Market anxieties were stoked after Jump Trading removed 17,049 ETH worth of Lido, valued at $46.44M. Data, however, suggests a deliberate liquidity setup.

In anticipation of an anticipated sell-off, Jump Trading, a market maker and trading company, has transferred 17,049 Ether valued at roughly $46.44 million.

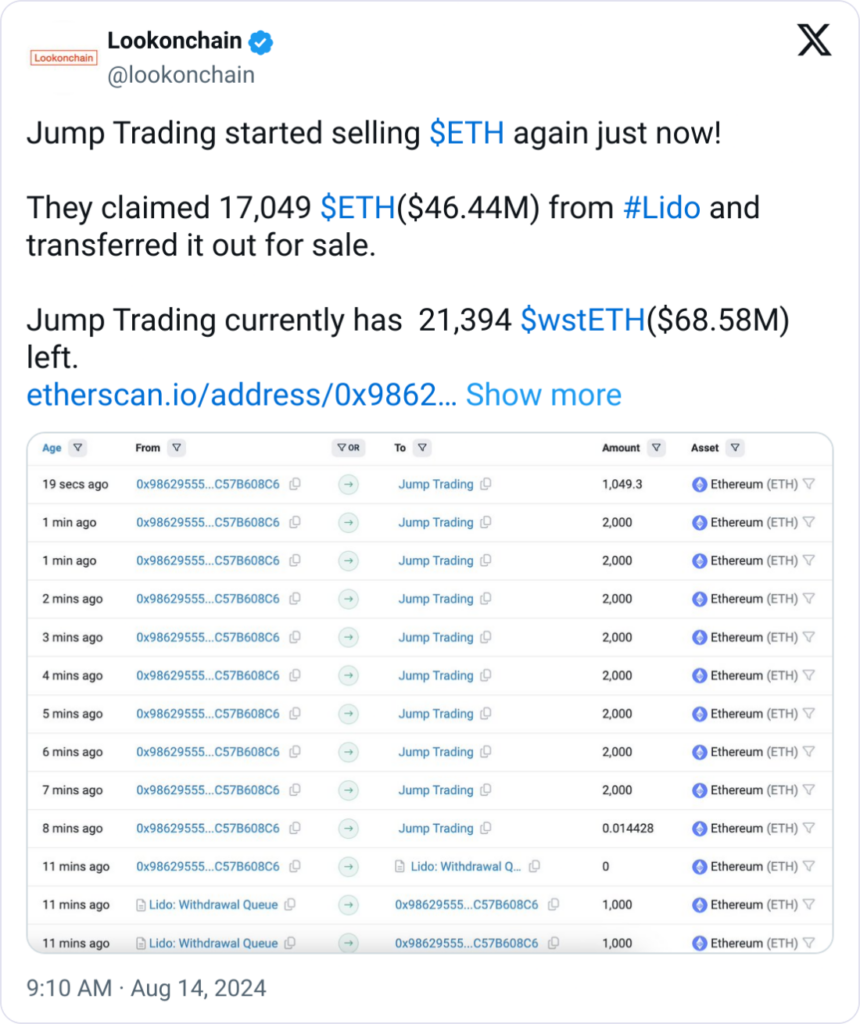

The $46.44 million Ether ETH$2,751 taken from the liquid staking system Lido has reportedly been “transferred out for sale,” according to a post on X by blockchain analyst Lookonchain.

The expert added that when the new wave of ETH sales supposedly starts, Jump Trading currently possesses 21,394 ETH worth roughly $68.58 million.

Removal from Lido

Lookonchain reported that Jump Trading’s wallet address started the Lido withdrawal of its ETH holdings on August 14 at 7:47 am UTC.

The transactions listed on Etherscan since August 9 at 3:09 pm UTC indicate that the wallet has been inactive and that ETH is being moved in batches according to a regular schedule.

Although Lookonchain expressed reservations about a sale, the response from the community and the statistics from Arkham Intelligence indicates a very different story.

Concerns About Manipulation

Jump Trading has moved the ETH “back to their account,” according to one X user who remarked on the platform. Another expressed concerns about potential manipulation and stated the company “just [wants] to buy more.”

The company deposited 137.33 ETH valued at $375,600 to Binance, 92,692 Tether USDT$1.00 to Gate.io, 223,724 Circle USD USDC$1.00 to Bybit, and 67,668 USDC to Coinbase, according to Arkham data.

These fund changes refute Lookonchain’s sell-off story and show that the exchange is ready to provide liquidity for trading activity.

Fears of a Jump Trading Sell-Off

According to a QCP Group study published on August 5, intense ETH sell-offs “from JumP Trading and Paradigm VC” might lead to a market meltdown.

The Singapore-based digital asset trading organization report was supported by Lookonchain’s August 5 X article, which mentioned Jump Trading’s $377 million sale of 83,000 Wrapped Lido Staked ETH (wstETH).

The United States Commodities and Futures Trading Commission (CFTC) is looking into the company.