Margex’s redesigned platform provides retailers with expert trade replication and fee-free conversions by capitalizing on institutional momentum

The $4.3 billion settlement between Binance and U.S. regulators represented a significant paradigm shift in how institutions have adopted digital assets. Historically, institutional actors have dismissed digital assets as ostentatious, worthless assets propelled by criminals.

The tectonic plates of ideas that once influenced the sentiments within these institutional corridors of power have progressively shifted. Digital assets such as Bitcoin (BTC) may encounter an ideological collision with a defining characteristic of institutional adoption for the first time in decades.

A constant influx of novel concepts enters the cryptocurrency industry, generating infinite market prospects. The partnership between Binance and Signum, which permits major cryptocurrency actors to store their assets elsewhere, enables institutions to investigate digital assets and further amplifies numerous revolutions.

In addition, since the approval of spot Bitcoin exchange-traded funds (ETFs), institutions have continued to enter the cryptocurrency market, enabling many businesses to trade a proxy with minimal management fees and to engage in other strategies such as hedging.

Significant evidence that these factors have influenced the influx of capital and attention into the cryptocurrency space is Bitcoin’s performance, which has reached unprecedented heights. Recently, corporations, smart money, retailers, families, and hedge funds have all adopted Bitcoin as a portfolio diversification strategy.

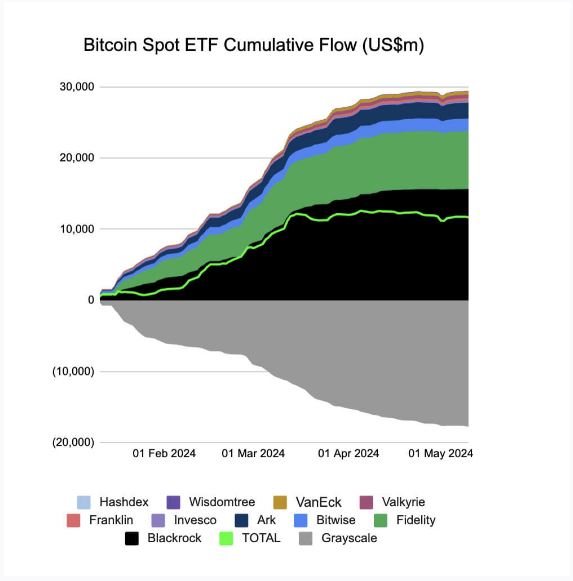

According to research, a remarkable $17 billion in institutional capital has poured into the cryptocurrency space this year alone as institutions continue to allocate a portion of their investments to digital assets.

BlackRock, Fidelity, VanEck, and other major institutional firms have shown considerable interest in digital assets, as evidenced by the farside Bitcoin ETF trade. Institutional money is currently a major factor in the cryptocurrency market frenzy.

Over five of these institutional investors have taken numerous actions to acquire these crypto assets, and more than seven out of ten have expressed a desire to diversify their holdings into digital assets.

