Robert Kiyosaki warns that U.S. economic bubbles may burst soon, sparking sharp drops in Bitcoin, gold, and silver prices.

According to seasoned investor and Rich Dad Poor Dad author Robert Kiyosaki, Bitcoin will eventually burst along with the big bubbles in the US economy.

The price of Bitcoin has experienced a slight decline after reaching its highest point of $123,000 last week, and it is currently trading at $118,000 as long-term holders book profits.

As a longtime Bitcoin bull, Kiyosaki thinks any decline would allow investors to buy.

During Bitcoin Crash, Robert Kiyosaki Advises Buying Dips

A well-known investor, Robert Kiyosaki, has warned again that “bubbles are about to start busting” in the financial world.

His remarks come as Treasury yields are still rising and the US national debt has skyrocketed to $37 trillion, indicating the country’s economic instability.

Furthermore, the US CPI data for June suggest that inflation is still persistent.

According to a new post by Kiyosaki, major asset classes like gold, silver, and Bitcoin may also see steep corrections if larger market bubbles start to burst.

However, Kiyosaki presented the possible decline as a chance to invest.

“I will be purchasing if the prices of gold, silver, and Bitcoin plummet,” he declared.

Robert Kiyosaki predicted that Bitcoin would soon reach a banana zone, and that a correction may result from retail buying motivated by FOMO after the cryptocurrency’s all-time high last week.

Bitcoin is currently priced at about $118,000, down more than 5% from its peak.

Will Bitcoin See Correction? Exchange Deposits Are Increased By Miners, Whales

Bitcoin is currently experiencing profit booking following a strong run-up of more than 50% from April lows to new all-time highs.

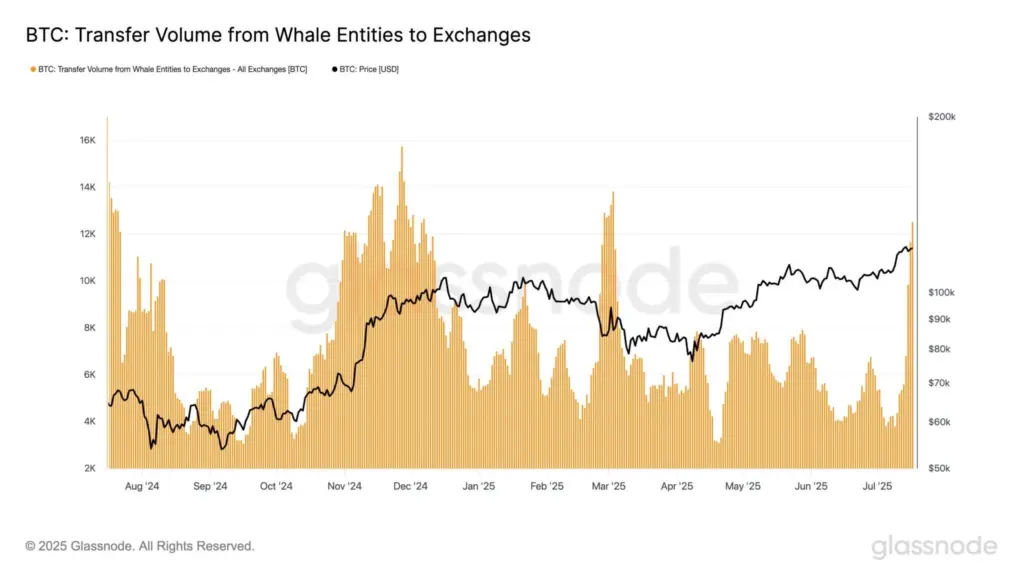

According to on-chain data, Bitcoin whales and miners have recently upped their exchange deposits.

The 7-day simple moving average (SMA) of whale-to-exchange transfers is approaching 12,000 BTC, one of the most significant levels so far in 2025, according to on-chain monitoring company Glassnode.

It further stated that this spike in transfer volumes is comparable to that of November 24, indicating capital rotation and profit taking.

However, corporate and institutional demand for Bitcoin is still high.

A staggering $810 million worth of Bitcoins were added by 21 companies last week to their BTC treasury plans.

During this time, inflows into spot Bitcoin ETFs continue to be steady.