After trading closed last Thursday, Nvidia’s stock price, which had more than doubled this year, boosting its market worth by $1.3 trillion, is expected to rise further following the corporation’s better-than-expected quarterly performance

The demand for the chipmaker’s semiconductors, which are utilized to power artificial intelligence applications, has skyrocketed. In the recent quarter, revenue for the organization has more than tripled compared to last year.

This finding further proves that the enthusiasm surrounding artificial intelligence will likely remain the same soon. The numbers produced by Nvidia, which has established itself as one of the most prominent actors in AI, are astounding. Take a look:

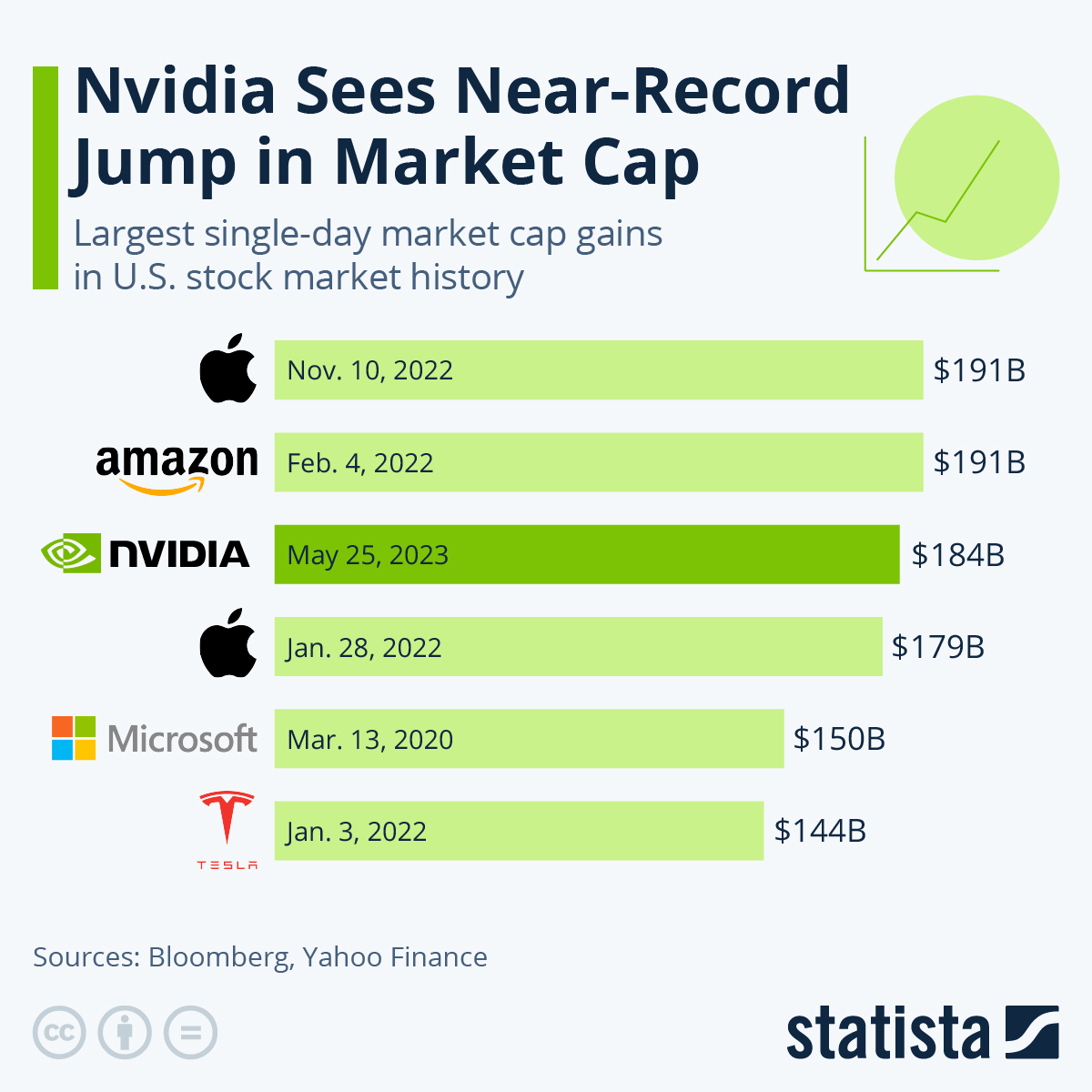

The value of $221 billion

Specifically for Thursday, Nvidia’s market value increased by that amount. Significantly, the one-day increase in the company’s market value is merely the second-largest of the year after an unprecedented surge of $273 billion on February 22.

Nvidia reported that its first-quarter net income increased more than sevenfold year-over-year, from $2.04 billion to $14.88 billion on April 28. This information prompted gains on Thursday.

$1.374.000 billion

FactSet reports that Nvidia’s market value has increased by a certain amount thus far this year. However, Nvidia’s year-to-date profit surpasses the market capitalization of Meta Platforms, the parent company of Facebook and Instagram.

Nvidia is among the six companies with market capitalizations exceeding $1.152 trillion in the S&P 500.

$2.593.000 Billion

The aggregate market value of Nvidia as of Thursday’s close of trading. Earlier this year, it surpassed Alphabet and Amazon to rank as the third most valuable publicly traded company, trailing only Apple ($2.864 trillion) and Microsoft ($3.172 trillion). Two years ago, the company was valued at approximately $418 billion.

$1,037.99

It is worth noting that Nvidia was the ninth company in the S&P 500 with a share price exceeding $1,000 as of the close of trading on Thursday.

This fact may appear more significant than it is. However, that will soon change. Nvidia declared its intention to execute a 10-for-1 stock split on Wednesday.

This would result in a 10-fold increase in outstanding shares, each priced at approximately $100. The company stated that once the markets close on June 7, the division will increase the accessibility of its shares for investors and employees.

Revenue of $26 billion for the most recent fiscal quarter of Nvidia.

This is over three times the $7.2 billion it disclosed during the corresponding period of the previous year. Wall Street anticipates that Nvidia will generate $117 billion in revenue for its fiscal year 2025, nearly double the company’s revenue from 2024 and more than four times its earnings from the previous year.

The estimated net margin of Nvidia, which represents the proportion of revenue converted into profit, is 53.4%. Considering the previous year, Nvidia’s profit margin was approximately 53.3 cents per $1 in revenue.

Nvidia Stock As of May 24, 2024, Nvidia stock had increased by 115%, outperforming the S&P 500 with a 238.9% increase in 2023.

It is comfortably outperforming the other members of the Magnificent Seven this year, with Meta stock following far behind at 35%. In addition to being a distinct outlier in valuation and earnings, Tesla stock is forecast to decline by 27.9% in 2024.

As of 2024, Microsoft stock is at an all-time peak, increasing by a more moderate 14.4%. Apple stock is down 1.3% despite a robust recovery in May.

Nvidia Accomplishments On June 13, 2023, Nvidia closed with a market capitalization exceeding $1 trillion. The value of NVDA stock surpassed $2 trillion on February 23, 2024.

Nvidia surpassed the $1,000 threshold and the $2.5 trillion mark on May 23.

Nvidia’s Upcoming Milestones

Nvidia, currently valued at $2,662 trillion, requires only a 12.8% increase in price to reach $3 trillion. That would also surpass the present valuation of Apple and significantly reduce the disparity with Microsoft.

Early Tuesday, Nvidia stock increased 4.5%, elevating its market capitalization above $2.75 trillion.