Robert Kiyosaki reiterates his support for Bitcoin and provides investors with advice as the “largest market crash in history” approaches.

Robert Kiyosaki, the author of Rich Dad Poor Dad, once again warned about an imminent economic downturn. He predicts that the “biggest market crash in history” will occur in 2025, which could result in employment losses, a stock decline, and a housing market slump. Nevertheless, Kiyosaki has also offered essential guidance to assist investors in navigating the turbulence and capitalizing on new opportunities.

Robert Kiyosaki Issues Warning Regarding The “Greatest Depression” That Is To Come

Robert Kiyosaki has consistently issued cautionary statements regarding economic instability, and he now believes that his predictions are becoming reality. The author of Rich Dad Poor Dad recently conveyed apprehensions regarding the imminent “Greater Depression” in a post on X. He emphasized that individuals who lack financial literacy will experience the most hardship.

Kiyosaki contends that conventional education fails to adequately equip individuals with the necessary skills to achieve financial independence. He thinks colleges instruct students to become employees rather than entrepreneurs or investors. Instead, he encourages individuals to prioritize financial literacy and entrepreneurship to protect their wealth during a recession.

The Investment Strategy Advice of Rich Dad Poor Dad

The author of Rich Dad Poor Dad has provided crucial guidance for individuals seeking to invest in assets that will maintain their value during a market downturn. Some of his most significant recommendations are as follows:

Gold, silver, and Bitcoin are assets that Kiyosaki recommends as safeguards against inflation and economic catastrophe. He has consistently emphasized their importance in safeguarding wealth during low fiat currency value periods.

Real Estate Investments: He recommends purchasing properties at reduced prices despite the possibility of a real estate price collapse. Nevertheless, he cautions against investing in small retail spaces and office structures, as they may face difficulty recovering.

Self-Sufficiency and Business Ventures: Robert Kiyosaki advocates for establishing successful businesses during economic downturns. He identifies agriculture, including cultivating vegetables and rearing chickens, as resilient business opportunities.

The Current State of Bitcoin

Robert Kiyosaki has actively advocated for Bitcoin, viewing it as a protective measure against economic downturns. Kiyosaki recently emphasized two primary reasons for his preference for Bitcoin over the US dollar. Furthermore, in a recent post on X, he also stated:

“WHY I bought more gold and Bitcoin.

Answer: Owning gold and Bitcoin is smarter and safer than saving dollars.”

In addition, this is consistent with the perspective of other specialists, who also regard BTC as a safer haven during economic turmoil. Nevertheless, the author of Rich Dad Poor Dad has recently issued a warning regarding the potential for a Bitcoin collapse, as Trump’s tariff plans dampen the market’s sentiment.

Top traders echo Robert Kiyosaki’s sentiment

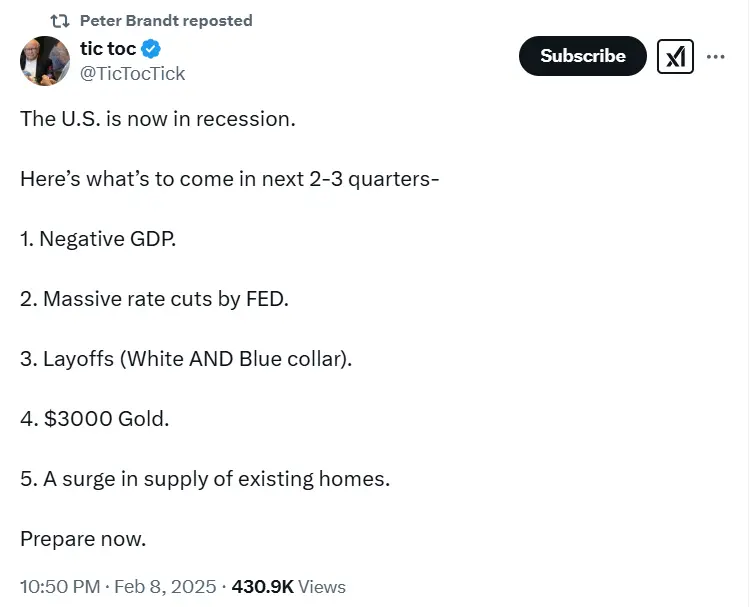

Veteran trader Peter Brandt recently shared a bleak economic forecast that was shared by Tic Toc, echoing Robert Kiyosaki’s concerns. Tic Toc, a professional trader, has predicted that the United States has already entered a recession, and conditions are anticipated to deteriorate in the next two to three quarters.

The anticipated outcomes, as per the trader’s forecast, are as follows:

- Negative development in the gross domestic product.

- Industrywide reductions on a grand scale.

- The price of gold is expected to increase to $3,000.

- A surplus of existing properties in the marketplace.

Nevertheless, it is essential to acknowledge that Robert Kiyosaki maintains his optimism in the face of the impending economic crisis. He is confident that the forthcoming crisis offers a unique opportunity for those willing to adjust. Additionally, he has reiterated his belief in BTC as a protective measure against the impending market collapse.