Kraken confirmed receipt of Mt. Gox Funds, as Mt. Gox recently began reimbursing injured parties in Bitcoin and Bitcoin Cash since it collapsed in 2014.

Kraken users have reportedly received an email from the exchange informing them that the Mt. Gox reimbursement funds have been transferred to Kraken and will be disbursed within the next seven to 14 days.

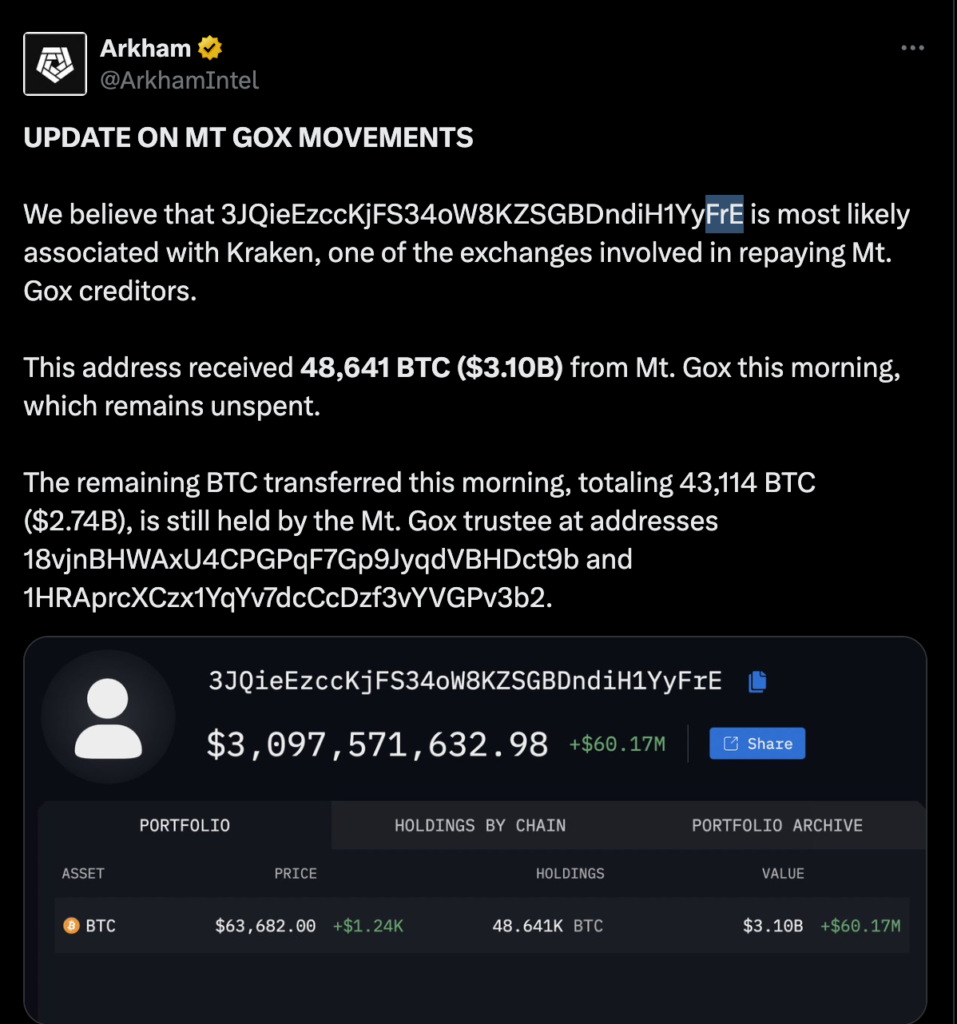

Arkham Intelligence also detected a transfer of 48,641 Bitcoin, valued at $3.1 billion, from a Mt. Gox trustee wallet on the morning of July 16. The analytics platform suspects that the wallet is associated with Kraken.

The Mt. Gox trustee has been transferring funds from cold wallets to hot wallets under its custody over the past few weeks. Mt. Gox currently possesses 138,985 BTC, estimated to be worth approximately $8.93 billion, according to data from Arkham Intelligence.

Experts debate the effects

The impact of the Mt. Gox reimbursement on markets remains a topic of debate within the crypto community. The dread, uncertainty, and doubt that the selling pressure has generated are believed by analyst Matthew Hyland to have the potential to propel Bitcoin to a low of $38,000.

Stock money Lizards, a pseudonymous analyst, also predicted that Bitcoin would collapse again; however, they projected a price floor of $50,000 on the downside.

ZackXBT, an on-chain investigator, expressed a more optimistic perspective. The blockchain detective predicts that the impact on markets will be temporary, as only investors with the least confidence in Bitcoin will choose to sell their reimbursed funds.

Analyst Jacob King issued a more bleak prediction, cautioning that up to 99% of Mt. Gox’s unsecured creditors may sell their BTC holdings on the market. The analyst stated that certain creditors may elect to realize their meteoric gains, which sometimes exceed 8,500% for those who invested in Bitcoin over a decade ago.

Institutional liquidity to cushion markets?

The volatility generated by the selling pressure of Mt. Gox could be mitigated by the liquidity provided by institutional Bitcoin investors.

The July 15 CoinShares Fund Flows report indicates that the weekly inflows into Bitcoin investment vehicles exceeded $1.35 billion, making it one of the most successful weeks for Bitcoin investment inflows on record.

On July 16, the Bitcoin market sentiment, as measured by Santiment, transitioned from “extreme fear” to “greed” due to the German government’s decision to sell its Bitcoin holdings and inject $300 million in daily capital into Bitcoin investment vehicles.