Explore how Central Bank Digital Currencies could transform global payment systems by improving efficiency, lowering costs, and encouraging financial inclusion.

Understanding the Global Payment Systems Landscape

Current status: Traditional Systems and Challenges

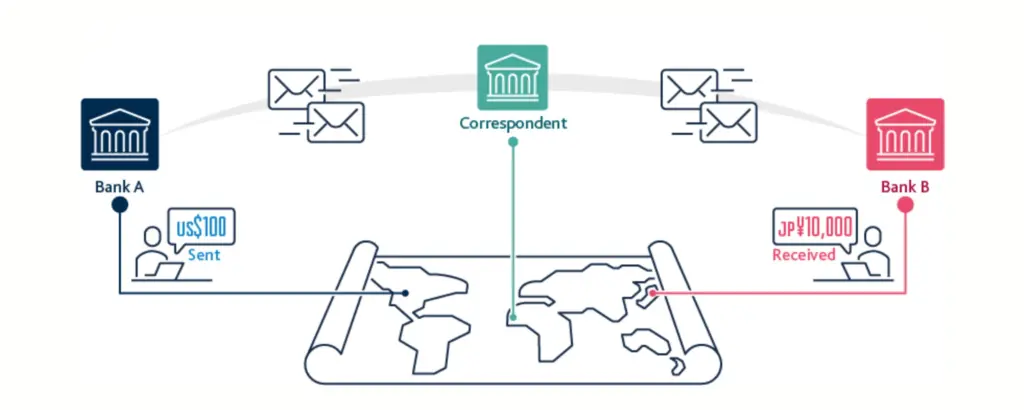

SWIFT and correspondent banking networks have long been at the center of global payment systems. These systems facilitate cross-border fund transfers, although they are inefficient.

SWIFT serves as a messaging protocol for financial institutions, but correspondent banking requires the use of intermediary banks to process cross-border transactions, which causes delays, more costs, and increased complexity.

Challenges of the Global Payment Systems

Key challenges of global payment systems include:

- Cross-Border Delays: Transactions can take several days to settle due to the use of intermediary institutions and time zone differences.

- High Transaction Costs: Fees from many intermediaries and compliance controls add up to significant costs, which disproportionately affect smaller transactions such as remittances.

- Lack of Transparency: Payers and recipients are uncertain about fees, currency rates, and transaction timelines.

Demand for Change: Digital Economies and New Needs

As economies digitalize, the limits of traditional payment systems become increasingly apparent.

The global shift toward digital-first solutions has fueled demand for faster, cheaper, and more inclusive methods of payment:

- Growth of Digital Economies: As e-commerce, global business activities, and digital financial services expand, smooth, instant payment solutions are required.

- Inclusivity Needs: There is an urgent need for payment systems that serve underserved regions and populations, particularly in emerging markets where traditional banking is limited.

- Cost Efficiency: Reducing costs is a vital aim, especially for remittances, which are lifelines for millions globally.

Efforts to modernize global payment systems include measures to increase network interoperability, the introduction of central bank digital currencies (CBDCs), and the use of emerging technologies like distributed ledger technology (DLT) to expedite processes.

What are CBDCs?

Central Bank Digital Currencies (CBDCs) are digital fiat currencies issued and regulated by central banks. CBDCs, unlike traditional cash, are entirely digital but retain the same value and function as real cash.

Their primary goal is to modernize financial systems by implementing more efficient, secure, and inclusive monetary tools.

Types of CBDCs:

- Retail CBDCs: These are designed for direct usage by individuals and businesses in regular transactions. Retail CBDCs strive to make digital payment options more accessible to the general public.

For example, China’s e-CNY, or digital yuan, is the most prominent retail CBDC in operation, facilitating approximately $14 billion in transactions during its pilot stage.

- Wholesale CBDCs: Wholesale CBDCs target financial institutions for interbank transactions, providing benefits such as faster settlements and lower cross-border transaction costs.

Projects such as “mBridge,” which involve central banks from China, Thailand, and other countries, demonstrate wholesale CBDCs’ potential to change global payment systems by allowing for near-instantaneous international transfers.

Examples of CBDCs:

- e-CNY (China): A fully operating retail CBDC integrated into many cities for payments and securities transactions.

- Sand Dollar (Bahamas): Sand Dollar (Bahamas) was one of the first CBDCs to be launched, with the goal of increasing financial inclusion in the Caribbean.

