Robert Kiyosaki urges Bitcoin accumulation, predicting 0.01 BTC will be priceless in two years as crypto’s value skyrockets.

Robert Kiyosaki, the renowned investor and author of “Rich Dad Poor Dad,” has once again sparked enthusiasm with his bold prediction regarding Bitcoin. Kiyosaki declares this is the most straightforward period in history for accumulating wealth as Bitcoin continues its precipitous ascent to unprecedented heights. Furthermore, he makes an audacious assertion, stating that even 0.01 BTC will be “priceless” in two years.

Robert Kiyosaki’s Future Predictions for Bitcoin

In his most recent X post, Robert Kiyosaki said, “Even 0.01 BTC will be priceless in two years… and maybe make you very rich.” His statement is in accordance with the recent surge of Bitcoin to a new all-time high of $111k and the rollercoaster journey it has experienced over the past week.

It is worth noting that the author’s X post underscores his unwavering commitment to and enthusiasm for Bitcoin. He thinks that the pioneering cryptocurrency has significantly simplified the process of accumulating wealth. Nevertheless, he is perplexed as to why more individuals are not capitalizing on the potential of Bitcoin.

A Closer Examination of Bitcoin and Gold

Significantly, the debate between Bitcoin and Gold has been a long-standing and contentious issue for years. Financial investors are currently involved in a contentious debate regarding the asset considered the most valuable: the traditional gold or the decentralized BTC.

Peter Schiff, a critic of Bitcoin (BTC), has consistently expressed his opposition to BTC while simultaneously lauding gold as a secure haven asset. In his most recent post, Schiff recently shared his perspective on why global governments are increasingly utilizing gold as a reserve asset in place of BTC.

The price of 1 Bitcoin has remarkably converged with the value of 1 kilogram of gold, further igniting the ongoing debate. This remarkable parity has exacerbated discussions among investors. This prompts comparisons between the digital scarcity of the crypto and the physical rarity of gold as repositories of value.

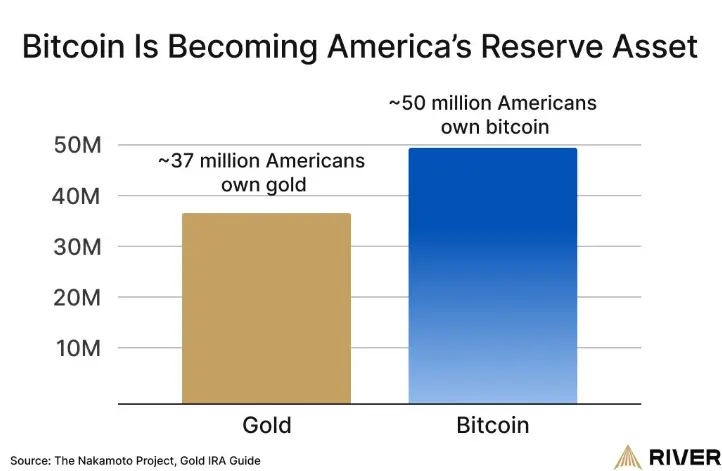

The increasing purchase of Bitcoin over gold in the United States is another significant factor that has garnered attention in the Bitcoin vs gold debate. As previously reported, Bitcoin is owned by 50 million American residents, while only 37 million individuals possess gold.

Robert Kiyosaki Encourages Traders to Amass Additional Bitcoin

While acknowledging the inherent volatility of Bitcoin and crypto, Robert Kiyosaki draws a comparison to real life, contending that both face ups and downs.

Additionally, Kiyosaki emphasizes the prospective bullish trend in BTC, as only 1-2 million coins remain to be mined. He anticipates that the price of BTC will reach new heights, as Raoul Pal has described it, and enter a “banana zone.”

Additionally, Robert Kiyosaki cautions traders against failing to capitalize on the opportunity and accumulate BTC. Additionally, he suggests that they investigate the future of money and follow experts such as Raoul Pal, Michael Saylor, and Anthony Pompliano.