Hyperliquid hits $10 billion market cap, and $1.5T in volume, surpassing dYdX as token buybacks and no cash incentives drive long-term platform stability.

Hyperliquid has faced significant controversies, notably the delisting of JELLYJELLY due to a short squeeze earlier this year. Despite this, the platform has been working to restore its reputation and continues to achieve substantial trading volume.

Hyperliquid Outpaces dYdX in Trading Volume

Hyperliquid, a high-efficiency L1 trading blockchain, has recently marked several achievements. This month, it secured over 60% of the perpetuals trading market, with its HYPE token reaching a three-month peak soon after.

Analysts observed yesterday that Hyperliquid’s cumulative trading volume has now exceeded that of dYdX, hitting $1.5 trillion today.

dYdX, a decentralized perpetuals exchange operational for five years, contrasts with Hyperliquid, which launched in 2023. Despite its shorter history, Hyperliquid has surpassed its older competitor. After introducing its native token in 2021, dYdX used it to offset trading fees, increasing its volumes. It also fostered excitement through an unofficial “trading contest” with rivals.

In contrast, Hyperliquid did not adopt dYdX’s incentive model. Following its TGE last year, it built significant volumes through robust functionality, organic growth, and superior product quality.

The year 2024 was a high point for crypto perpetuals trading, and Hyperliquid’s HYPE TGE capitalized on this trend, proving to be a more sustainable strategy.

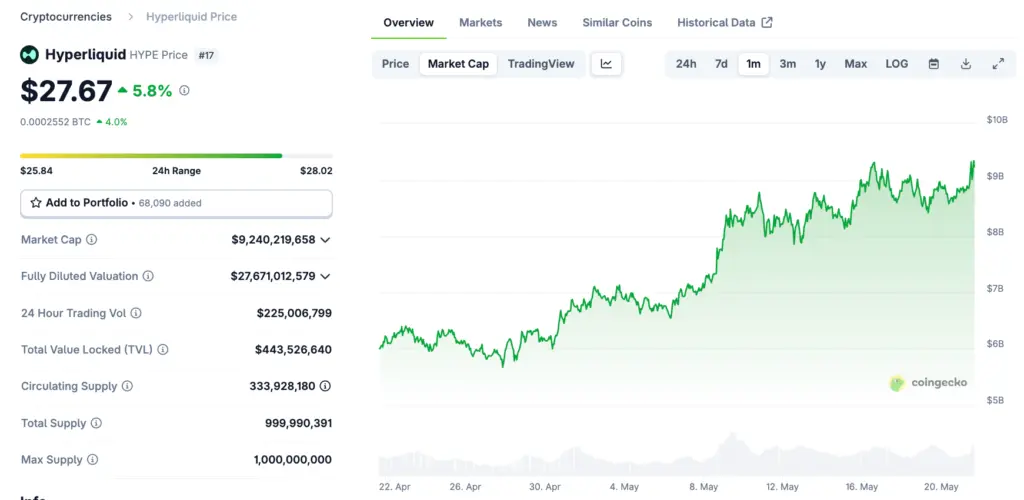

Moreover, Hyperliquid allocates most of its trading fees to token buybacks, a practice that dYdX adopted later, and to a lesser extent. This enabled Hyperliquid to repurchase 17% of circulating HYPE tokens, yielding multiple benefits. Over the past month, HYPE’s market cap has steadily climbed toward $10 billion.

Despite its rapid growth, Hyperliquid has encountered significant controversies. Last year, despite evident on-chain data, it refuted allegations of a Lazarus Group security breach.

In March 2025, it sparked a major uproar by delisting JELLYJELLY amid a short squeeze, prompting accusations of market manipulation and significant financial losses.

While dYdX has recently avoided such public scandals, Hyperliquid has taken swift steps to rebuild trust, with apparent success.

Today, Hyperliquid also hit a new record high in open interest, exceeding $8 billion. The exchange could establish a dominant position in DeFi’s perpetuals market if it sustains this trajectory.