Hong Kong plans to allow crypto derivatives trading for professional investors as part of efforts to grow its fintech and digital asset ecosystem.

Local media said that Hong Kong’s securities regulator wants to allow professional investors to trade digital asset derivatives.

This is part of a larger plan to offer more products and strengthen the city’s position in the global digital asset market.

It was revealed by Christopher Hui Ching-yu, secretary for Financial Services and the Treasury, on June 4.

This was written in the English-language newspaper China Daily HK.

The Hong Kong Securities and Futures Commission (SFC) said good risk management would be the top priority.

The report noted that trades would be carried out “in an orderly, transparent, and secure manner.”

According to SFC data cited by China Daily HK, Hong Kong is reportedly moving into crypto derivatives at a time when the world market for digital assets has grown to over $3 trillion in value and trades worth over $70 trillion every year.

Earlier this year, the government laid out plans to give investors a wider range of virtual asset goods.

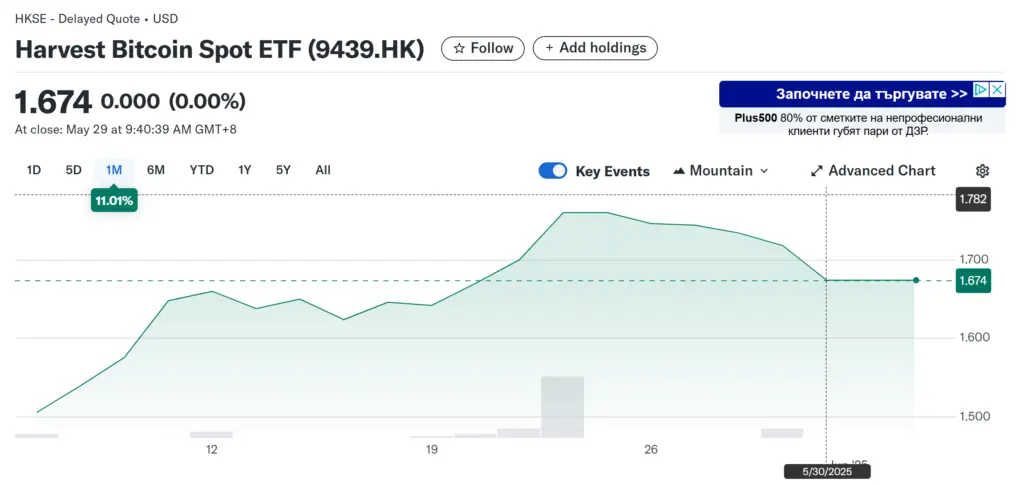

It has given the go-ahead for holding services, virtual asset spot ETFs, and futures products. HashKey got permission to offer staking services in April 2025.

Hong Kong Will Improve Its Tax System

Hui also said that Hong Kong is improving its tax system to attract more foreign businesses.

Soon, digital assets will get tax breaks under Hong Kong’s special tax system for funds, single-family homes, and carried interest.

The special administrative region has been telling people in the Greater Bay Area and the rest of China about its fintech environment.

Invest Hong Kong and the Hong Kong Key Enterprises Office are two examples of agencies that help businesses with licensing, tax breaks, and following the rules.

The work is paying off. Hui is said to have said that Hong Kong is home to more than 1,100 fintech companies, such as eight licensed digital banks, four virtual insurers, and ten regulated trading platforms for virtual assets.

The city released its first virtual asset policy statement in October 2022.

Since then, it has added Asia’s first VA futures ETFs, spot ETFs in April 2024, and futures inverse products in July 2024, making its crypto market more diverse.

Two of the administrative region of China’s top financial officials said together in September 2024 that they would follow the European Securities and Markets Authority’s (ESMA) rules for reporting crypto over-the-counter (OTC) derivatives.

Hong Kong Is Getting Ready For Second Policy Statement On Virtual Assets

the administrative region said in April that it would be putting out a second policy statement on virtual assets later this year.

The goal is to integrate Web3 technologies further into traditional banking.

Also, the city’s Legislative Council passed the Stablecoin Bill in May.

This created a regulated system that could make the area a world leader in digital assets and Web3 development.