Differences between cryptocurrencies and stablecoins:

- CBDCs vs Cryptocurrencies: CBDCs, unlike cryptocurrencies such as Bitcoin, are controlled and issued by governments, which ensures stability and regulatory compliance.

- CBDCs vs stable coins: While stablecoins are pegged to fiat currencies and issued by private entities, CBDCs are completely backed by central banks, eliminating the risks of reserve mismanagement or volatility commonly associated with stablecoins.

How CBDCs Could Transform Global Payment Systems

Central Bank Digital Currencies (CBDCs) represent a significant innovation in financial technology, with the potential to transform global payment systems by addressing inefficiencies, improving security, and fostering economic inclusion. Here’s how CBDCs could transform global payment systems:

- Improving Speed and Efficiency

- Cost Reduction

- Increased Transparency and Security

- Financial Inclusion

- Strengthening Monetary Policy

Improving Speed and Efficiency

CBDCs hold the potential to enable real-time cross-border transactions by removing the need for intermediaries such as correspondent banks. Traditional systems, like SWIFT, experience delays due to interbank communication and reconciliation.

CBDCs use technologies such as distributed ledger technology (DLT) to provide instant payment settlement, streamlining trade and personal remittances while optimizing working capital flows. This acceleration boosts liquidity and economic activity internationally.

Cost Reduction

CBDCs could significantly lower transaction fees. For example, using blockchain or DLT eliminates the fees associated with intermediaries, which are especially costly in international remittances.

Lower rates for day-to-day transactions and cross-border trade would benefit both individuals and enterprises. Furthermore, the digital nature of CBDCs reduces expenses associated with cash handling, printing, and distribution.

Increased Transparency and Security

CBDCs, which are often built on secure blockchain platforms, ensure that all transactions are recorded infallibly. This transparency streamlines auditing procedures, lowers fraud, and improves anti-money laundering (AML) compliance.

Blockchain’s inherent security features, such as cryptographic validation, strengthen trust and prevent illegal modifications, offering a robust framework for secure global payment systems.

Financial Inclusion

CBDCs can bridge the gaps in the global financial ecosystem by giving underbanked and unbanked people access to digital financial services.

CBDCs require only a smartphone to participate in the digital economy, eliminating traditional banking constraints. This inclusivity is particularly revolutionary for developing nations, boosting economic participation and eliminating poverty.

Strengthening Monetary Policy

CBDCs give central banks unprecedented power over the money supply and liquidity. Governments can use programmable money to execute targeted monetary interventions like direct stimulus payouts.

Real-time insights into payment flows enable proactive monetary policy adjustments, leading to economic stability and growth.

CBDCs have the potential to greatly improve global payment systems by solving systemic inefficiencies and creating a more connected, secure, and inclusive financial ecosystem.

Real-World Examples and Developments of CBDCs

Leading Nations:

- China’s e-CNY: The central bank’s digital currency (e-CNY) is one of the world’s most advanced initiatives.

It was launched as a pilot in ten regions, including high-profile events such as the Beijing Winter Olympics, and processed millions of dollars in daily transactions during the event. The e-CNY provides both software-based mobile wallets and hardware wallets for offline payments.

This initiative aims to promote resilience in China’s financial ecosystem by lowering reliance on private platforms like Alipay and Tenpay while also improving transaction efficiency and scalability.

- Digital Euro Initiative: The European Central Bank (ECB) is in the second phase of its Digital Euro initiative, which aims to create a secure, efficient, and privacy-preserving digital currency for usage throughout the Eurozone.

The initiative aims to reduce cross-border transaction delays and costs, with expected launch dates ranging from 2025 to 2027.

- Pilot Programs in Africa and Latin America: Countries such as Nigeria, with the eNaira, and the Bahamas, with the Sand Dollar, have proved CBDCs’ ability to promote financial inclusion.

These projects aim to improve global payment systems in underbanked regions with limited access to traditional banking infrastructure.

Collaborative Efforts:

- Project mBridge: The BIS Innovation Hub collaborated with central banks from Hong Kong, China, the UAE, and Thailand to create a platform for cross-border transactions involving multiple CBDCs.

The pilot, which included 20 banks, performed more than $22 million in transactions, demonstrating the potential to reduce costs and enhance efficiency.

This initiative also addresses concerns like decreased correspondent banking services, which affect cross-border payments in emerging economies.

