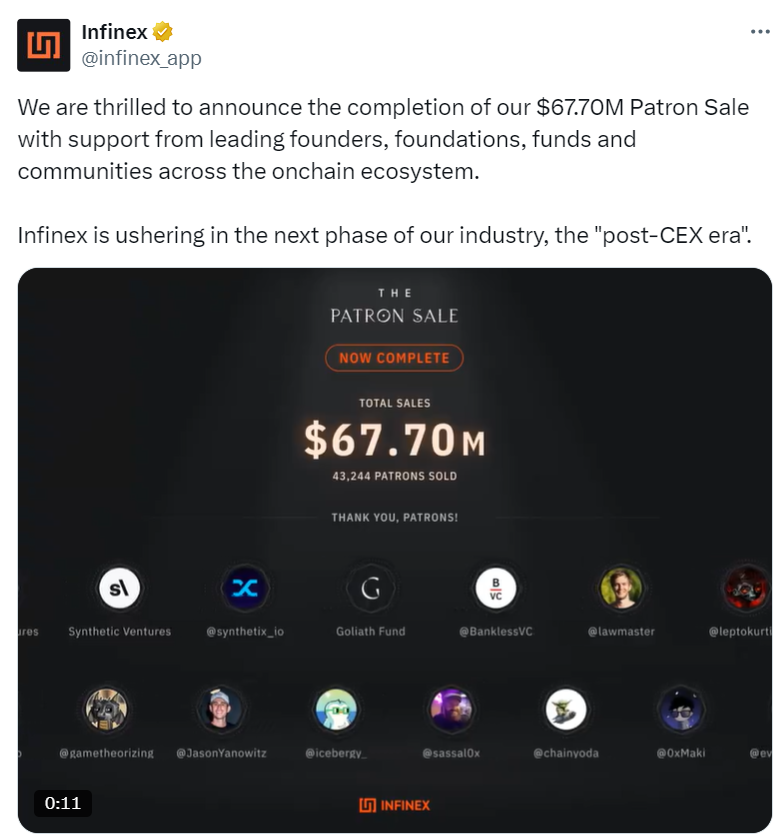

Despite a downturn in the NFT market, Infinex’s Patrons NFT collection has attracted over $67.7 million in investments within just six weeks of its launch.

Thiel was a co-founder of PayPal and contributed early capital to Yelp and LinkedIn.

With support from the Founders Fund, co-founded by billionaire and former PayPal CEO Peter Thiel, the Patrons NFT collection achieved the $67 million milestone.

In an X post on October 28, the non-custodial platform declared its intention to usher in “the next phase of our industry, the “post-CEX age” by providing simple access to onchain protocol and decentralized applications (DApps).”

“We are thrilled to announce the completion of our $67.70M Patron Sale with support from leading founders, foundations, funds and communities across the onchain ecosystem.”

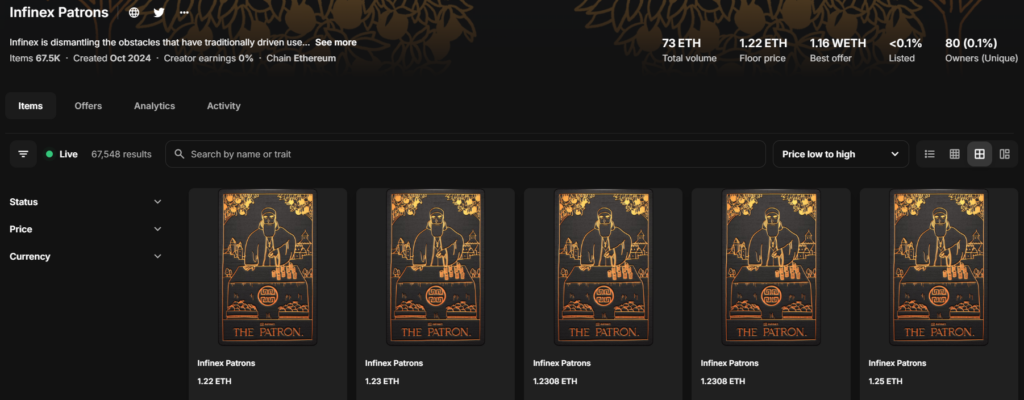

Additionally, the platform declared that the unlocked Patron’s NFTs will be withdrawable on October 28. This means that users can sell them on NFT marketplaces such as OpenSea, whose floor price will be 1.22 Ether ETH$2,515.63, which is now slightly more than $3,086.

