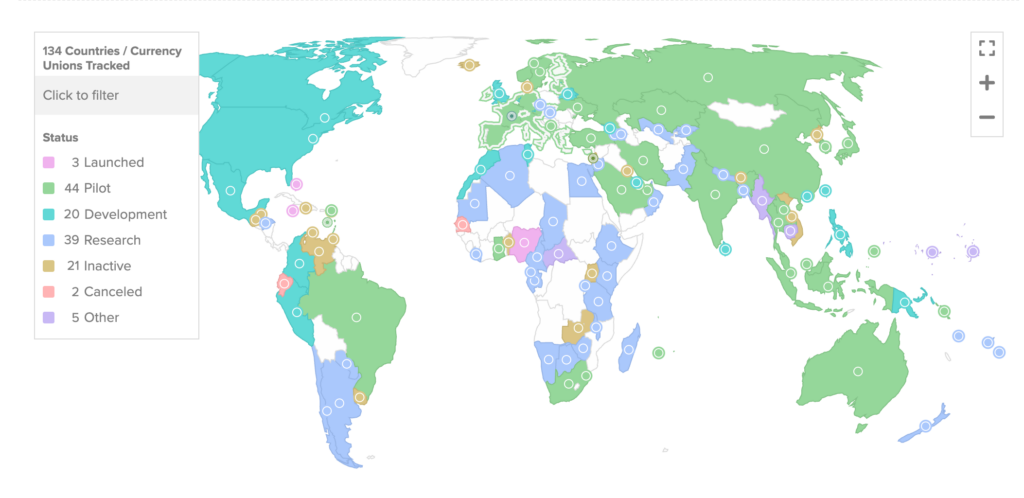

134 nations, including all G20 members, are exploring CBDCs, while the Reserve Bank of India (RBI) is expanding cross-border payments with new Asian, and Mideast partners.

By adding new trading partners in Asia and the Middle East, the Reserve Bank of India (RBI) hopes to grow its cross-border payments platform, which will enable quick settlement.

India already has agreements with Bhutan, Nepal, and Sri Lanka, and it intends to expand its cross-border payments settlement program to include the United Arab Emirates (UAE), according to Bloomberg.

Within its cross-border payments system, India is also investigating the use of central bank digital currencies (CBDCs) as the main settlement method.

At the moment, the Reserve Bank of India’s CBDC is a bank-to-bank solution rather than a widely used digital currency that is aimed at consumers.

Although the bank has not given a timeline for a mass retail CBDC, it may eventually expand the program to encompass the majority of retail customers.

CBDC Growth In India

Along with China, Russia, and other BRICS nations, India remains one of the world’s leading proponents of CBDCs.

In 2020, India began looking into the prospect of CBDC settlement, and the Reserve Bank of India started using trial projects to test CBDC development in 2022.

In order to promote the usage of the CBDC in the numerous rural areas of India that lack reliable internet connectivity, Reserve Bank of India governor Shri Shaktikanta Das stated in February 2024 that the bank was developing offline alternatives for the digital rupee.

Later, in August 2024, India reported that it had gathered almost 5 million users for its digital rupee trial program.

Shri Shaktikanta Das stated during the Global Conference on Digital Public Infrastructure and Emerging Technologies that there was no rush to make the digital rupee pilot program a standardized, system-wide CBDC for the Indian populace.

Das also disclosed intentions at the conference to implement a “plug-and-play” mechanism that would enable smooth and effective transactions between various systems, hence increasing the interoperability of sovereign CBDC schemes.

Human rights groups, privacy advocates, and liberty-minded people have strongly criticized the drive to create central bank digital currencies.

Critics contend that any cost or efficiency gains are greatly outweighed by the risks of centrally managed digital ledgers and the possibility of government exploitation.