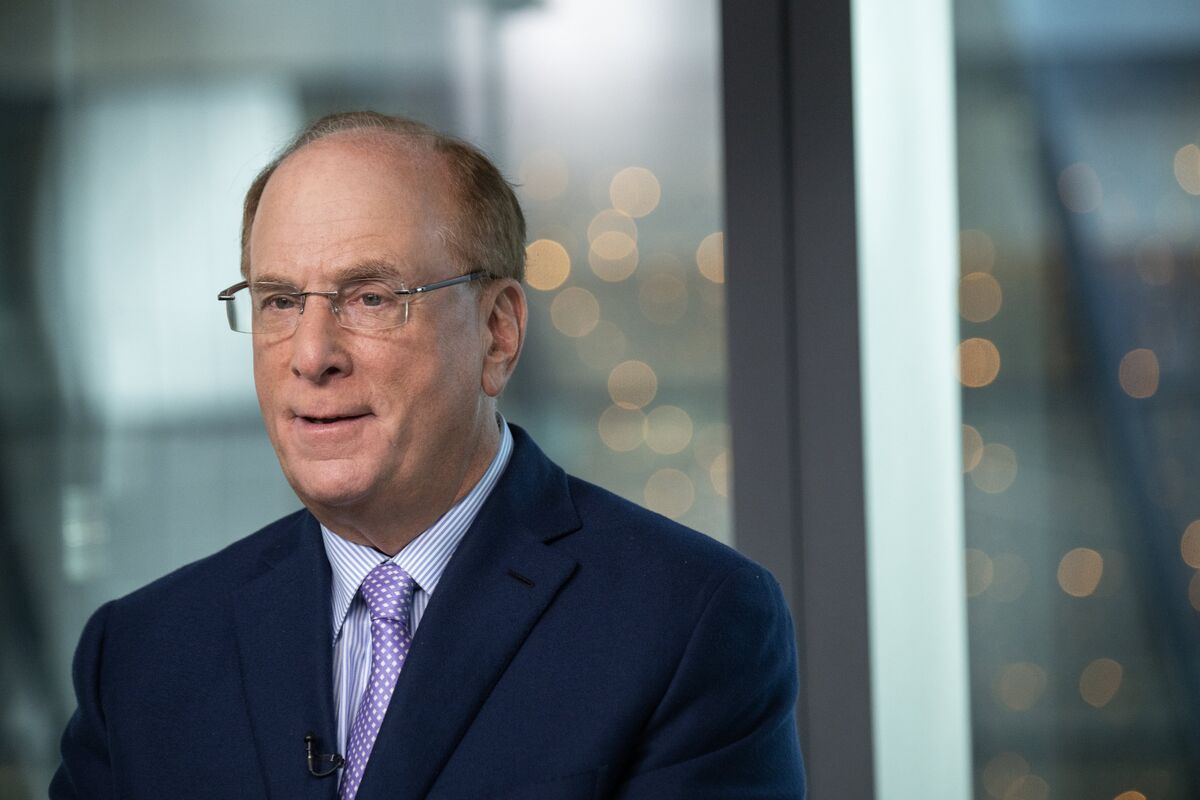

BlackRock Leads the Inflow of Institutional Capital Into Cryptocurrencies

BlackRock, one of the largest institutional conglomerates and a prominent asset manager, has demonstrated considerable interest in the cryptocurrency ecosystem, spurring considerable innovation in cryptocurrency asset tokenization.

The aforementioned activities of reputable financial services illustrate the increasing prevalence of blockchain technology implementation within conventional organizations. This adoption is driven by the incredible benefits the blockchain ecosystem offers, including liquidity, transparency, and use cases by various initiatives.

Initially, the blockchain ecosystem was dominated by private companies; however, institutional adoption on a large scale could facilitate greater operational efficacy.

JPMorgan and BlackRock were heavily influenced by innovative concepts such as the tokenization of digital assets by the cryptocurrency startup Libre; as a result, they redirected their attention towards the tokenization of digital assets and bringing innovation to this sector.

Larry Fink, the chief executive officer of BlackRock, perceives blockchain technology and the tokenization of crypto assets as a model for eventually applying such brilliant concepts to equities and bonds to establish a unified blockchain ledger that facilitates instantaneous transactions.

Institutional Opportunity Unlocking

In finance, which is constantly changing, asset tokenization remains widespread among institutional firms, including BlackRock, JPMorgan, Fidelity, and others. In the near future, it intends to be a transformative force and a tremendously promising development for these institutions.

Recent research from investment firm ADDX and Boston Group Consulting (BGC) indicates that asset tokenization is the direction in which most institutional companies becoming more interested in the cryptocurrency ecosystem are headed. Asset tokenization could actualize in the coming decades and is anticipated to become a $4 trillion industry as it attracts more institutions to the space.

In contrast to the currency market trend, this shift in asset tokenization by financial institutions is not speculative, as it has been manifested in practice by market participants who acknowledge the potential of this industry. Establishing a connection between blockchain technology and conventional finance would be akin to setting a ball in motion, as it would facilitate enhanced accessibility, liquidity, and efficiency.

In light of the opportunities this presents for institutional investors, numerous retailers have embraced emergent technologies, including artificial intelligence (AI), copy trading, social trading, and others, to capitalize on the inexhaustible capital that institutional investors pour into the cryptocurrency space.

Margex Copy Trading Assists Retailers in Improving Their Market Position

It was implausible for conventional finance to penetrate the cryptocurrency market. Many conventional financial institutions have only recently developed a significant interest in cryptocurrency.

Conventional financial The entry of institutions into the cryptocurrency market excites many retailers. Significant new capital has been invested in the market, indicating that the present uptrend has contributed to their presence. Numerous retailers are eager to capitalize on the current market sentiment.

The interest of institutions has been drawn to real-world assets (RWAs) and exchange-traded funds (ETFs). In the past few months, digital assets following this trend have surpassed all expectations; the Margex platform ensures these high-conviction assets are tradeable.

