HashKey denies ties to 45 scam sites flagged by Hong Kong’s SFC, warning users of fake URLs impersonating the licensed crypto exchange to deceive investors.

HashKey says it has nothing to do with the dubious URLs added to the SFC’s list.

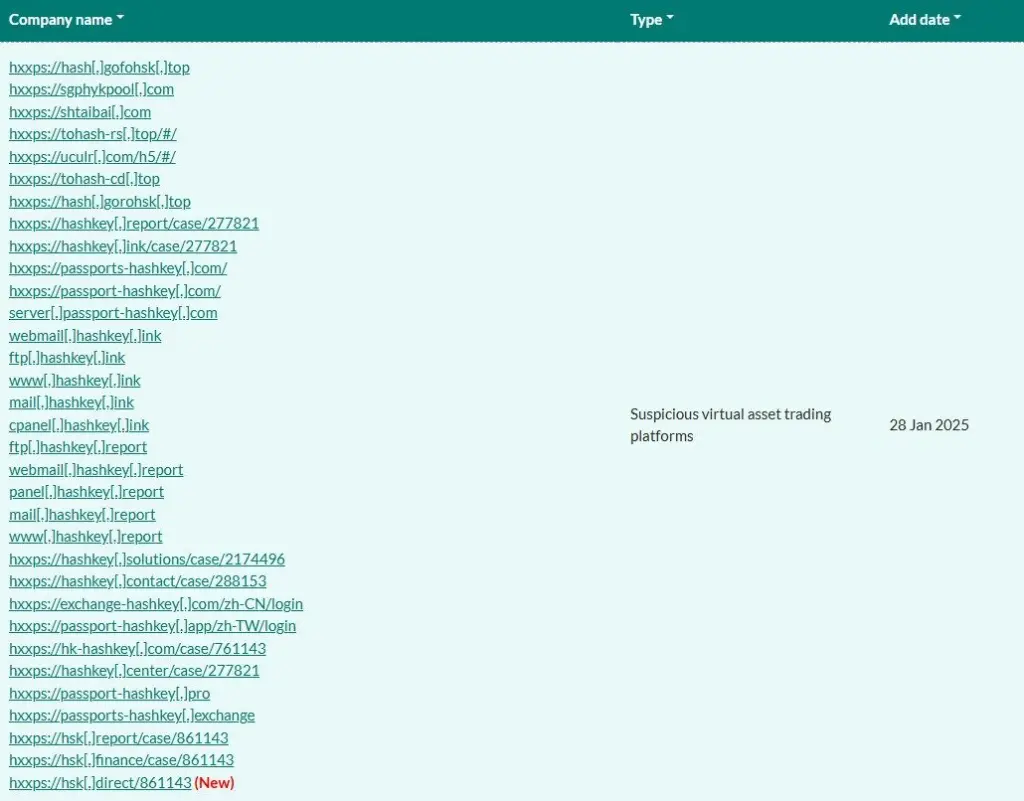

There are now 45 known impersonators after Hong Kong’s Securities and Futures Commission (SFC) reported 33 more dubious websites posing as HashKey, one of the authorized cryptocurrency trading platforms in the city.

HashKey, the second exchange to receive a crypto license from the SFC in November 2022, identified the dubious links. The exchange claimed that to deceive its customers, the bogus websites slightly changed legitimate URLs connected to the exchange.

In an announcement to its customers, HashKey Exchange stated, “HashKey Exchange declares that it has no connection with the aforementioned fraudulent websites.”

Since November 2021, the SFC has monitored dubious cryptocurrency services, including unlicensed exchanges, bogus websites, and impersonators. The regulator found 91 questionable trading platforms and linkages as of January 29.

The SEC’s most prominent target is JPEX, whose demise has been compared to Hong Kong’s “FTX moment,” when it was charged with a 1.3 billion Hong Kong dollar (about $166 million) scam that affected 2,000 investors. Despite the platform’s denials, the SFC’s public warning that JPEX was operating without a license sparked the controversy.

HashKey and OSL were the only two cryptocurrency trading platforms with SEC-issued licenses until the latter quarter of 2024.

Beginning in 2024, the SFC increased the number of approved permits to nine. On January 27, YAX and PantherTrade were added to the city’s official roster, which was the first set of license approvals for 2025.

In an attempt to compete with Singapore as a regional center for digital assets, Hong Kong has issued at least 30 complete licenses to cryptocurrency operators.

Hong Kong initially attempted to spot Bitcoin and Ether exchange-traded funds (ETFs), but Singapore has more licenses than Hong Kong. According to Singapore Exchange CEO Loh Boon Chye, the market in Lion City isn’t yet prepared for these kinds of financial products.