Boyaa Interactive, a Hong Kong-based company swapped Ether for Bitcoin, raising its holdings to 3,183 BTC from 2,635 in September to reorganize its treasury.

Boyaa Interactive International, a Hong Kong holding company specializing in online card and board games, has elected to exchange Ether for Bitcoin to reorganize its treasury assets.

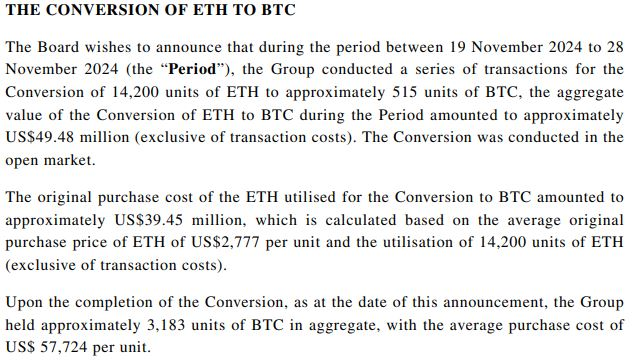

According to a statement released on November 29, between November 19 and November 28, the gaming company converted 14,200 Ether, which is valued at over $49 million, into approximately 515 Bitcoin.

Boyaa Interactive International has acquired 3,183 Bitcoin, which, at current prices, is valued at $310.7 million, as reported by CoinGecko.

Boyaa stated in a statement that the Group’s strategy is to purchase, hold, and continuously expand its BTC reserves.

“The Board believes that the current time is a relatively appropriate one for the Group to convert the ETH held by the Group to BTC to increase the BTC reserves, taking into account the prospects of BTC and ETH and the Company’s strategic plan.”

The company’s treasury contained 2,635 Bitcoin and 15,388 Ether, as indicated by its third quarterly results, which were disclosed on November 21.

According to CoinGecko, the price of Bitcoin has increased by over 6% in the past 14 days, reaching over $96,000.

However, Ether has performed even better, with an 18.3% increase in price, currently trading at $3,669.

Boyaa initiated its crypto treasury strategy in November 2023, when the board of directors authorized a $100 million initiative to allocate $45 million of corporate funds to Bitcoin, $45 million to Ether, and $10 million to stablecoins such as USD and Tether.

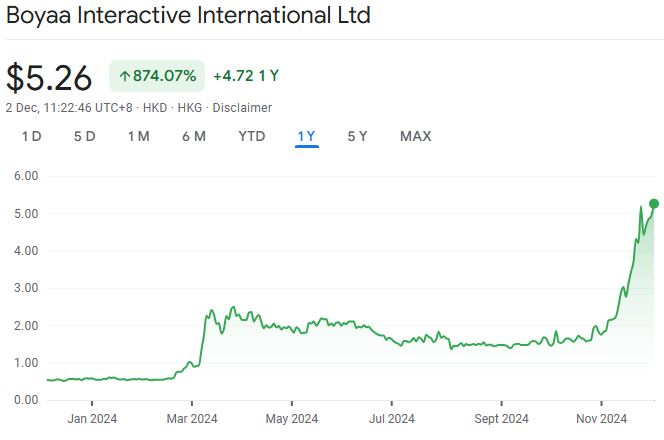

The company’s stock price has increased by over 874% in the past year, reaching its current value of $0.68 (5.26 Hong Kong dollars).

Nevertheless, Google Finance indicates that it is still below its all-time high of $1.81 (14.06 Hong Kong dollars).

This year, an increasing number of other organizations have either increased their existing Bitcoin holdings or added it to their balance sheets.

MicroStrategy, which is led by Michael Saylor, disclosed a significant increase in its Bitcoin holdings in a filing on November 25, purchasing an additional 55,000 Bitcoin.

An alternative to YouTube Rumble, In November, Semler Scientific, a technology solution provider, and Genius Group, an artificial intelligence firm, also initiated the acquisition of Bitcoin.