Donald Trump has recently shown interest in crypto. He aspires to be the “crypto president” and is bringing up the geopolitical significance of digital assets.

Is China sorry that it outlawed Bitcoin mining in 2021? Will it opt back in? Can even a single country govern decentralized assets such as Bitcoin?

When asked on July 16 why he’s adopting the crypto community all of a sudden, he told Bloomberg:

“If we don’t do it, China is going to pick it up and China’s going to have it—or somebody else, but most likely China.”

In the interview, Trump stated that 80% of the proceeds from selling his “Mugshot” NFT Collection were paid in cryptocurrency, describing how the recent experience with the collection “opened my eyes” to cryptocurrencies. It was amazing.

Thus, we have a solid basis in crypto. It’s a newborn. It’s currently a baby. However, I don’t want to be accountable for letting another nation control this area,” he continued.

Beyond whether China, which outlawed cryptocurrency trading and Bitcoin mining in 2021, is interested in returning to these markets, his comments raised several noteworthy points.

It discusses the broad interaction between governments and the blockchain/crypto industry.

How much control can a single sovereign nation have over diverse and decentralized digital assets like Ether $3,491 and Bitcoin BTC $67,244?

Is it even feasible?

Why China?

China formerly dominated the cryptocurrency market. China was home to the biggest cryptocurrency exchanges, like Binance, and estimates place the country’s mainland as the location of up to 75% of Bitcoin mining activity.

However, China clamped down on cryptocurrency mining and trading in 2021, and by July of that year, Bitcoin mining had all but disappeared on the Chinese mainland.

However, recent events have sparked conjecture, according to Chainalysis in October, “that the Chinese government may be warming to cryptocurrency and that Hong Kong may be a testing ground for these efforts.”

The central government of Hong Kong authorized the introduction of multiple Bitcoin exchange-traded funds (ETFs) in April 2024. Despite the continuous prohibition of trading on the mainland, some analysts believe China aims to turn Hong Kong into a cryptocurrency hub.

Bitcoin ban in China is a “strategic blunder”

Does China feel bad about clearing out the crypto market in 2021?

“Definitely,” Tressis Chief Economist Daniel Lacalle said, “China committed a grave error by outlawing cryptocurrency mining and trading, especially considering their eventual goal of de-dollarization. The choice removed a significant disruptive technological advance and did not benefit the yuan.

