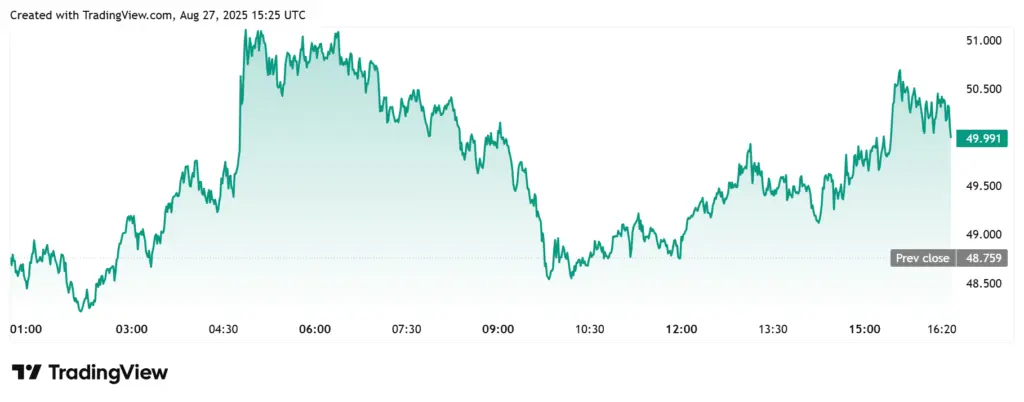

Hyperliquid’s HYPE token hits a new all-time high of $50.99, driven by whale accumulation of $18.23M and record $3.52B spot volume.

The price of HYPE has increased by 9.9% over the past 24 hours, reaching a new all-time high (ATH) of $50.99. This recent price increase results from the decentralized exchange’s trading volume reaching record highs and the significant accumulation of whales.

On renewed investor demand, hyperliquid surpasses $50

The price of HYPE reached a new all-time high due to the demand from whale investors, which was evident in both the primary market and derivatives trading. Today, the Hyperliquid token surged in spot volume by 53%, reaching approximately $3.52 billion, per CoinGlass’s market data analysis.

The platform accounted for most of HYPE’s spot volume over the past 24 hours, totaling approximately $1.27 billion. Spot volumes of roughly $760 million, $512 million, $268 million, and $254 million were recorded by the top crypto exchanges, including Binance, Bybit, MEXC, and OKX.

Today’s HYPE price surge resulted from a 15.7% increase in its Open Interest (OI) to approximately $2.29 billion. The trading platform is where the preponderance of this OI is located. Binance and Bybit have recorded $292 million and $167 million in HYPE’s OI over the past 24 hours, respectively.

In the interim, on-chain data analysis has indicated increased demand from whale investors. For instance, earlier today, two distinct billionaires acquired 358,279 HYPE tokens, which are estimated to be worth approximately $18.23 million. Notably, 52.9% of Hyperliquid traders are long HYPE tokens, while 47.1% are banking on a price retrace.

The Token’s Robust Fundamentals

The Hyperliquid platform has experienced substantial organic growth since its inception, primarily due to its deep liquidity and blockchain transparency. Hyperliquid announced earlier this week that its spot volume reached a record high of $3.4 billion, which was driven by the increase in Bitcoin (BTC) and Ethereum (ETH) deposits facilitated by the Unit platform. This decentralized asset tokenization layer is exclusively developed on Hyperliquid.

One of the reasons BitMEX co-founder Arthur Hayes predicts a 126x increase in the HYPE price is the DEX’s expanding market share. Additionally, he anticipates that the global stablecoin supply will surpass $10 trillion by 2028, with Hyperliquid accounting for 26.4% of the corresponding trading volume. The stablecoin market valuation on the Hyperliquid chain has increased from $2 billion in early April to approximately $5.5 billion today.

BitGo’s custody of HYPE has also influenced the favorable sentiment toward the token. It is worth noting that BitGo has announced its support for HyperEVM, a smart contract layer for the Hyperliquid ecosystem compatible with Ethereum. This support allows BitGo’s institutional clients to securely custody assets on HyperEVM, including HYPE.

Furthermore, DeFiLlama’s market data analysis indicates that the total value locked (TVL) of the hyperliquid chain experienced an exponential increase from $311 million in early April 2025 to approximately $2.6 billion at the time of this writing.