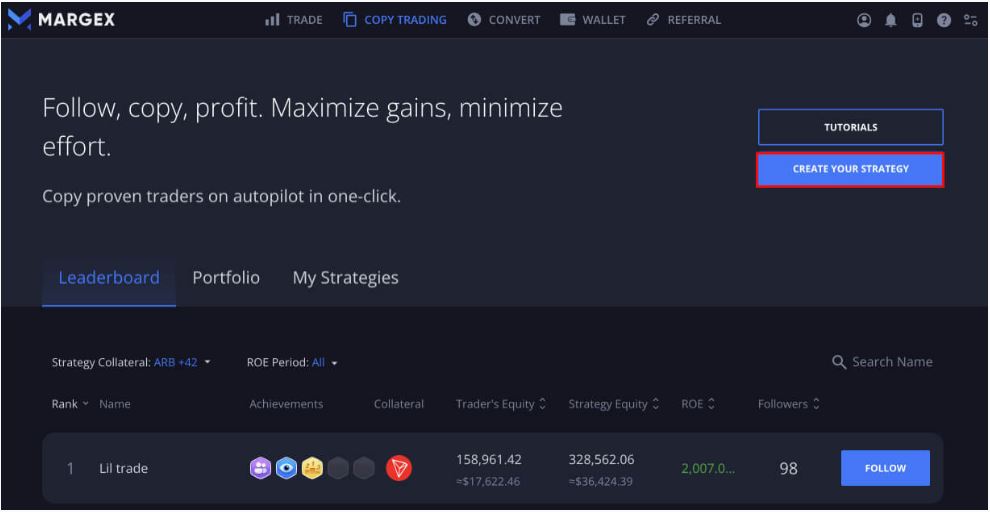

Margex is an industry-leading platform for cryptocurrency copy trading, allowing consumers to simulate the transactions of professional traders. This enables users to investigate digital assets with practical applications and greater potential for financial gain.

With a concentration on usability, Margex has spent over $3 million redesigning its platform. It implemented a fee-free converter to facilitate the exchange of tokens by users at no cost. Margex intends to introduce a cutting-edge wallet that provides users with a high level of asset security and enables them to retain complete possession of their assets on the same platform.

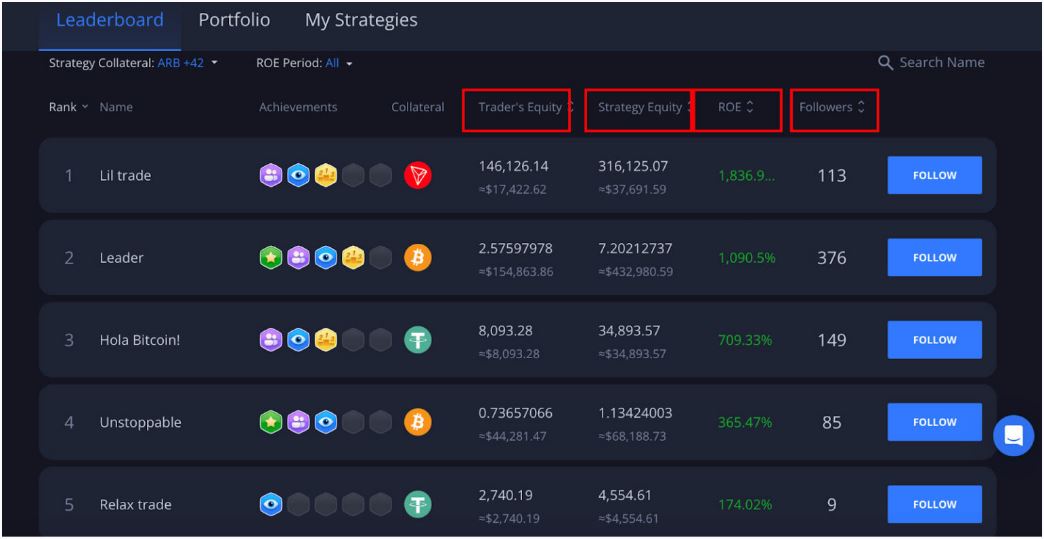

Users of the copy trading platform developed by Margex have an advantage over those of competing platforms. It empowers users to replicate the strategies of the most successful traders, who maintain a win rate exceeding 90% and effectively manage the risk associated with user assets. Most importantly, trades are executed mechanically with minimal oversight.

Investigating Margex copy trading and generating mouthwatering returns from automated transactions has never been simpler. Three steps are required to implement the Margex copy trading strategy.

- Establish a Margex Account

By establishing a Margex account, users gain access to its copy trading. - Observe Reliable Professional Traders

Following your preferred expert trader, you can automatically replicate all transactions and strategies. Imitate trading leaderboards from Margex furnish users with all the data required to imitate an expert trader in the most informed manner possible.

- Allocate Capital For Copy Trading Automation

Users can replicate or generate a personalized plan for every trade executed in real-time, provided that they allocate the desired quantity to be entered per trade.

Margex mandates a minimum investment of $10 to engage in copy trading strategies.