In Chainalysis’ 2024 Global Crypto Adoption Index, India first appeared. It also ranked second in the CSAO area for the cryptocurrency received.

According to Chainalysis, despite the country’s restriction on offshore cryptocurrency exchanges, India—the nation with the largest population—remains at the forefront of cryptocurrency adoption globally.

The country continues to be the world’s largest cryptocurrency market in terms of adoption in 2024, according to Chainalysis, the blockchain analysis company, which released its fifth annual Chainalysis Global Crypto Adoption Index on September 11. India topped Chainalysis’ crypto adoption report last year.

In Chainalysis’ worldwide crypto adoption index, out of 151 countries examined, India ranked top, surpassing nations such as Nigeria, Indonesia, the US, and Vietnam.

The adoption index of Chainalysis consists of four sub-indices, including the value of onchain cryptocurrency received by decentralized finance (DeFi) services and centralized exchanges (CEX), including retail subcategories for both services.

Users continued to access Binance and other offshore exchanges in 2024 despite the FIU of India’s ban on them.

The Indian Department of Revenue’s Financial Intelligence Unit (FIU) designated nine offshore exchanges as non-compliant with the nation’s anti-money laundering regulations in December 2023.

Among those exchanges, major industry players include Binance, HTX (previously Huobi), Kraken, Gate.io, KuCoin, Bitstamp, MEXC, Bittrex, and Bitfinex.

The FIU then requested that the websites of the non-compliant exchanges, such as the Ministry of Electronics and Information Technology, be blocked for users in India.

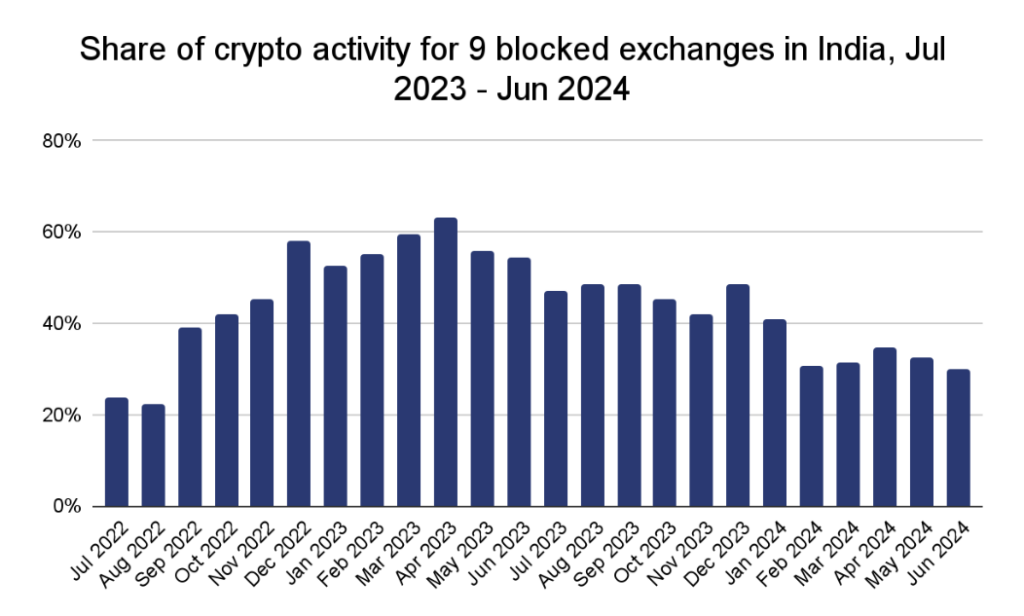

According to data compiled by Chainalysis, the nine prohibited exchanges’ combined value still comprised a sizeable portion of the total value received by CEXs, even after the suspension.

For instance, as of April 2024, the nine prohibited exchanges accounted for almost 40% of all CEX traffic in India.

The utilization of offshore exchanges has been relatively impacted by the country’s ban on them, according to Chainalysis’ research, since local users could still access the exchanges through downloaded apps or some trading programs that remained functional.

India’s FIU has loosened its restrictions on the sites above since outlawing the exchanges in late 2023; in May 2024, it registered KuCoin and Binance after collecting fines.

According to local sources, the FIU considered approving the resumption of operations in India for two more offshore exchanges in early September.

India is ranked second in the CSAO area in terms of the cryptocurrency received.

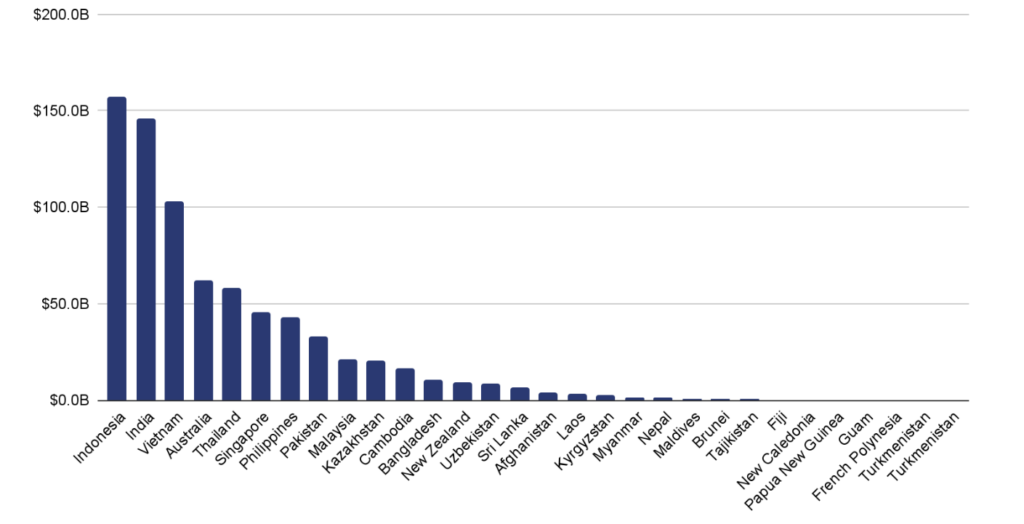

India not only led the world in cryptocurrency adoption but also came in second place in the Central, Southern Asia, and Oceania (CSAO) area for the amount of cryptocurrency value received.

India got around $143 billion in cryptocurrency between July 2023 and June 2024, only surpassed by Indonesia, which received $157 billion, according to Chainalysis’ estimates.

Over the last year, CSAO received $750 billion in crypto asset inflows or 16.6% of the total value received worldwide. Only Western Europe and North America are ahead of the region in this ranking.

Chainalysis reports that CEXs accounted for most of the crypto activity in CSAO, with transactions larger than $10,000 indicating the highest percentage of value received and significant institutional and professional involvement.