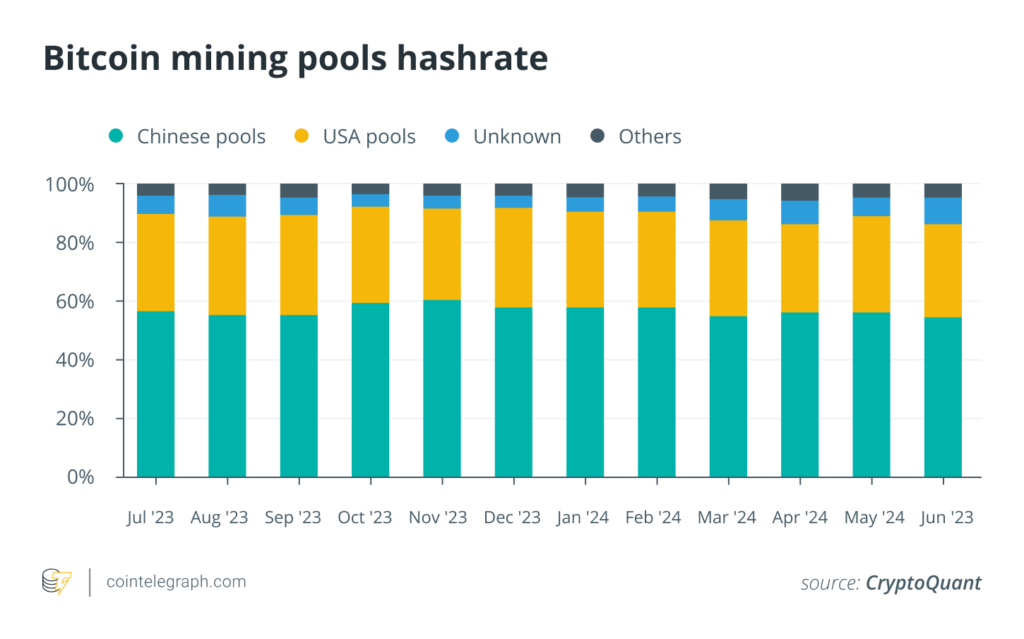

Emiliano Pagnotta, an associate professor of finance at Singapore Management University, told Cointelegraph, “Beijing’s 2021 mining crackdown was a strategic blunder.” “They held 75% of the mining industry and quickly lost a significant portion, mostly to the United States.”

Why make a tactical mistake? “By controlling the majority of the hashrate, an adversary of Bitcoin has much more leverage against the security properties of the network.” The prohibition temporarily decreased the hashrate; that latent threat is far more potent, according to Pagnotta.

He was unable to confirm whether China regretted its choice, though.

Because the capital markets in China and Hong Kong are different, Yikai Wang, an assistant professor at the University of Essex’s Department of Economics, stated, “I don’t think that China regrets banning crypto trading and mining in 2021.”

China forbade cryptocurrency trading because, as Wang said, it wished to keep strict control over cash outflows from the mainland.

Despite being under Chinese rule, Hong Kong’s economy is distinct. Since it has traditionally had free capital movements and open market rules, cryptocurrency may fit right in with the former British colony. Wang continued, saying:

“Hong Kong serves as the hub to allow some capital flow in and out of mainland China, which is important for Hong Kong and also for mainland China.”

“Since its inception in April 2024, the digital asset ETF market in Hong Kong has experienced significant expansion,” stated Patrick Pan, the chairman and CEO of OSL, a cryptocurrency exchange presently functioning in Hong Kong.

Pan stated that mainland China “has upheld a strict policy regarding the trading and speculating cryptocurrencies.”

Pan notes, however, that China has come to terms with the significance of blockchain technology in powering cryptocurrencies.

According to Pan, “China’s development and gradual rollout of the digital yuan demonstrate a willingness and ability to adopt blockchain technologies, which improve the efficiency and security of the nation’s financial systems and have long-term benefits for the financial infrastructure.”

China’s position on cryptocurrencies may be evolving.

China’s decision-making process is murky, so it’s possible that the country doesn’t sincerely regret banning cryptocurrencies in 2021. According to Zennon Kapron, founder and director of consultancy business Kapronasia, “the country is reassessing its approach, especially as it sees the strategic value in digital assets,” which is evident.

“The softening stance in Hong Kong could be a strategic move to remain competitive in the fintech and digital finance space without fully reversing its mainland policy.”

Is it too late, though?

Kapron conceded, “China still has advantages, like access to inexpensive hardware and electricity in certain regions. “It’s possible that some degree of dominance could return if the government were to offer incentives or relax restrictions.”

However, it would be more complex. “There is less room for any nation to dominate as the global mining landscape has become more diversified,” noted Kapron.

Wang stated that even if China permitted Bitcoin mining, it would still “have a high chance of succeeding” since the industry is “medium-tech and a capital-, energy-, and infrastructure-intensive production” rather than high-tech. Wang continued, saying:

“Bitcoin mining is not like making CPUs, but more similar to producing solar panels, building railways, etc. China has the capacity and even the comparative advantage in this type of mass production.”

However, cryptocurrency trading might be a different story. Wang stated that China is unlikely to alter its mainland trading prohibition unless it also modifies its capital markets regulations.

Lacalle, an economist, was dubious. “It is difficult for many traders and miners to regain confidence once they see the risk of interventionism and legal or investor insecurity.”

In contrast, Pagnotta stated that China might still influence cryptocurrency if it shows more pragmatism and transparency in its regulations.