- BIS Innovation Initiatives: Additional BIS projects, such as Project Genesis (focused on tokenized green bonds) and Project Aurum (retail CBDC infrastructure), explore strategies to integrate CBDCs into global payments systems while maintaining regulatory compliance and technical scalability.

These examples highlight how CBDCs are updating domestic payment systems while simultaneously eliminating inefficiencies in global payment systems.

Challenges and Risks in Implementing CBDCs in Global Payment Systems

The challenges of implementing CBDCs in global payment systems are discussed below:

Technical Barriers: Infrastructure and Interoperability

CBDCs require a strong digital infrastructure capable of handling high transaction volumes. Interoperability is critical for ensuring that CBDCs integrate effectively with existing payment systems and other countries’ digital currencies.

Achieving technical alignment requires major investment in technology and cross-jurisdictional collaboration, making it a challenging endeavor.

Regulatory Concerns: Jurisdiction and Privacy

Regulations vary greatly across nations, creating challenges for CBDC standardization in global payment systems.

Privacy concerns are especially important because many CBDC frameworks must combine user anonymity with regulatory compliance for anti-money laundering (AML) and combating financing terrorism (CFT) programs.

Adoption can be complicated by jurisdictional disputes, especially for cross-border applications.

Geopolitical Risk: Power Shifts in Monetary Dynamics

CBDCs may alter global monetary dynamics, undermining the dominance of established currencies such as the US dollar in cross-border transactions. This could cause tensions between major economies and lead to geopolitical conflicts over CBDC design and use.

Adoption Challenges: Financial Institutions’ Resistance

Traditional banks and financial institutions could resist CBDCs due to concerns about disintermediation, as CBDCs might bypass existing intermediaries for transactions.

Educating stakeholders, addressing security concerns, and ensuring economic inclusivity are critical for fostering trust and adoption.

To fully realize CBDCs’ potential for revolutionizing global payment systems, each of these challenges requires careful planning, regulatory harmonization, and international cooperation.

CBDCs’ Future Impact on Global Payment Systems

Potential Scenarios: Decentralized vs Centralized Models

CBDCs represent a dual future for payment systems: centralized frameworks managed by governments and central banks or decentralized models that use distributed ledger technologies.

Centralized CBDCs, such as those implemented by China and the European Union, maintain rigorous central bank supervision over monetary policy and liquidity.

Decentralized cross-border systems, like the mBridge pilot involving China, Hong Kong, Thailand, and the UAE, demonstrate the potential of distributed platforms to facilitate direct, efficient international payments, minimizing reliance on intermediary banks and reducing transaction complexity.

Changing Roles of Banks and Fintech Companies

The rise of CBDCs has the potential to reshape the financial ecosystem by reducing banks’ traditional intermediary function. Retail CBDCs may let people and businesses do transactions directly with central banks, bypassing commercial institutions.

Banks could encounter pressure to innovate, focusing on value-added services and digital financial products. Fintech companies may discover opportunities for developing wallets, integration tools, and cross-border solutions specific to CBDC frameworks.

Global Standards and Interoperability

Creating interoperable frameworks is a big challenge for CBDCs on a global scale. Projects such as mBridge and Project Dunbar indicate early steps toward integrating CBDCs across borders, including currency compatibility and governance.

However, broad adoption would require robust international standards and political cooperation to ensure smooth functionality across borders.

Broader Economic Impact: Trade, Remittances, and Stability

CBDCs could change global trade by eliminating reliance on reserve currencies such as the US dollar and introducing direct settlement mechanisms for international transactions.

This would save costs and increase the speed of trade invoicing. Furthermore, CBDCs offer reduced fees and real-time transfers, which will help remittances, a crucial revenue stream for many developing economies.

CBDCs can improve economic stability by modernizing monetary systems and increasing financial inclusion.

CBDCs have the ability to transform global payment systems by addressing these transformative aspects; nevertheless, their long-term success will depend on overcoming geopolitical, legislative, and technological challenges.

Conclusion

Central Bank Digital Currencies (CBDCs) have the potential to transform global payment systems by providing unparalleled speed, efficiency, and security while lowering costs.

CBDCs could bridge gaps in the financial ecosystem by enhancing financial inclusion and transparency, benefiting underbanked populations while also upgrading cross-border trade and remittance systems.

To fully exploit the potential of CBDCs, global stakeholders must prioritize their development and deployment. By accepting this technological leap, the world can build a more efficient, inclusive, and transparent global payment system that promotes long-term economic stability and growth.