As traditional finance adjusts to the 24/7 digital asset markets, hedge funds such as Qube, Virtu, and Jump are recruiting weekend cryptocurrency traders.

Global finance is changing due to the constantly shifting cryptocurrency market, which is forcing trading businesses and hedge funds to go beyond regular business hours and weekend staff desks.

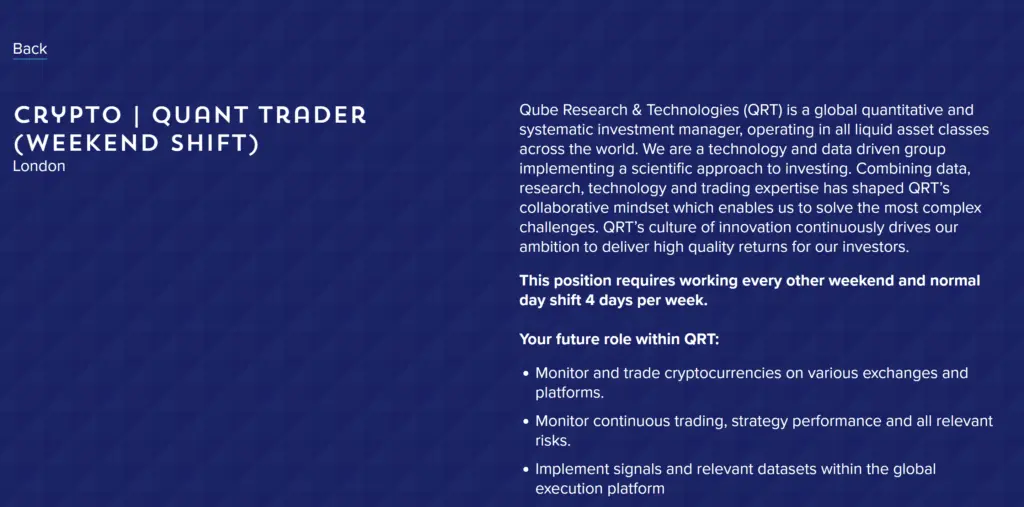

In addition to a four-day workweek, Qube Research & Technologies, a global quantitative investment management company headquartered in London, is searching for a “Crypto | Quant Trader (Weekend Shift)” position in London.

Working every other weekend and a regular day shift four days a week is necessary for the position, which involves managing ongoing cryptocurrency trading, keeping an eye on strategy performance and risks, and putting signals and data sets into action.

The cryptocurrency market is open around the clock, unlike traditional financial markets that set hours and close on weekends. Price changes can occur anytime, on weekends, without holidays, closing bells, or after-hours sessions.

Weekend crypto positions are filled by TradFi businesses.

Other conventional financial institutions are increasing their crypto recruiting to cover weekends. Virtu Financial, an American high-frequency trading company, is looking for a weekend trader in Singapore to cover digital asset activity outside of weekday trading periods.

The cryptocurrency section of Jump Trading was trying to find a weekend trader in Chicago. Since the job isn’t open now, the business may have discovered the ideal applicant.

The increase in weekend crypto jobs coincides with the development of crypto teams and infrastructure for round-the-clock operations by large trading businesses and hedge funds.

Today, BH Digital, Brevan Howard’s specialized crypto division, employs dozens of people, including more than 15 portfolio managers, over ten data scientists and traders, and twenty outside engineers who help with its strategy.

Point72, Steve Cohen’s hedge fund, is growing similarly. Its Cubist Quant branch in Paris is hiring a quantitative developer focusing on cryptocurrency.

According to a CoinShares report from March, hedge funds currently own seven of the top ten largest holders of Bitcoin BTC $107,641 ETF shares. For the first time, the firm noted, “Hedge funds alone now account for 41% of all 13-F Bitcoin ETF holdings, surpassing investment advisers.”

On weekends, cryptocurrency is still erratic.

Weekend volatility in cryptocurrency is still present. Following US President Donald Trump’s tariff announcement on Friday in April, cryptocurrency values fell precipitously. Bitcoin fell 7% over the weekend, from $83,000 to $77,000.

On weekends, cryptocurrency markets may become very erratic in the event of hacks or breaches. Exploits planned for late Friday or Saturday might cause quick sell-offs and precipitous price declines because of reduced liquidity and workforce.

Crypto traders have traditionally worked nonstop, while hedge funds are only now hiring for weekend positions.

“We work on the weekends. Have some free time? Work time, no such thing. Don’t waste your leisure time on the bear. Altcoin trader Gordon commented on X, “For now, we grind.”