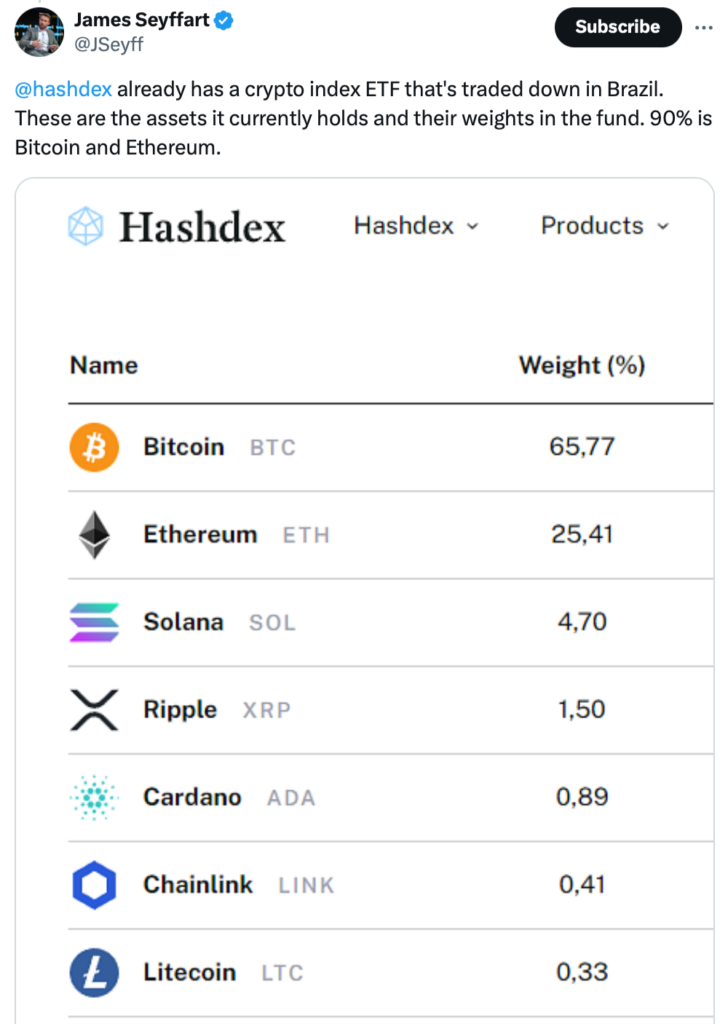

The crypto assets would be balanced according to their market capitalizations, which were 70.54% Bitcoin and 29.46% Ether on May 27. The proposed ETF would implement this strategy.

Its passive investment strategy would monitor the daily market movement on the Nasdaq Crypto US Settlement Price Index without attempting to surpass it.

An ETF with the best of all worlds

Analyst James Seyffart stated that a combined-asset exchange-traded fund (“ETF”) “makes a lot of sense.” The ETF would refrain from investing in other spot assets besides BTC and ETH. Nevertheless, it included the following:

“In the event that any other crypto asset is included (other than bitcoin or ether), or is eligible for inclusion as an Index Constituent […], the Sponsor will transition the Trust’s investment strategy […], with only bitcoin and ether in the same proportions determined by the Index.”

The filing stated that crypto assets are eligible for inclusion under a set of rules that “includes being currently listed on a U.S.-regulated digital asset trading platform or serving as the underlying asset for a derivative instrument listed on a U.S.-regulated derivatives platform.”

Both Coinbase and BitGo will hold the BTC and ETH assets as custodians. They will provide segregated accounts for individual shareholders.

Hashdex innovates ETF structures

Hashdex, an investment manager based in Brazil, applied to the Securities and Exchange Commission (SEC) to establish an Ethereum ETF. However, the company subsequently retracted its application.

Nine currencies are included in the indexed crypto ETF traded in Brazil, with BTC and ETH comprising nearly 92% of the value. It acquires the spot asset on the CME and contains up to 5% BTC futures contracts in its U.S.-traded spot BTC ETF.

Hashdex must still submit and obtain SEC approval for an S-1 application. The agency is required to respond to the 19-b4 within 90 days. During this time, it will take comments from the public and other financial institutions regarding the proposal. According to Seyffart, the fund should receive a definitive SEC decision by March 2025.