JPMorgan predicts Bitcoin could hit $126,000 by year-end 2025, driven by corporate treasury adoption and low volatility, aligning with gold.

In a note issued on Thursday, analysts at JPMorgan, a top-tier financial holding company with approximately $4 trillion in assets under management (AUM), informed investors that the Bitcoin price is undervalued compared to gold. The Bitcoin price may increase by 13% to reach a target of $126,000, equivalent to the $5 trillion in private investment in gold, as per JPMorgan analysts, led by Nikolaos Panigirtzoglou.

Comments by JPMorgan on the Advantages of Bitcoin in Comparison to Gold

As a JPMorgan research report indicates, Bitcoin’s volatility index has decreased from 60% to 30% over the past six months. This is the smallest gap ever recorded since Bitcoin’s inception, as it is presently twice as volatile as gold. JPMorgan observed that Bitcoin’s mainstream adoption is well-positioned to expand in the future, as it is vastly undervalued compared to gold due to its low volatility.

Furthermore, the largest U.S. bank, which had previously been skeptical about Bitcoin’s effectiveness as a safe refuge, observed the increasing demand for corporate treasuries, resulting in companies increasing their holdings to approximately 6% of Bitcoin’s total supply.

This is one of the reasons why these JPMorgan analysts anticipate that the BTC price will shortly rebound to a new all-time high. Yes, this is the upside that we emphasized in our note, and we anticipate that it will be achieved by the end of the year,” Panigirtzoglou stated.

An Accelerator for Increased Prices

The increasing adoption of Bitcoin among institutional investors is anticipated to result in a rebound in its price soon. 3.68 million Bitcoins have been accumulated by 309 entities, including Michael Saylor’s Strategy, as part of their treasury management, as indicated by market data from BitcoinTreasuries.

Strategy currently controls 3% of the total supply of Bitcoin (BTC) due to its most recent $356 million acquisition, as CoinGape reported. Furthermore, Bitcoin ETFs traded in the United States have experienced the most rapid growth, surpassing $100 billion in just over a year. The U.S. spot BTC ETFs had a total net asset value of approximately $144.5 billion at this writing, with BlackRock’s IBIT leading the pack with roughly $83.5 billion.

As part of the Strategic Reserve initiative, Bitcoin is also being adopted by nation-states, including the United States and El Salvador. The United States has implemented numerous initiatives to encourage the widespread adoption of Bitcoin, blockchain technology, and the broader cryptocurrency market under the presidency of Donald Trump.

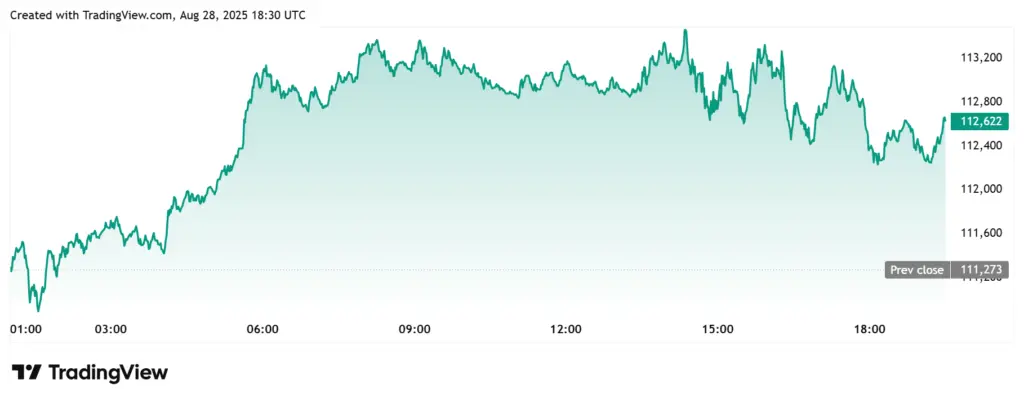

Today’s Bitcoin Price Movement

The modest Bitcoin price rebound that occurred before a brief retracement was synchronized with JPMorgan’s Bitcoin analysis in relation to gold. BTC reached a range of approximately $113,479 on Thursday, according to market data from TradingView, before retracing by approximately 1% to trade at roughly $112,272. However, it gained as much as 2.3%.

Veteran trader Peter Brandt maintains that the Bitcoin price must surpass $117,570 to disprove additional midterm adverse sentiment. Moreover, Brandt observed that the flagship coin experienced a significant sell order over the weekend, which occurred in the context of the ongoing capital rotation from BTC to Ethereum (ETH) through the U.S. spot ETF market.