Solana Ventures, WMT Ventures, Variant Fund, Hi Framework, Moonrock Capital, Wormhole, and Pyth Network are some other early investors.

Despite the NFT bear market, Infinex NFT sales are up.

Since its inception, Infinex’s NFTs have been successful, generating $40 million in sales in the first four days despite the general NFT bear market.

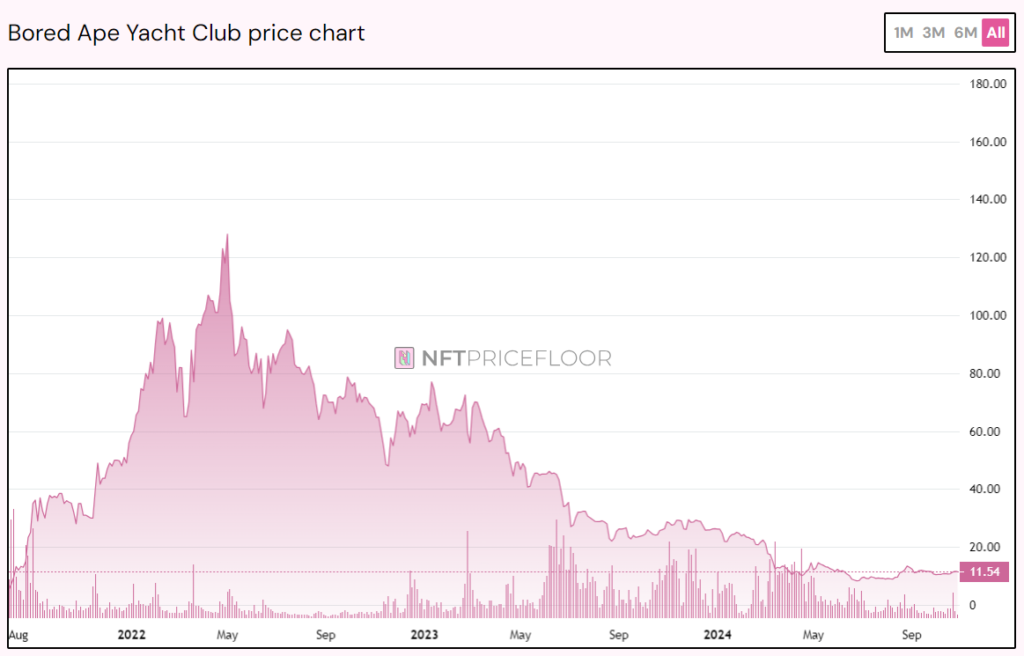

However, some of the most extensive collections and the NFT market are still depressed.

According to NFTPriceFloor statistics, CryptoPunks, the most extensive Ethereum-native NFT collection, sells at a floor price of 26 ETH, or $65,000. This is more than 76% lower than its highest valuation of 113 Ether, or $285,000 in today’s rates, attained in October 2021.

The second-largest NFT collection, the Bore Ape Yacht Club (BAYC), is currently worth about $322,000, down more than 91% from its top floor price valuation of 128 ETH. At the moment, it is only worth about $29,000 at 11.5 Ether.

According to CryptoSlam data, Ethereum’s overall NFT sales volume dropped 34% over the last 30 days to $119.8 million, making it the largest blockchain by NFT sales. Bitcoin came in second with $67 million.