IREN, a cryptocurrency miner previously known as Iris Energy, experienced a 24% decline on the Nasdaq due to a short-seller report

After a report from short seller firm Culper Research criticized the company as “wildly overvalued” and claimed it failed to invest the necessary capital to compete in the AI industry, Bitcoin mining firm IREN — formerly Iris Energy — experienced a 24% decline on the Nasdaq.

Culper disclosed its short-selling position on IREN and accused the company of making “big promises” regarding its high-performance computing plans while investing significantly less than necessary.

In a short-seller report dated July 11, Culper asserted that IREN “talks a big game” about its HPC plans but ultimately appears utterly disinterested in taking the necessary steps to compete in the space.”

Culper asserts that the organization has expended less than $1 million per megawatt to construct its current facility and has informed investors that it will build a comparable high-performance computing (HPC) center at approximately the exact cost.

It was also noted that developing an HPC-ready data center costs approximately $10 to $20 million per MW, as confirmed by prominent operators, analysts, and experts.

“To analogize, IREN claims that it’s set to win the Monaco Grand Prix, but just arrived to the track in a Toyota Prius.”

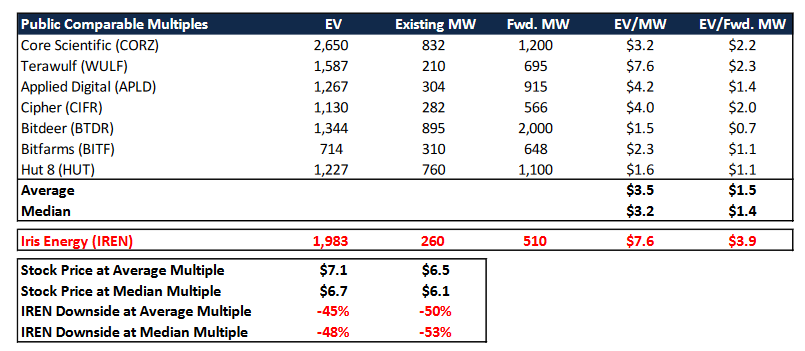

The report also accused IREN of being “wildly overvalued” and argued that it should be priced between 52-79% lower.

In contrast to other publicly traded miners, the research firm emphasized IREN’s exceptionally high enterprise value relative to the hash rate on a MW basis.

“We assign a value of $0 to $100 million to the Company’s crypto mining operations, which we consider to be generous in light of the business’s historical record of cash burn,” Culper stated.

Culper stated that the most recent halving event “further decimated” miner economics. As a result, he does not anticipate that IREN will be able to improve its position shortly.

Culper also observed that IREN has failed to deliver its promises numerous times, such as the claim that it would achieve a hashrate of 10 exahashes per second by April 2023. However, it has only attained 5.5 EH/s by that time.

The researchers also identified insider selling of shares by the firm’s co-CEOs, brothers Daniel and Will Roberts, since February 2024.

This is not the first instance in which Culper has targeted a Bitcoin miner.

In January 2021, Culper published a short seller report on CleanSpark. However, CleanSpark responded a week later by denying that many of the accusations were “false” and announcing that it would investigate the origins of the misrepresentations and the identity of the individuals behind Culper.

On July 11, IREN shares experienced a 24.5% decline to $10.36 before marginally recovering to $11.20 at the close of trading, according to data from Google Finance.

Presently, the organization is worth $2.09 billion.