A16z’s Miles Jennings calls a U.S. ruling a “huge blow” as DAO members face accountability under state partnership laws.

According to a federal judge in the United States, state partnership laws allow participants in decentralized autonomous organizations (DAOs) to be held accountable for the conduct of other members.

The United States District Court for the Northern District of California’s Judge Vince Chhabria ruled on November 18 that Lido DAO’s governing bodies are considered partners under California’s general partnership statutes.

Members might therefore be held accountable for the organization’s deeds.

Lido DAO Members Are Subject To Legal Action

Andrew Samuels, a buyer of Lido DAO tokens, filed a complaint that led to the lawsuit.

To recoup his losses, the investor filed a lawsuit against the company.

Samuels claimed that DAO Members ought to have filed the tokens with the US Securities and Exchange Commission, claiming that they were unregistered securities.

According to the lawsuit, “Samuels argues that Lido DAO is liable for his losses under Section 12(a)(1) of the Securities Act because it never registered the securities.”

Samuels successfully claimed that Lido DAO and its identifying partners were unable to assert immunity, the court decided.

The complaint states that the judge found Lido DAO to be a general partnership for California law, which holds partners responsible.

According to Samuels, four sizable institutional investors in Lido—Robot Ventures, Andreessen Horowitz, Dragonfly Digital Management, and Paradigm Operations—should be held accountable for their roles as Lido DAO members.

The four parties filed motions to dismiss the case in response. But just one was approved. According to the court filing:

“The upshot is that the motion to dismiss filed by Robot Ventures is granted, because Samuels has not adequately alleged that Robot Ventures is a member of the Lido general partnership. All other motions to dismiss are denied.”

Because of their claimed involvement in the governance and operations of Lido DAO, the judge determined that Paradigm, Andreessen Horowitz, and Dragonfly were declared general partners.

Because there was not enough evidence to prove that Robot Ventures was a general partner, it was exempt from liability.

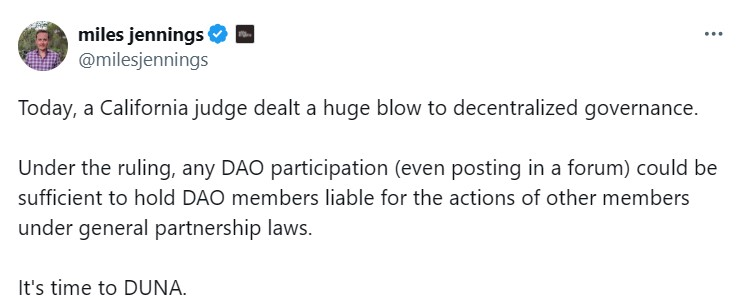

A “severe setback” to decentralized government

The decision is a major setback to decentralized governance, according to Miles Jennings, general attorney and head of decentralization at a16z Crypto.

According to Jennings, the decision may make DAO members accountable for the conduct of other members under the general partnership regulations simply for commenting in forums.