Justin Drake warns Bitcoin’s security model is a “time bomb,” citing unsustainable Proof-of-Work and low fees threatening its decentralization and stability.

Drake highlighted a critical vulnerability in Bitcoin’s Proof-of-Work (PoW) system, warning that it could jeopardize the entire cryptocurrency ecosystem if not addressed.

Why is Bitcoin Security a “Time Bomb”?

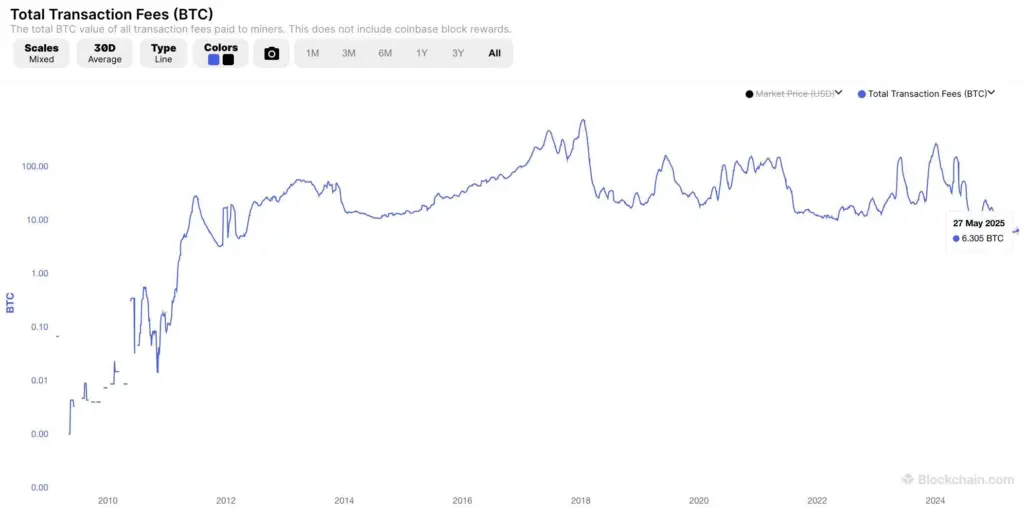

Drake’s concern focuses on a significant drop in Bitcoin transaction fees, now at a 13-year low, below 10 BTC per day.

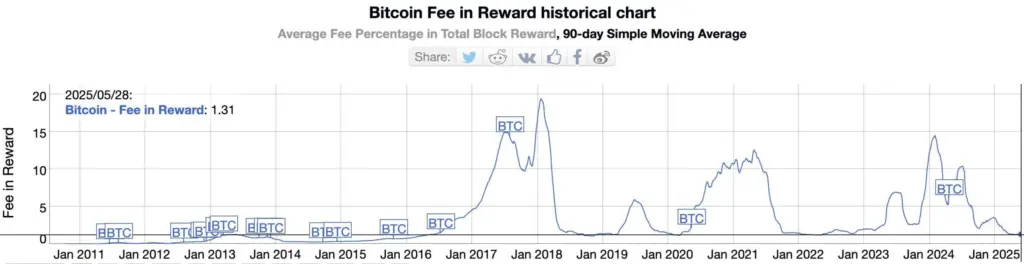

He noted that transaction fees make up just 1% of miner revenue, with the remaining 99% derived from block rewards—the new Bitcoins created to incentivize miners to secure the network.

However, block rewards are halved every four years during Bitcoin halving. In April 2024, the reward fell to 3.125 BTC, a trend that will persist until Bitcoin reaches its 21 million coin cap.

Historically, the Bitcoin community expected transaction fees to increase as block rewards declined, ensuring miners remained incentivized to secure the network. Yet, data reveals the opposite: transaction fees have dropped faster than block rewards over the past decade.

For instance, in March 2016, transaction fees accounted for 1% of the 25 BTC block reward. By April 2025, with the reward at 3.125 BTC, fees still comprised only 1%. This ongoing decline in fee revenue reduces Bitcoin’s security budget, which funds miner incentives, making the network more susceptible to attacks.

“Imagine fees were the only source of miner revenue today:

→ revenue drops 100x

→ hashing infra decreases 100x

→ 1% of today’s infra (1 large farm) can 51% attack Bitcoin

That’s the trajectory we’re on. The 21 million cap breaks security, it’s self-destructive. It should be clear now Satoshi made an ooopsie.” – Justin Drake said.

Efforts to increase transaction utility and boost fees, such as Lightning Network, Liquid, Stacks, and Ordinals, have only led to temporary fee spikes followed by declines.

Consequently, Bitcoin’s security relies heavily on block rewards—a finite resource that will eventually vanish under the current model.

Not everyone concurs with Drake’s view. Kushal Babel, a researcher at Category Labs, argued that transaction fees should be evaluated in US dollars, not BTC, to assess their trend accurately.

“It’s incorrect to say fees are at an all-time low by denominating them in BTC. What matters for security is the fees in dollar terms—we need to consider the BTC/USD price. That may tell a different story.” – Kushal Babel said.

Did Satoshi Make a Mistake?

Drake suggested two contentious solutions to avert a security crisis.

The first involves introducing perpetual block rewards by eliminating the 21 million BTC cap, which would undermine Bitcoin’s core principle of scarcity. The second is to abandon PoW for a Proof-of-Stake (PoS) consensus mechanism, as Ethereum did in 2022. PoS relies on validators staking coins rather than computational power, offering a more energy-efficient and potentially sustainable security model.

However, both proposals are deeply unpopular among many Bitcoiners, as they challenge the foundational principles of scarcity and decentralization.

Lukasinho, a Strategy Analyst at Auditless, argued that Satoshi made no error. Instead, he believes Bitcoin deviated from Satoshi’s vision of becoming digital cash with frequent transactions—and thus higher fees—transforming instead into a store of value.

“Satoshi didn’t make an error nor are the 21 million wrong. The small blockers made the oopsie. Satoshi’s vision was for BTC to become digital cash, used frequently—and generating tx fees. Not for it to become a pet rock sleeping in wallets.” – Lukasinho said.

Additionally, a factor Satoshi likely didn’t foresee is quantum attacks.

While a 51% attack like Drake’s may seem improbable due to its cost and coordination, experts have recently escalated warnings about quantum computing’s potential to break Bitcoin’s cryptography, heightening the need for a robust, future-proof security model.