Working with Cyberport, the Hong Kong Monetary Authority is launching a generative AI sandbox focusing on fintech advances in the financial sector.

In partnership with the state-run technology company Cyberport, the Hong Kong Monetary Authority (HKMA), the city’s central banking organization, has introduced a generative artificial intelligence (GenA.I.) sandbox for finance.

At FiNETech2 – Into the AI verse, an event devoted to fostering collaborations between financial institutions and AI solution providers, HKMA announced the opening of the GenA.I. sandbox on August 13.

An Environment Under Control for Creativity in AI

The GenA.I. sandbox in Hong Kong serves as a testing ground for AI’s possible uses in risk management, fraud prevention, customer support, and process re-engineering.

The GenA.According to Carmen Chu, executive director of HKMA, I sandbox offers financial institutions and tech businesses a controlled environment in which they may collaborate to test generative AI applications and receive specialized supervisory input. She continued, saying:

“This new sandbox aims to overcome the “hard” and “soft” barriers to the adoption of GenA.I., that is, the demand for computing capabilities and the need for supervisory guidance.”

Eddie Yue, the HKMA’s chief executive, provided a more detailed explanation of the program, stating that banks will be able to test their innovative GenA.I. use cases in a risk-managed framework with the help of critical technical support and focused supervisory feedback thanks to the GenA.I. sandbox.

He urged banks to incorporate generative AI tools into their business operations and to “make full use of this resource.”

Finding Applications of Generative AI in Finance

The local banking sector was recently trained on practical AI adoption techniques by the HKMA. The release states that the HKMA will use the Generative AI Sandbox to learn about best practices and the most recent advancements.

To encourage fintech adoption, the Hong Kong Monetary Authority (HKMA) introduced the FiNETech series on April 26 as part of its Fintech 2025 plan.

The Securities and Futures Commission of Hong Kong (SFC) is still taking legal action against unregistered cryptocurrency exchanges, even as the HKMA advocates using AI in the financial industry.

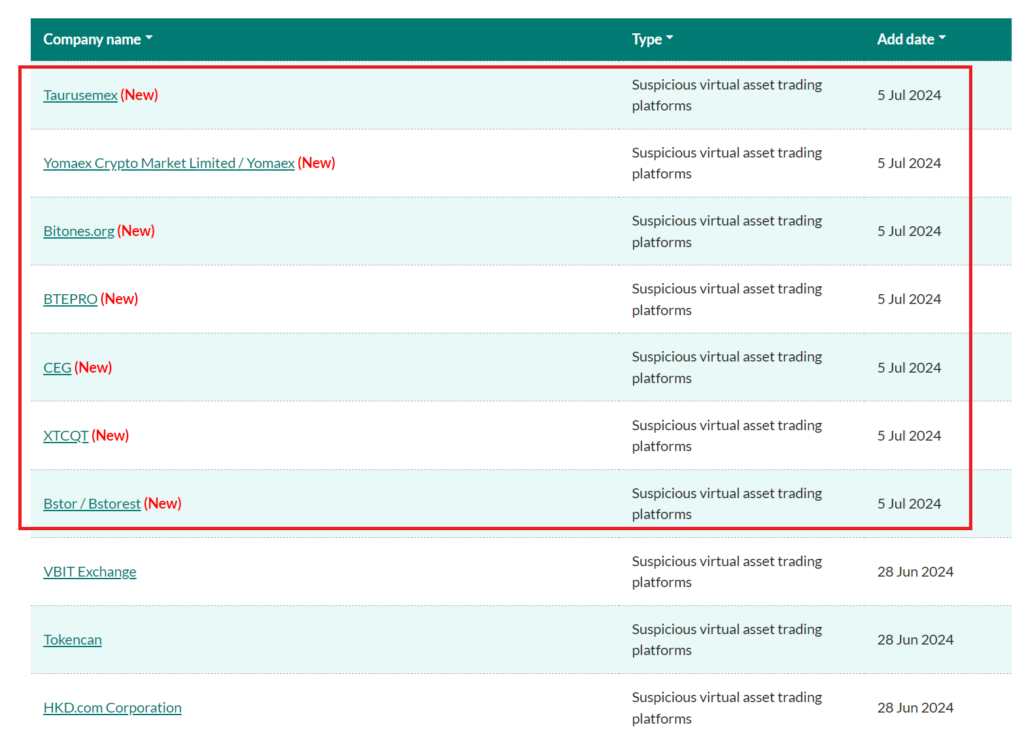

Seven cryptocurrency trading platforms were the target of notices from the Hong Kong SFC in July due to their illegitimate operations in the area.

According to the warnings, most of these exchanges employed extortion tactics such as preventing withdrawals and requesting “fees” to continue operating.