“Bitcoin mining is still important in China despite the ban. Most of the ASIC [application-specific integrated circuit] equipment is developed and manufactured there, and there is a lot of know-how.”

In previous years, the development of jobs, energy demand smoothing, and mining tax revenues have benefited many local governments in China. They are in favor of legalizing Bitcoin mining once more.

“I am not so sure that China will accept self-custody for its people, despite what Trump has been saying lately,” Pagnotta said. As the Biden administration has done, “China could ease investors’ exposure to Bitcoin-related products through ETFs,” but “the domestic custodial firms would always be under Beijing’s control.”

According to Julio Moreno, head of research at CryptoQuant, “they certainly made some mistakes in the past by banning crypto investments and Bitcoin mining,” “Other nations exploited this prohibition to expand their cryptocurrency industries, such as the US in the case of Bitcoin mining.”

However, according to Moreno, “China now seems more open to the crypto industry and has allowed the launch of Bitcoin and ETH ETFs in Hong Kong.”

Furthermore, even after Bitcoin mining was outlawed on the mainland, Chinese influence did not disappear. “Every piece of equipment used in China just moved to other places,” Moreno continued.

The founder of CryptoQuant, Ki Young Ju, wrote on July 1 that “Chinese mining pools still hold nearly 54% market share despite China’s ban on Bitcoin mining.” “Some mining farms may still be operating covertly in China, with authorities possibly concealing data, even though not all participants in these pools are Chinese.”

To be clear, Ju referred to mining pools that operated outside the Chinese mainland.

Because of its previous actions, China’s central government continues to be a Bitcoin “whale,” owning 190,000 BTC, or around 1% of all currently circulating Bitcoin. This sum is not insignificant.

Could China take the lead in cryptocurrencies once more?

Wang, on the other hand, thinks China might still “play a super important, if not dominating, role” in the global cryptocurrency industry if it correctly puts its mind to it.

Wang noted that in addition to its inherent benefits in Bitcoin mining—which were previously mentioned—there is a substantial market for utilizing cryptocurrencies to transfer Chinese assets overseas, particularly in light of China’s strict capital market regulations.

According to Wang, Binance, “which is a company started in China by a Chinese but later moved abroad, and still 20% of Binance’s trade comes from China,” remains the largest cryptocurrency exchange platform globally in terms of trade volume.

“There were even more Chinese cryptocurrency exchange platforms in a similar size to Binance,” Wang continued before China outlawed cryptocurrency trading.

Is cryptocurrency genuinely becoming a new arena for great power competition in light of Trump’s remarks? As stated by Pagnotta:

“Trump wants votes, and he understands that tens of millions of Americans hold digital assets and see it as an important electoral issue. Drawing a contrast to Biden or China in this regard is politically astute.”

He’s also utilizing game theory.

On a deeper level, Trump opposes the rise of a central bank digital currency (CBDC) led by China or the BRICS nations—Brazil, Russia, India, China, and South Africa. He undoubtedly understands enough game theory to understand that Bitcoin is the politically neutral global property rights system of the twenty-first century, even if he did not become a true Bitcoiner overnight, Pagnotta continued.

The former US president may merely use the proverbial maxim “the enemy of my enemy is my friend” in this situation.

Others think it is incorrect to imply that China may attempt to regain its supremacy in the global cryptocurrency market. Popular cryptocurrencies like Ether and Bitcoin are now too diverse and decentralized for one sovereign state to have authority over them.

According to Kapron, “China’s influence in the cryptocurrency market may grow, particularly through initiatives like the digital yuan,” but dominating decentralized cryptocurrencies will be a very different problem.

According to Kapron, “The reality is that these digital assets’ decentralized and diversified nature acts as a significant barrier to dominance by any single nation. “Trump’s recent remarks may be a reflection of a strategic worry.

Furthermore, economist Lacalle:

“There is no such thing as nationalist crypto. The beauty of the crypto market is that it is completely diversified and decentralized. The concept of government control of crypto makes no sense to anyone that understands independent currencies.”