Trump administration’s crypto rules and the Fed’s monetary policy are key factors shaping Bitcoin’s price direction.

During the first quarter of 2025, Bitcoin could potentially mitigate investor concerns regarding delayed crypto regulations in the United States by generating over $612 billion in new liquidity.

In the 24 hours preceding 8:00 am UTC on January 8, Bitcoin experienced a nearly 6% decline, dipping below the $100,000 threshold that has been a psychological resistance since December 19, according to data from Cointelegraph Marketspro.

Although the cryptocurrency industry anticipates President-elect Donald Trump’s inauguration on January 20, any delays in the implementation of crypto regulations could potentially undermine investor sentiment and depress valuations.

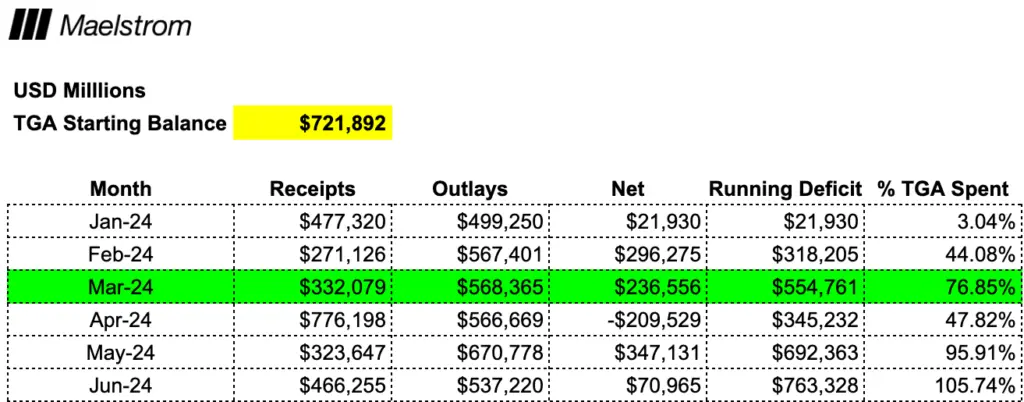

Nevertheless, Arthur Hayes, co-founder of BitMEX, suggests that the regulatory disappointment may be mitigated by the $612 billion in new liquidity that will be added to the US Treasury by March 2025.

Hayes composed the following blog post on January 7:

“A letdown by team Trump on his proposed pro-crypto and pro-business legislation can be covered by an extremely positive dollar liquidity environment, an increase of up to $612 billion in the first quarter.”

Hayes predicts that the issuance of money will increase following Trump’s inauguration, resulting in a local high for Bitcoin in March prior to the initiation of a potential correction.

The correction, according to Hayes, is likely to be precipitated by disappointment with the Trump administration’s inadequate crypto policy.

“The market will immediately recognize that Trump has a maximum of one year to implement any policy changes on or around January 20th.”

Hayes wrote in a post on December 18 that this revelation would result in a vicious sell-off in crypto and other Trump 2.0 equity trades.

Analysts are sanguine about the trajectory of Bitcoin’s price, despite the potential for regulatory disappointment.

Some anticipate a cycle top above $150,000 in late 2025, which is expected to be driven by a projected $20 trillion increase in the global money supply.

This increase is expected to attract $2 trillion of investment toward BTC.

Is It possible For Bitcoin To Regain $100,000 Before Donald Trump Inauguration?

The recent Bitcoin correction has been attributed to a decrease in institutional investor activity during the holiday season.

Nevertheless, institutional investors generally redeploy capital at the commencement of each new year.

Bitcoin may surpass $100,000 before Trump’s inauguration on January 20, as per Binance Research, which attributes this to the institutional “liquidity boost.”

“While it is possible for BTC to recapture $100K ahead of the Trump inauguration on expectations of positive crypto regulation, the market will need to see continued supportive conditions to maintain such levels.”

Binance Research further stated that the long-term sustainability of these levels will be contingent upon a variety of factors, such as the Federal Reserve’s policy trajectory in 2025 and the actual implementation of crypto regulations.

Institutional Bitcoin holders continue to harbor optimism regarding Trump’s inauguration. KULR Technology Group, which is listed on the New York Stock Exchange, forecasted on January 7 that Bitcoin would surpass $200,000 in 2025 after purchasing the decline at $97,000.