A judge in Illinois has concurred with the Commodity Futures Trading Commission in a crypto fraud case, classifying two altcoins, OHM and KLIMA, as commodities.

In a crypto Ponzi case, an Illinois district court judge concurred with the Commodity Futures Trading Commission (CFTC) and classified two lesser-known altcoins as commodities.

A man from Oregon, Sam Ikkurty, and several of his companies were implicated in the Ponzi scheme. The scheme defrauded victims by pledging “steady returns” of 15% per year from investments in “digital asset commodities.”

The order also classified Olympus (OHM) and KlimaDAO (KLIMA) as commodities, in addition to Bitcoin and Ether.

The CFTC stated, “Those virtual currencies fall into the same general class as Bitcoin, on which there is regulated futures trading.”

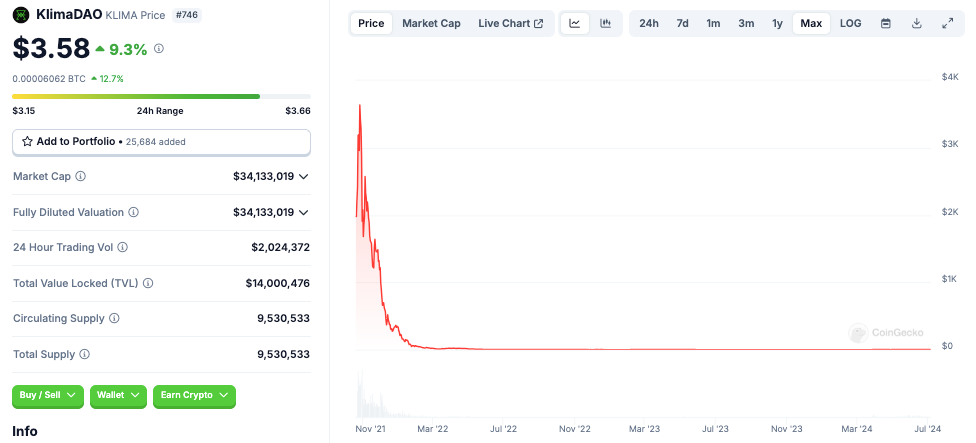

KLIMA is the governance token of Klima DAO, a decentralized autonomous organization that advertises itself as a solution to “coordination” issues in climate financing.

At the time of publication, KLIMA is trading at $3.55, a 99.9% decrease from its all-time peak of $3,777 on Oct. 21, 2021, as per CoinGecko data.

OHM is the governance token of the OlympusDAO, an organization dedicated to establishing a community-owned decentralized reserve currency.

An Oregon individual must contribute $120 million to a Ponzi scheme.

The CFTC stated on July 3 that Ikkurty reassured potential participants that he exclusively invested in stable crypto assets and embellished stories of his prior successes to bolster investors’ confidence.

Nevertheless, Ikkurty “ran something like a Ponzi scheme,” repeatedly misrepresenting the facts of his fund’s performance, intentionally omitting the fact that the value of his fund fell by over 98.99% in a few months instead of returning profits to participants.

Furthermore, the order determined that Ikkurty transferred a significant portion of the funds to the early investors to prevent them from incurring losses. This led to a $20 million deficit for investors in the putative carbon offset program.

The CFTC also observed that Ikkurty had previously experienced the loss of all of his personal Bitcoin holdings due to a breach.

As per Judge Rowland’s order, Ikkurty was required to pay over $83.7 million in restitution and $36.9 million in disgorgement.

In May 2022, the CFTC accused Ikkurty and Ravishankar Avadhanam of fraud and neglecting to register with their agency.

The CFTC stated that the duo solicited over $44 million from at least 170 individuals to trade cryptocurrencies, derivatives, and commodity futures contracts through a website, YouTube videos, and “other means.”