MicroStrategy stock is anticipating substantial purchases from hedge funds to rectify its downward trajectory to $500 as the price of Bitcoin surpasses $100,000.

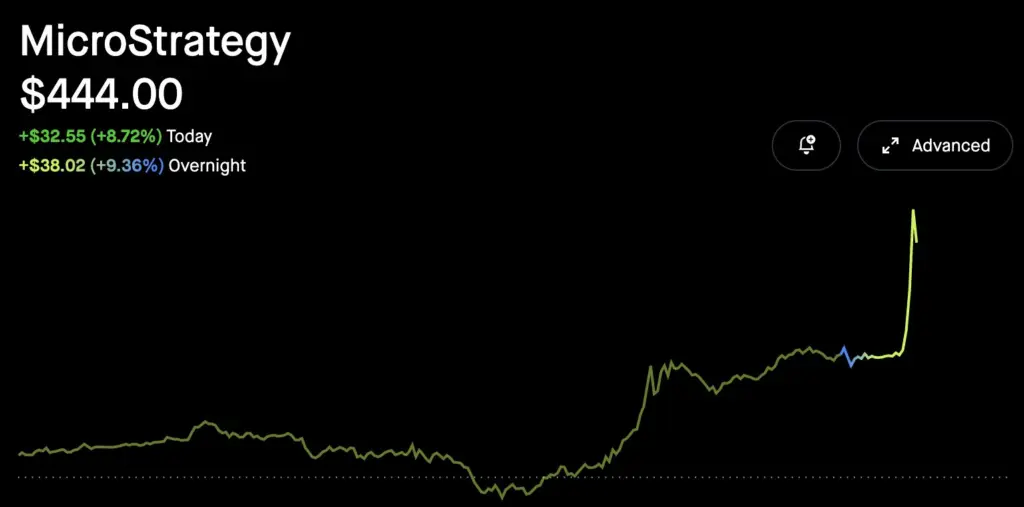

The stock of MicroStrategy (MSTR) has once again reversed its trajectory, surging past $400 as the price of Bitcoin surges past $103,000 to a new all-time high.

MSTR has outperformed BTC this year and is on the verge of reaching new highs, as evidenced by its over 500% rally.

Consequently, it has emerged as a top choice for hedge funds that are seeking to capitalize on the volatility of the MSTR.

Shares Of MicroStrategy Are On Upward Trajectory

The stock of MicroStrategy has once again demonstrated fortitude by rebounding from the lows of $350 last week, as Bitcoin emerges from its consolidation phase.

On Wednesday, the MSTR stock price surged past $400 once more, gaining 8.72%.

Additionally, Bitcoin surpasses the $100,000 threshold, resulting in a 10% increase in the stock price during overnight trading.

For the first time in history, the company’s Bitcoin holdings have now exceeded a valuation of $40 billion.

In November, MicroStrategy co-founder Michael Saylor disclosed that the company raised $13.5 billion to acquire 149,880 BTC at an average price of approximately $90,231 per Bitcoin.

This strategic decision resulted in a Bitcoin yield of 38.7%, which translates to a net benefit of 97,500 BTC for shareholders or an impressive 3,250 BTC per day. This sum is equivalent to $10 billion.

The company’s total Bitcoin holdings, which amount to 402,100 BTC, have exceeded $40.8 billion in the wake of the current BTC price rally.

Subsequently, the organization maintains an immense profit of $18 billion in its Bitcoin portfolio.

The MSTR stock has already been assigned a target price of $600 by Bernstein analysts, indicating that it is likely to experience an additional 50% increase from this point.

Hedge Funds Are Riding Volatility Of MSTR

Eli Pars, the co-chief Investment Officer at Calamos Advisors LLC, has been instrumental in the acquisition of more than $6 billion in convertible notes issued by MicroStrategy this year.

The notes are employed by Pars, as well as other firms, in market-neutral arbitrage strategies that exploit the increased volatility of the underlying asset, Bitcoin.

Calamos Advisors utilizes a combination of arbitrage strategies and long positions to optimize returns and manage exposure, with a total of over $130 million in MicroStrategy notes.

Pars stated, “Convertibles are a method by which issuers can capitalize on the volatility of their stocks, and MicroStrategy serves as an extreme illustration.”

In addition, Wall Street professionals have been drawn to MicroStrategy’s convertible bonds due to their appealing pricing, which has the potential to generate substantial arbitrage profits.

This year, the organization has become the world’s largest issuer of convertible bonds.

Pars stated, “The trade is appealing because the implied vol of the converts is significantly lower than the realized vol or option implied vol.”

As the MicroStrategy stock increases, Michael Saylor continues to raise additional funds through stock sales and reinvests the proceeds in Bitcoin.

This results in an even greater increase in the price of BTC, which in turn generates further profits for MSTR, thereby establishing a cycle.

The risk is the potential for Bitcoin’s year-long rally to reverse, which could result in substantial repercussions for investors who are holding increasingly leveraged positions on its value.

According to David Trainer, CEO of New Constructs LLC, a market research firm:

“It could be a giant house of cards that will crush many shareholders when it crashes. There is no fundamental benefit here. It has become a game of musical chairs, you play until the music stops and you just hope you can get out before the crash.”

In the past 24 hours, the price of Bitcoin (BTC) has increased by 7%, reaching a high of 103,900.

Bulls have maintained the price above $102K, as the trading volume has increased by 75% in the past few hours, suggesting a significant level of interest among traders.