Hyperliquid AUM climbs to $6.2B on surging USDC and ETH inflows, pushing HYPE price up nearly 5% in recent days.

The significant inflows of USDC and ETH over the previous few days have propelled Hyperliquid AUM to a record $6.2 billion.

Consequently, the price of HYPE saw an increase of around 5%.

Hyperliquid AUM Reaches Record $6 Billion

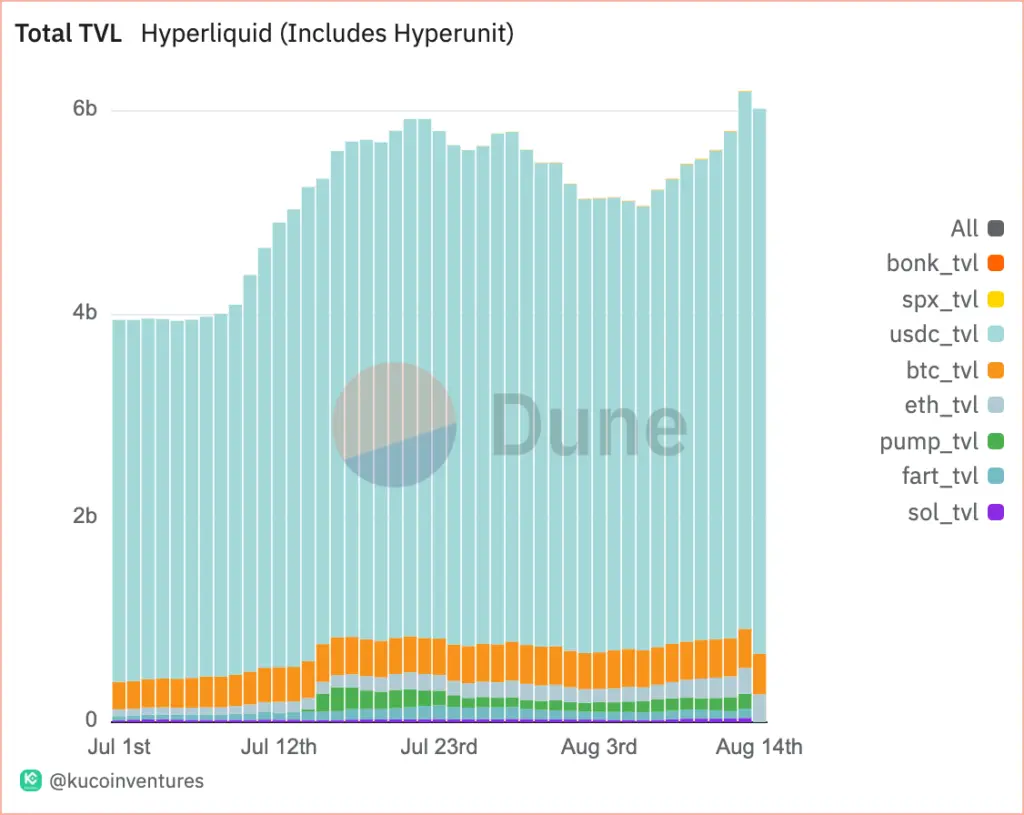

Due to recent inflows from USDC and Ethereum on the platform, Hyperliquid AUM surpassed $6 billion, citing Dune statistics.

On August 13, the derivatives exchange recorded a single-day net inflow of $395 million, marking the first time it has reached this milestone.

The main drivers of the day’s advances were $304 million in USDC deposits and about $47.6 million in ETH.

One noteworthy transaction was when Galaxy Digital made the most significant single deposit in the platform’s history, moving $100 million USDC into Hyperliquid.

When half of that was instantly transferred to the Hyperliquid spot market, the USDC total value locked (TVL) on the platform reached a record high of $5.23 billion.

The enhancement follows Circle’s announcement a few weeks ago that its Cross-Chain Transfer Protocol (CCTP v2) would enable Hyperliquid natively using USDC.

This connection allows for direct USDC transactions between blockchains without using wrapped tokens.

The USDC momentum of Hyperliquid has been steadily increasing. By August, the platform had grown from $4 billion in early July to $5.5 billion, controlling 70% of USDC liquidity on Arbitrum.

The main driver of the exchange’s growth in July was USDC, as $1.2 billion in net inflows enabled Hyperliquid to increase its total AUM by $1.5 billion in only one month.

ETH saw more than $47 million in inflows in a single day compared to the USDC trend.

Hyperliquid benefited greatly from the recent surge in the token’s value, bringing more liquidity to DeFi platforms.

Growing Position Of Hyperliquid In Crypto Market

Hyperliquid’s growth has outpaced its AUM. Ansem, a cryptocurrency analyst, recently emphasized HYPE’s steady rise in all significant measures.

The platform’s market share increased to 22.8% in August, ranking it third globally among derivatives exchanges.

It is attractive because its decentralized, order-book-driven business model gives traders greater asset control than its centralized competitors.

Volumes of DeFi perpetual futures have reached all-time highs due to Hyperliquid AUM growth.

According to DefiLlama, the $465 billion in total DeFi perp trades in July represented a 27% increase this week.

Furthermore, last month’s $10.6 billion in open interest on the exchange suggests greater liquidity and higher trader involvement.

This could help sustain price momentum by further reducing the supply of its native HYPE coin, analysts say.

HYPE Price Increases By 5%

HYPE has increased by 4.96% in a day and by 23.5% in a week, mirroring the platform’s expansion.

In addition to the AUM milestone, other drivers include aggressive HYPE buybacks, robust whale participation, and record fee revenue ($97.7 million in July, surpassing Ethereum and Solana).